Well so far this market is doing what we expect, there haven't been that many moves that are worth the risk of a trade, but a few like XOM that had set up a week or so ago popped, gold miners popped, I think silver is going to drop too.

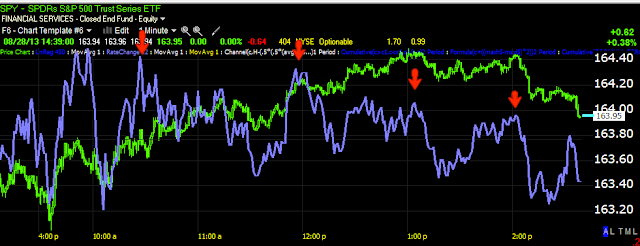

It's really hard to tell what the market is actually doing other than the inverse H&S price pattern seen today that I doubt was coincidence.

Remember it was a couple of weeks ago (I think) that I said, "We aren't near the big picture, WE ARE IN THE BIG PICTURE" and as such, I like to have a large percentage of my short set ups ready and I have had them ready, a few were closed for bounces like XOM, but I think it has a bit more on the upside, Energy broadly speaking on the other hand looks troublesome as I just posted.

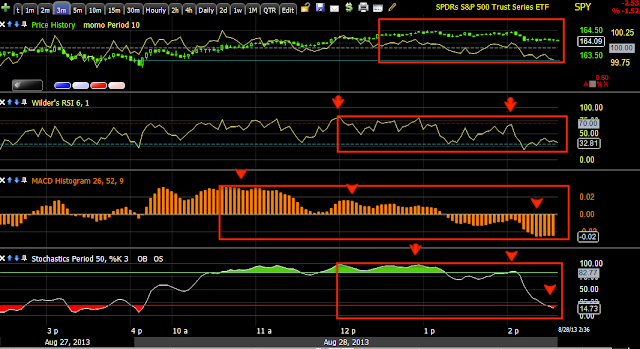

Here's a view of the big picture we are in.

The SPX and a channel, do you recall out behavior expectations for a channel? Usually a break above the channel (yellow arrow), then a quick move to the opposite end of the channel (first green arrow which also caught 100 day m.a.a support), then the "Kiss" of the channel "Good Bye"

The kiss use to be right at resistance or the bottom of the channel before everyone started using technical analysis, now traders still expect that and place stops just inside the channel so Wall St. almost always takes price back inside the channel to knock out those stops as you can see above.

Mow we have another pullback to 100-day support, this is hairy because a break here is a bad break. I'm guessing we head toward that little gap in yellow at the far right, perhaps lower at a gap around $1654, but I'm guessing it will be more extreme.

As far as assets and signals today, HYG and Junk credit both outperformed the SPX as did the skittish HY Credit, not only on a 2-day relative basis, but at the close as well.

This is a larger view of HYG's negative divergence as a leading indicator pulling the market lower, THIS CHART SHOWS US WE ARE IN THE BIG PICTURE NOW.

Both JUNK and HYG have better 2-day relative performance vs SPX and both had a better close in the smaller white box and HY credit as mentioned moved higher again for the 3rd day.

Credit points to a bounce, not much more.

As for VIX futures, they hold a short term and longer term hey (both timeframes relative to the bounce expectation).

VXX put in a clear positive the same day 1 min VIX futures did, we took the signal for a day trade and made double digits on it, but the "Blah" character of VXX now isn't screaming market move lower, it's more lazy like it could fall with a bounce higher, but likely see strong accumulation during such a move.

15 min VXX is certainly not looking like the market is ready to break right here and now to the downside, in fact it's much more supportive of the bounce scenario.

It's the 5 min VIX Futures chart that really stands out, that small white positive divergence was HUGE when it occurred, it jumped off the chart and was an obvious long, now consider the size of the negative divergence suggesting VIX futures move lower, the market moves opposite the VIX.

ES 60 min also looks set for a bounce, although noisy still in many other places.

ES 60 min (SPX futures)

Our sentiment indicator HIO made more upside ground today suggesting pros are expecting a move higher, FCT which was in terrible shape is at least now in line and staying that way.

I see a number of trades setting up.they don't look quite there yet, Silver may be an exception and I already started a position there that is in the green from a day ago. This morning before the open both silver and gold were slammed down and then formed kind of a bear flag in futures. I guess I don't need to say it, but I still like the GDX short / DUST long, if I see a pullback that makes sense as a new entry, I'll alert you.

SLV...

5 min SLV, note the similarity...

10 min SLV

Ultimately 60 min SLV, I like the open position, but if it sets up again I'll let you know again.

You saw MCP earlier which is close, also UNG which is on track, but not at an entry point.

I didn't want to take chances with speculative positions like the $85 Sept. XOM call so I took half off the table for nearly a 40% gain, however if it opens up a new entry, I'd add it right back.

The 15 min chart looks like there's a lot more in the tank, but...

The 5 min is looking a little shaky not to take some gains, if it pulls back and the 15 stays strong, it will likely be a new call or long entry for a bounce. I want to get back short XOM as soon as the signals are there.

I think transports are going to set up for a long play, these can be played with options or just long IYT as they are quite volatile,

2 min

3 min

15 min NOTE today did what we wanted it to, to carry over and continue yesterday's starting 3C strength.

even 60 min? Well maybe because the 16th nis the date accumulation started showing up.

I wouldn't jump in right this second, but it may set up tomorrow or really any time as these divergences are moving so fast since yesterday afternoon.

FSLR is another potential add to/ new position

5 min, we were looking for additional strength today

10 min

60 min

If today was about solidifying some of the divergences that took hold yesterday after the dump down, today was about continuing that task. Tomorrow would be about getting all of the short term ducks in a row and setting up entries.

There was one thing I noticed early and was happy to see it, stocks here and there are one thing, but the Tech sector is another and I saw strength earlier today, I just checked again and it looks even better, so an entire sector and an important one at that.

XLK 2 min leading

3 min migrating

10 min leading

And the important 15 min starting to lead today.

This doesn't mean I like AAPL here, in fact I don't but we'll keep an eye on it.

Basically for me most of this right now is about position maintenance like closing out some of the XOM and locking in the gain, otherwise it's about being patient because not much is happening that I'd want to be real exposed to short term until all the ducks are in a row. As I said above, if today was about seeing a carry through of yesteray's positives, tomorrow will be about either making those stronger and/or getting the timeframes in order to make for high probability positions with low risk.

I'm not going to put out sub-standard trades, especially speculative ones. Like a good wolf-pack, a lot of the hunt is just lying in wait.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago