First since I've had a few questions about this and second because other than the F_O_M_C, I think this is one of the biggest, most influential events of the week, I want to share the USD/JPY situation this week.

Several weeks before the SPX/market hit the November 16th (2012) lows, which was the end of the roughly 7 week downward drift that started September 14th, the day after QE3 was announced

(the second day of upside knee-jerk reaction that failed later that afternoon on the 14th and never saw that high again until January) followed by a 7-day -5.25% decline right in to the November 16 low, the carry trades were already being accumulated and put together.

Carry trades are a way for

(really any trader, but more often than not, hedge funds and larger institutional money) Hedge funds mostly to leverage up their AUM (Assets Under Management). With A carry trade there can be leverage as high as 200 to 1 so a hedge fund can really create a lot more buying power than their AUM would dictate.

Since the leverage is so large and even a small move against the carry pair can be disastrous (more on that in a minute), they are often entered in to in baskets, meaning more than 1 pair, a pair being EUR/JPY (long the Euro, short the Japanese Yen). When these carry trades unwind (are closed out) they can have pretty spectacular moves and sometimes spectacular blow-ups, I don't just mean a trade going wrong, I mean something much more sinister.

A fantastic example and if you don't recall or have never heard about it, read up on

"Long Term Capital Management". This was the DreamTeam of hedge funds, the principles were some of the most experienced traders in the world including:

John Meriwether who had been the head of bond trading at

Salomon Brothers. Other directors included,

Myron Scholes of the "Black-Scholes" derivatives model and

Bob Merton, both Scholes and Merton won (shared) the 1997 Nobel Prize in Economic Science.

These were certainly some of the brightest minds in the world when it came to finance/trading. To make a long story short, they did very well initially, then they lost over $4.5 billion in about a quarter in 1998, the blow up of this fund was so big the F_E_D had to step in and by 2000, LTCM was liquidated.

LTCM was known for using a lot of leverage, but when things turned south (and there were many reasons), they went from $2.3 Billion in equity to $400 million 3 weeks later with $100 billion in liabilities

for a leverage ratio of 250 to 1!

One of the interesting parts of the story was how connected various Wall Street firms were to LTCM and the fear was their collapse would cause a chain of events ending in the collapse of a good portion of our economic system, at least Wall Street's.

Warren Buffet (Berkshire Hathaway) with Goldman Sachs (and I believe 1 or 2 other firms)

thew LTCM a low ball offer to buy out LTCM, something like $250 million for a firm that had been worth over $4,5 BILLION at the start of the year.

THIS IS THE PART THAT ALWAYS STUCK WITH ME, Warren Buffet gave Meriwhether 1 hour to accept or decline the deal! Can you imagine, one year you are returning 40% gains, your firm is worth over $4.5 billion dollars and things go so bad that 9 months later you are offered $250 million for your ALL-STAR company with 1 HOUR TO DECIDE! Any way, the deal fell through and the F_E_D had to step up to prevent a wider collapse.

There are a lot of lessons to be learned in LTCM, but one was certainly leverage and risk management and these were some of the brightest guys out there, the Black -Scholes model is still used today.

Back to the Carry trades, there were 3 that were running, EUR/JPY, AUD/JPY and the most recent one or last one left standing was USD/JPY which has been a primary driver of the market for nearly 7 months with very high correlation.

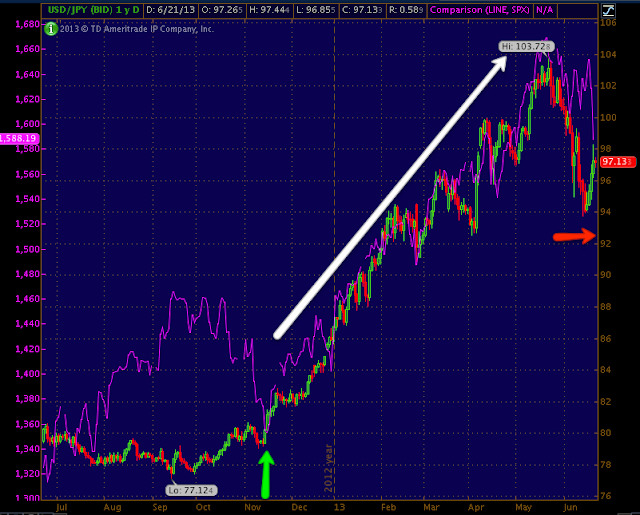

For example, here are the 3 carry pairs vs the SPX.

The green arrow is the November 16th SPX(purple) lows. Note the correlation was certainly there, but not as close as the USD/JPY.

The AUD/JPY started with very good correlation and then (as many of you remember because we were watching 30 min charts of the pair), that Carry pair collapsed. That left 1 pair really standing.

This is the USD/JPY, this is what we have been paying so much attention to, few traders have any idea what is really moving the market, the Yen is the last thing on their mind, but that correlation speaks for itself.

You may recall over the last week+ we had a VERY strong 15 min $USD positive divergence and a very strong JPY negative divergence, here's the $USD...

3C had been showing a very strong positive divergence in the $USD and the opposite in the JPY, this is one of the reasons we were expecting a VERY strong market move to the upside

because the USD moving up and the JPY moving down is exactly what the USD/JPY pair is, that sends the pair sharply higher (as you can see the USD divergence did fire off as expected) which as you can see on the chart above this one, has sent the market higher for 7 months with an increaSINGLY STRONG CORRELATION.

This week, since Sunday night I've said many times that the short term 3C signals aren't there, the near term action is very opaque, I figured it was because of nervousness in front of what many were calling "The most important F_O_M_C meeting in years". I noticed and mentioned in the daily wrap a distortion in the USD/JPY and SPX correlation, I didn't think too much of it as traders were likely moving in all kinds of directions in front on the F_O_M_C policy statement.

It turns out, whether temporarily or permanently, we had a POLAR 180 DEGREE shift in the pair's correlation with the SPX, you can see it on the USD/JPY chart above to the far right, but here's a closer look.

Instead of moving together in sync, the correlation for the first time since November 16th totally reversed and right at the F_O_M_C meeting, this has been a pretty huge event and instead of sending the market sharply higher and the USD/JPY have moved as you can see above over the last 4 days, the new (historic $USD correlation) correlation did the exact opposite.

So this was one of the big events this week other than the F_O_M_C, and one that few people are probably aware of, although it has immense influence.

Of course we'll be keeping an eye on things, I think it could flip flop back and forth, but it is probably likely that this carry trade is shot and thus the market very near the final date with destiny.

That doesn't change today's analysis at all, things still jiggle and gyrate in very volatile manner.

The Index Futures are looking pretty decent tonight thus far. The Nikkei is off with a beautiful move thus far...

The SPX and NASDAQ 100 futures are also looking good...

ES doesn't look as strong as the NASDAQ futures below, but ES had a stronger divergence during regular hours today so I'd think NQ is catching up.

NQ positive divergence.

We had a lot of strong signals the last two days, as I warned before the F_O_M_C and I ALWAYS warn before any F_E_D event,

"Beware of the knee-jerk reaction", the initial knee-jerk is almost always wrong.

I also tried to set expectations to some degree, I've seen the knee-jerk reaction (and it's always VERY impressive no matter how long) last 2 hours or so, I've seen it last a week, typically it's about a day and a half so we aren't really out of the ordinary, we are in a very volatile spot of the market so all moves are going to be exaggerated, but I feel good about where we are right now, not only from the charts and concepts above, but from credit and other leading indicators to individual 3C charts in the averages or even individual stocks.

I'd love to see a heaping, massive gap up/short squeeze and finish the last move of our working thesis laid out nearly 3 weeks ago that so far has been pretty spot on. If it does, we'll be very happy about the positions opened the last 2- days.

The one thing you always have to remember is the market and price are extremely deceptive.

According to conventional wisdom, with all of the overnight bad news from China through Europe and right in to Initial Claims, all of that news should have created a strong up day today as bad news is good news as it forces the F_E_D to stay their hand, but I don't believe that's what is moving this market at all, these cycles are set up ahead of time, the price patterns are there to manipulate traders, nothing is as simple as it seems.

I'll see you in the a.m.