I was thinking about how quiet Janet Yellen has been, I don't think she's said much since April and this week she'll be in front of the Senate Banking committee going for confirmation on Thursday.

I have to wonder if she won't take on a more hawkish tone than would normally be her demeanor? Especially when questions come in about this month's Non-Farm Payrolls blowout, many would wonder why that isn't proof that tapering should begin and Yellen may have to tread carefully as these aren't people there to listen, they're minds are made up, they're there to grill.

On another note, looking at the dominant Price/Volume relationships tonight, there's no single dominance, but a co-dominance of Close Down / Volume Up which is generally taken as short term oversold and Close Up/ Volume Up, which is the most bullish of the four combinations, but often taken as a 1-day overbought condition, however I wouldn't think too much about it as not one average was dominant.

What does catch my attention is not the CBOE's SKEW Index reading, it's how fast it's moving, this is an indicator that tries to predict an improbable event, a Black Swan or market crash. $115 is the normal range, $130's is elevated, but it's the recent ROC that caught my attention.

Recent Rate of Change in Skew is a bit alarming.

I also am starting to like where TLT is ending up, you may recall I had a core long and closed it on pullback signals for a small gain, I'd like to leverage it by shorting TBT, but the $100-$102 was my TLT target area and we are getting close.

For some reason I don't like 10 year treasuries as much, they do look like they can bounce with TLT around the same time, but they haven't had the same consistiency many, many times over the last several months.

TLT was clearly going to pullback, in April I actually thought it would in part be to help the market move higher. I took a position around August and closed it out for a small gain seeing a pullback coming and have been waiting for $100-$102 ever since and now we are close.

The 60 min chart which has been helpful.

The 15 min is showing that basing action I expected to see around the $102 area.

And here it is again with more detail.

TLT is 20+ year treasuries so here's the 30 year Treasury futures 1-day.

Obviously I like this too. I just think TLT needs some leverage and a stop really isn't too far away, you could do 3 or 4% on the position and way below the 2% rule, even with leverage, but I'm not interested in options, this looks like it will be a longer term trend.

I don't understand it, but have watched it develop for a while, the 10 year though just doesn't have the same look, interesting.

Otherwise, we'll look at gold from a different perspective, I envisioned one of 2 pullbacks a shallower one which we blew past that could lead gold up on a sub-intermediate to intermediate uptrend, like a strong counter trend rally or if gold pulled back enough to widen its base, then I envision an intermediate to primary uptrend or bull market.

We'll take a closer look and at gold futures too, I think the December contracts have plenty of time to benefit from a move on the upside, depending on what we find, it may even be an equity long that I'd be more interested in, even if we get a counter trend bounce, hey- they are some of the strongest rallies out there.

Futures tonight don't look great to me, it's that 5 min chart that's really nasty.

The 5 min chart leading negative, unlike Thursday. Remember earlier I said 1 step at a time, well...

Just looking ahead, the 30 min chart and...

This tells me that the funds that have come out and said they have been selling everything including the kitchen sink for the last 15 months are done and have nothing to lose, this daily ES chart of 2013 tells me that these guys weren't lying.

RUSSELL 2000 FUTURES 1 DAY AND A BROADER PERSPECTIVE...

NASDAQ 100 FUTURES, 1 WEEK. There was damage before 2013, but the damage picked up in 2013 incredibly, the same time for the first time the F_E_D let on that they were looking at possible exit strategies, before September of 2012, they'd never even hint at hinting of something like that.

1 step at a time, but sometimes the market makes moves that skip a few flights of stairs, just saying, I've seen a gap down take out several months of longs and there was nothing they could do about it.

Retail bullish sentiment is strong and arrogant.

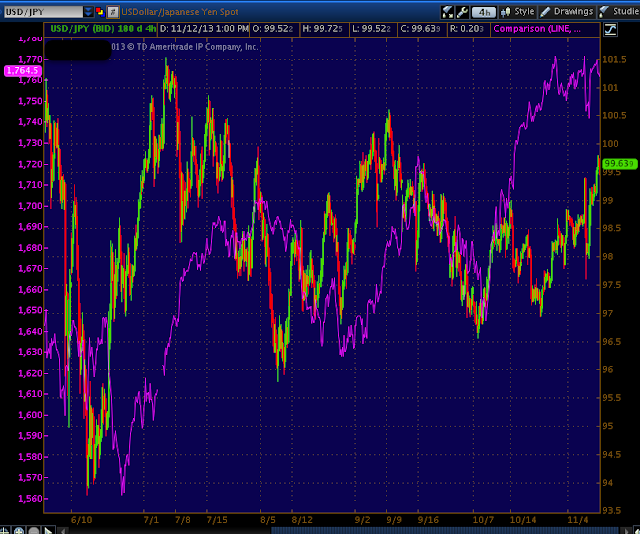

See you in a few hours, it looks like we might be looking at a lower open, especially if this Yen positive divegrence- 5 min + I'm watching lifts the Yen and drops the carry crosses, although as you saw today, even they have little power over the market, even with an out of no where Yen smack down.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago