I don't like what I'm seeing, actually I do like it because I think there's good money to be made, but I think we are in the midst of a reversal that may have already started.

Here are the charts....

IWM 60 min, the volatility that has been largely lateral masks the importance of this most recent negative divergence

IWM 15 min , same thing on this chart.

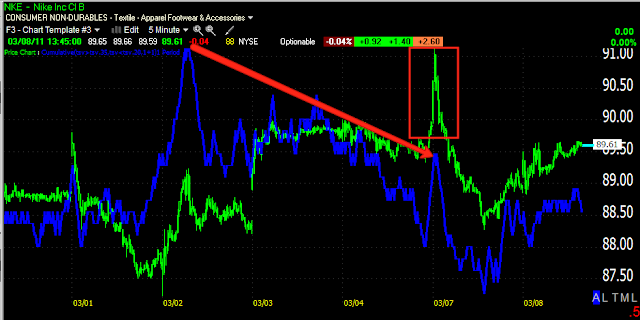

Today, unlike yesterday we do have a solid price gain, but a negative divergence through out, no strengthening into the late afternoon. Now we even have a leading negative divergence in the red box.

Look at the size of the candles, that's a lot of volatility, but it has gone NOWHERE! The initial break at the red arrow may have been the real break and what we may be seeing now is just a volatile consolidation getting ready for the next leg down. Note-break away gap HAS NOT been filled.

The IWM and the Q's as of last night where the two closest to an overbought condition. Note that neither the IWM or the Q's have truly filled the breakaway gap. This is VERY bearish.

The Q's on this daily chart are not only in a relative negative divergence, but a leading one as well. This is a big development for a daily chart.

Again, the lateral chop conceals the importance of the most recent negative divergence

The SPY 30 min chart showing extreme deterioration throughout the lateral chop. I think this lateral movement has obscured the importance of these readings.

The 15 min SPY 3C chart shows the deterioration as well as a leading negative divergence.

Here's the VIX-note the bullish descending wedge-trades inverse to the market-also the 3C positive divergence and the breakout from the wedge-this may have been underestimated. This is a breakout right now. The last time we had even a small positive divergence in the VIX, the market traded down over 16 points and that wasn't even 5% the size of this one.

Here's a wide view of the VXX. Not only has price lost downside momentum and turned up in the VXX, but look at volume as that has occurred.

And the VXX HAS broken out and on good volume.

The VXX positive 3C divergence on the daily chart.

All in all, the market has been lateral and choppy, but during this chop, there has been huge volatility. there are breakaway gaps that have not been filled and 3C does not look good. I'm increasingly starting to really believe we are now at a turning point in the market. All of the risk management things we have talked about in preparation for this event should be in place.