In an earlier post I mentioned that Wall Street and their actions is like a game of chess. when most traders are looking at what's happening right now, they're planning out into the future. I won't lie, it's a bit difficult to keep up with and to try to get ahead of the game in trying to determine how they are aligning their moves now thinking 4 moves ahead. I've seen this on a much bigger scale, like during the 200o tech meltdown, there was quiet accumulation for a year or more in homebuilders. Honestly, coming out of the tech bubble, most people thought tech would lead the next bull market after the excesses of the dot.com craze were rung out, that wasn't the case. Several years before the housing boom took off, Wall Street was accumulating home builders. Back then a home didn't appreciate very fast, maybe several percent a year, nothing like the triple digit gains some areas saw; so who would have thought? Who would have believed housing was even capable of that? Wall Street knew and knew well in advance.

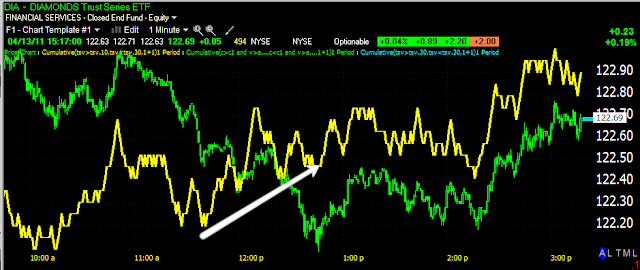

So on a micro scale, and a faster paced scale, I believe the same is happening in earnings right now. They didn't need JPM to run 5% today, they needed a gap up and I believe it is because the bulk of earnings season isn't going to be very pretty. So today they could easily have used the gap up (and remember yesterday we saw some accumulation in the market and also some great shorts that just needed a little pullback-today gave them that).

So I'm looking forward at tomorrow's earnings, so far the significant finds are HAS pre-market, GOOG and JBHT post market. So if we "assume" that one or most or all of these companies will disappoint, then today would be the day to do some last minute short positioning.

Lets take a look at the stocks reporting tomorrow (you have to bear with me as this is speculative theory, but so was yesterday and that came to pass).

HAS reporting premarket

Here's the daily for HAS, with a negative divergence in MoneyStream as well as a recent sell signal in STOCH/RSI.

Here's HAS with no real accumulation sending it higher, so it must be riding the market's coattails, but there is a negative divergence in 3C on this hourly chart, could that be some last minute short selling from Wall Street?

The 15 min chart also has a negative divergence

On the 10 minute, we can see a quick false breakout right before the plunge started, there was a deep negative divergence there (in the red box) and we have a little positive divergence currently.

Now, I don't know if HAS disappoints and moves the market lower, I suspect the end of day 3C readings may tell us more and give us a better idea. It's possible that HAS does fine and give Wall Street another day to sell short before the GOOG earnings out after market. In general, HAS doesn't look very hot to me, I'm not seeing (at this point) any strong accumulation suggesting a great report.

GOOG-This will be a biggie.

GOOG is already in a top formation and there's already been a STOCH/RSI Sell signal at the top, which also happened to see a false breakout right before it plunged.

MoneyStream is negative on GOOG's daily in a leading negative divergence. You can also see the false upside breakout right at the MS divergence.

GOOG 1 min sees some accumulation and this morning into the gap up, distribution. Again, the question is, whether this is just part of a very short cycle or last minute short selling.

JBHT After Market-JBHT is transports, thus is a vital indicator of the health of the economy. Rising fuel costs can't be good for this one and many sentiment indicators from consumers have been ugly so a bad report here is a good probability, but more importantly will be the forward looking implications. I don't see much to stop the advance of gasoline hitting all time record highs, so there's a good chance JBHT will fall into the margin squeeze category.

Daily MoneyStream is negatively divergent.

3C hourly shows good confirmation until April, then it's several negative divergences.

15 min 3C negative divergences and an interesting one into a breakout high on the gap open this morning.

The 10 min chart shows the same in greater detail

As does the 5 min, you can really see the breakout gap up this a.m. with a negative divergence.

We'll see what happens, but that's what I'm thinking right now.