So in Hussman's commentary for the week, this just stood out,

"There’s no question that the absence of consequences – to date – has led investors to believe that those consequences simply will not emerge. Once the consequences arrive, the preceding bubble seems obvious, but it’s a regularity of history that speculative episodes are only completely clear in

hindsight."

He carries on...

"History teaches clear lessons about how this episode will end – namely with a decline that wipes out years and years of prior market returns. The fact that few investors – in aggregate – will get out is simply a matter of arithmetic and equilibrium. "

He goes on a bit more about the history of Corporate buybacks which have been the biggest buyer in the market recently and how historically corporate buybacks are always at the top of a bubble on borrowed money, whereas the place that it makes the most sense to buy them from a corporate value perspective is near market bottoms, but just like the herd above, they do the exact opposite with some nice charts proving it. In any case, it struck a chord, from the "greater fool" aspect, from the "MArket bubble" aspect, which I sent a lot of timing studying going back over 400 years and they're always the same, although their defining feature is that each one claims, "It's different this time". I also identify with it from the bear market/fear perspective and how quickly fear wipes out years of gains in months and while you might think, "OK, well take the gains and get out before or at the decline". The other comments he made were that, "

"The fact that few investors – in aggregate – will get out is simply a matter of arithmetic and equilibrium."

which is something you just have to see and live through to understand it's true. I suppose it's sort of like the attitude of taking an initial loss and saying, "Well I get out on the next bounce as close to my entry as possible", but that bounce never comes, something much worse follows and the trap is set. I know it doesn't seem logical, but it's just like the corporate buybacks at all time highs at the top of a bubble on borrowed money rather than with cash at much cheaper prices at the lows of a decline, who knows why people do what they do, but they ALWAYS do it. In any case, just something I identified with having been through several of these episodes and having studies dozens more.

The one thing that I can't relate to, but just imagine on probably a very hollow scale are the consequences as this is a ginger bread house that we have never seen on a global scale never seen before. As Howard Marks recently observed,

"I don’t think it’s too early to take today’s carefree market conditions into consideration. What I do know is that those conditions are creating a degree of risk for which there is no commensurate risk premium.”

Although I try to imagine all of the ways this market is unique and all of the ways it has no historical precedent and how all of these things coming together create a perfect storm, the fact is, once things start a chain reaction, I don't think there's anyone (as Janet Yellen admitted in saying she didn't see the Credit Crisis coming) who has the immagination to understand what the true risks are, but I do think they are beyond historic and our comprehension and in that we find opportunity and after that stage completes, we find new opportunity, not that it will be easy to see or seize, but that's the market. Just an interesting aside I thought I'd share since this topic has come up frequently.

As for today...

I feel 100% vindicated in Friday's The Week Ahead post, in which for months we have called the next week with uncanny accuracy so it's not that I'm afraid to make a call, it just wasn't there which led me to post the following...

"Usually we'd have some very strong short term signals and we've been able to call the week ahead action pretty accurately, at least the trend, the timing may be off by a day or two.

I don't see anything that's standing out in the averages either way so if I had to make a call, I'd say more of the same, more lateral chop which in the cycle is stage 3 top/reversal process, the size of it vs. the size of the base is what we've observed numerous times in the past so nothing is out of the ordinary there."

I don't see anything that's standing out in the averages either way so if I had to make a call, I'd say more of the same, more lateral chop which in the cycle is stage 3 top/reversal process, the size of it vs. the size of the base is what we've observed numerous times in the past so nothing is out of the ordinary there."

Considering the closes in the averages, SPX -0.31%, NDX +0.14%, R2K +0.19% and Dow-30 -0.15%, the market did exactly what the "Week Ahead" post was looking for, at least early on for the week, MORE OF THE SAME. While this isn't the action I'd like to tell you to get ready for (a lack of action), this was what 3C was giving us. The post continued...

"I saw a carry trade shoot up like a rocket last night and Index futures that would normally follow it tick for tick, completely ignore it."

And what happened today? The USD/JPY carry trade shot up like a rocket to 5 year highs hitting stops at $106 and THE MARKET COMPLETELY IGNORED IT, IN FACT WENT THE OPPOSITE DIRECTION, charts can be found in today's post, $USD Causing Havoc. There's more to this than a glitchy day. The post continued...

"I've seen the second attempt at an HYG positive divegrence (short term) completely fail today and I've seen HYG lead the market consistently by 4 to 7 days, it's solidly in stage 4 decline."

Of course I've covered this more than once, but for the latest on the HYG situation, I updated that here today, EOD Market Update and I firmly believe this will have been a very obvious signal, however when you watch the market tick by tick all day like most of us, you expect things to happen faster which is just a cognitive bias. When you look back on a daily chart, timing and signals make perfect sense, sometimes it's just too easy to get lost in the lines. And finally...

"I think we'll get our opening to the shorts, SCTY just hit another alert. I don't think it matters really whether the market can pull off a head fake or not, the assets we are looking at as trades, are doing what we need them to do.

Based on breadth, HYG and multiple other things noticed this week (no follow through, ECB flop, etc), I feel pretty strongly the market will enter stage 4 decline sometime next week and I think we'll be glad to have entered and filled out the shorts that we are looking at."

Today at least 7 of the "Trade-Set-ups" triggered alerts on the upside, the direction we need to see them move for our set-ups, even as the market was weak intraday. As for stage 4 this week, we'll just have to wait and see if that pans out to be correct, but I have no problem updating forecasts when new information is presented as long as it's unbiased, objective data.

All that being said, even as the day on the whole came in pretty close to flat with two averages up a little and two averages down a little and in a choppy range, nearly all asset classes saw significant intraday weakness, from Treasuries gapping up and ripping down (although on a daily chart they're practically unchanged from Friday), oil gapped down and pressed back up to nearly unchanged, gold and silver were down about 1% on the day and seem to be answering the question, "Is the $USD legacy arbitrage back after years of F_E_D carry trade inspired disappearance?"Just based on GLD, SLV and GDX alone, it seems that's the scenario I've been questioning for a week or so, however today's action in stocks almost seemed to verify it, although 1-day does not make a trend, however last Friday in the early a.m. hours the same thing happened with USD/JPY and Index futures.

The close was absolutely predictable, from this afternoon, EOD Market Update ... The SPX recapturing 2000 now crossing over and below $2000 lord knows how many times the last 2 trading weeks and as usual, the EOD ramp to VWAP...

ES moves to VWAP by the close as usual and SPX recapture $2000 on the close.

All of these things seem like drudgery, they're predictable, they're rather boring, it's hard to see anything but small moves and chop with an overall lateral trend, but if you are paying attention to the details, the market will almost always speak to you.

Take the NYSE TICK for example, last week I saw one of the lowest readings I can recall at nearly -2000, today we were near -1400, then -1600 and then -1650 on top of last week's (Thursday's) nearly -2000 reading, this is not boring drudgery, this is a message from the market.

Of course the biggie may be the $USDX Legacy Arbitrage which you may not be familiar with if you've grown up in the markets since 2009 or so, but just about every dollar denominated risk asset from oil to gold to treasuries, commodities, stocks, typically move opposite the $USD, that has not been the case with the carry trades open, it has been the opposite as risk assets follow the $USD in pairs like USD/JPY, however that went out the window today and we suspected that may be happening at least a week ago after seeing some things with gold/GDX and a few other assets as well as the USD/JPY overnight ramp on Thursday early a.m. that saw Index futures go the opposite direction.

5, 10 and 30 year yields were moving with the $USD, however this is something we anticipated over a week ago with this post from, August 26th , TLT / Treasuries, when we predicted (via 3C) a decline in treasuries which are now well below the Aug. 26the level in which we said to look for a pullback in TLT and Treasuries so there are a few forces at work , some from almost 2 trading weeks ago, some from today.

You saw with your own eyes today these breakdown in correlations from $USD Causing Havoc...

This USD/JPY vs. ES/SPX futures (purple) was probably the most visually shocking.However we saw the same in Crude suggesting the historical arbitrage is working its way back in and...

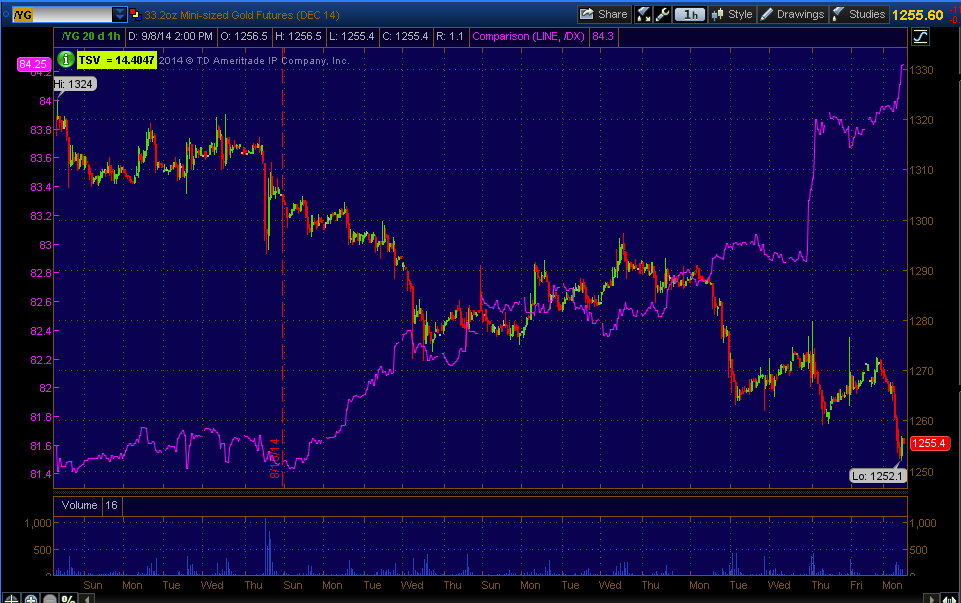

Of course gold which is not new as this was posted last Thursday Sept. 4th in ECB Actions / Daily Wrap

"If you want to know why gold , silver or oil were lower, look no further than the $USD strength off Euro weakness"

And while the closing prints seem like nothing is happening (except the fact that this is exactly the kind of price action of a stage 3 market and a clear departure away from the former 10-days of stage 2 mark-up), if you are paying attention, volatility is picking up. As mentioned today, half the market made a 1 week intraday low Friday and the other half made a 2-week intraday low Friday.

The point being, just like a transition from stage 1 to stage 2 or stage 2 to stage 3, all transitions are marked by volatility right before the transition, you may recall the late stage 2 charts I've posted in which price peels away from the trend on the upside in a seemingly bullish move just to move in to a stage 3 top, it's almost always a dead giveaway so long as you view it within proportion. It's really not any different than the "Channel Buster" concept.

Volatility intraday is definitely picking up.

While I believe firmly HYG is going to lead the way (is leading the way as it already has and has so many times in the past)...

This chart shows HYG (blue) vs SPX (green) since the start of the August cycle with HYG's stages on the bottom and SPX's right above them, HYG has clearly led which is why it's one of our most used Leading Indicators.

However as predicted in the EOD update and through the day as HYG 2 min positive divergences were building, HYG looks like it was the lever that led the SPX over $2000 on the day and led ES/SPX futures PERFECTLY to VWAP at the cash close... once again as it's just too silly to think anything other than "manipulated"...

After busting through a downtrending VWAP as well as its lower standard deviation intraday, the close magically lifted right to VWAP and HYG moved exactly in line with the SPX after building an intraday positive divegrence all day. If HYG is the only lever they have, they've got trouble because that divegrence wasn't past 2 mins.

Our Professional Sentiment Leading Indicators, they have been in decline at least since 11 a.m. Thursday and they have been very useful for short term moves, although like HYG, they will call large divergences that are market moving.

Spot VIX has quietly been creeping up making lower highs and on a 5-day chart has a bullish reversal candlestick in place. I have mentioned numerous times how VIX has one of the cleanest reversal processes in the market, of course with the exception of HYG.

High Yield Credit seems to have topped on 8/27 and continues to post wider divergences vs the SPX.

There was no dominant Price/Volume Relationship today which isn't surprising considering the continued divergence (no matter how small) between the major averages.

Only 3 of 9 S&P sectors closed green with Tech leading at a +0.15% gain, Financials and Healthcare barely closed green at +0.04 and +0.02 respectively.

On a 2 trading week basis, the Defensive Utilities and Healthcare lead with +2.14 and 1.89% respectively, the loser is Energy at -1.48%.

On a 4 trading week basis, the Defensive Utilities and what has become a defensive Healthcare sector lead the market by a wide margin at +7.29 and +6.72%, in last place in Energy at +0.52%

Of the 239 Morningstar Industry/Sub-Industry groups, only 81 of 239 closed green today, with only 49 posting a gain of +0.25% or more.

Our Most shorted Index hasn't led a short squeeze for quite some time, that may have something to do with the results of the Investors Intelligence Survey with bearish sentiment coming in at 27 year lows, not seen since 1987 and you may recall that was an interesting year for the market. In fact, the MSI if anything, has shown more steep drop-offs than steep short squeeze moves over the last 12 days.

As for breadth indicators, I showed you how they came off the oversold lows that convinced me to put out a call for a base and bounce on July 31st after the close which started the next day on Aug.1.

Then after 10-days of rally, breadth got out of the oversold zone, but still very poor as it has been getting worse all year. We had been nearly flat for almost 2 weeks with no breadth movement at all, seemingly the market gave as much as it was going to give back. Last week, I said these breadth indicators are now rolling over (bearish) again, despite the market essentially treading water, this is exactly what we saw at the 2007 top and are already amore extreme now than at 2007.

Today several of these breadth indicators which are not interpreted, they are hard numbers, like "The Percentage of NYSE Stocks Trading One Standard Deviation ABOVE Their 200-day Moving Averages'" has rolled over today to a new 15 day low.

"The Percentage of NYSE Stocks Trading Two Standard Deviations ABOVE Their 40-day Moving Averages'" (Momentum stocks) has also rolled over today to a new 15 day low.

"The Percentage of NYSE Stocks Trading One Standard Deviations BELOW Their 40-day Moving Averages'" (weak stocks) have hit a 12-day high."

"The Percentage of NYSE Stocks Trading Two Standard Deviations BELOW Their 40-day Moving Averages'" (very weak stocks) have hit a 15-day high.

The NASDAQ Composite Advance/Decline line which has been deteriorating all year, but in really bad shape since late June, has now hit all time wides between the Index and the A/D line (the A/D line diverging negatively).

The bottom line, even as the averages (for the most part) are ranging in stage 3, market breadth not only stalled, but is back on the decline which if left in this trend with the major averages holding the area with declining breadth, we'll have an exceptionally shallow/hollow market primed for a fast, sudden decline as there are fewer and fewer stocks to support it, which is a trend throughout 2014, but especially bad since late June and especially bad since July 31st.

For instance,

"The Percentage of NYSE Stocks Trading Two Standard Deviations ABOVE Their 200-day Moving Averages", as you can see, the support they gave the market (although not making higher highs) back in late June is VERY different than the lack of support for the market now, THIS IS EXACTLY WHAT HAPPENED AT THE 2007 TOP, EXCEPT WE PASSED THAT THRESHOLD ABOUT A MONTH AGO.

AAPL is the event tomorrow, the divergences it ended with today are not much different than the ones posted today in, AAPL Charts. Because of this, I'm sticking with the same short term and longer term trade set-ups.