Today I think we have pretty good evidence for manipulation in Brent Crude Futures as well as WTI / USO. When there's the kind of geo-political risks there are in the world presently and an asset such as crude which should be the most sensitive to them, common sense would have you expecting an upside move, but the market is no longer about common sense or value.

Furthermore, when an issue such as the Light Sweet Crude futures, go from trading 152 contracts one minute to 10,000 contracts the next minute, something is not normal. In addition, when the price of Brent Crude has 7 straight sessions of gains and suddenly goes from trading at $115.20 and is at $111.60 3 minutes later, something is up. US crude went from $98.65 to $95 during the same 3 minutes.

First lets look at Light Sweet Crude Futures...

On this 30 min 3C chart of the issue, there's good upside confirmation to the left, 3C is making higher highs with price, however after the high is put in, 3C is already starting a subtle leading negative divergence late Friday. In overnight trade 3C continues to lead lower while crude is relatively flat in the overnight session, someone knew something or was up to something. The negative leading divergence continued through the day session until crude broke. There's no doubt algos/HFT was used in the snap lower, but in the leading negative divergence which is selling, whether outright or short selling, it reads the same and shows they took their time (considering the plunge only took 3 minutes) and established their position without arousing suspicions by buying in bigger block sizes, just consistent block sizes and consistently distributing, as far as the market is concerned, it looks like a transaction between a buyer and seller the only difference is the seller is not a bunch of individuals but a few and they know something the buyers don't, then crude snapped it lower and buyers found out.

The 5 min chart shows the divergences in two forms, a relative negative (red arrow) and a leading negative (red box). Although this is only a 5 min chart, there is also a relative positive divergence at the lows, this will have an effect on crude.

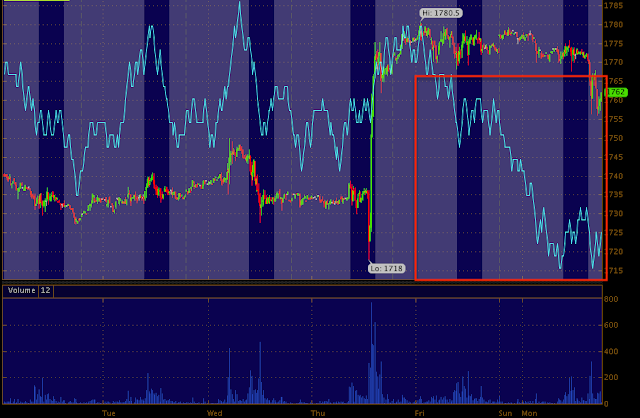

The 1 min chart of CL shows a large relative negative divergence in an overall leading negative position, just before 2 p.m. prices snap lower.

At the lows that 5 min relative positive divergence 2 charts above, seems to have put a floor in, likely shares were picked up on the cheap and even what appears to be a modest gain in the bounce back in crude is fairly significant at the leverage of Futures contracts. The 1 min chart now shows a relative negative divergence, I'll probably keep an eye on this, but I'm thinking maybe they bring price a bit lower, accumulate a bit more and take crude back to Friday's closing levels.

USO also showed similar activity...

This 3 min chart shows the leading negative divergence in 3C/USO. Measuring from the same relative price level (white trend line), had there not been distribution in USO, 3C should have been no lower than the area of the yellow box, instead it is at the red trendline before oil snaps.

The more detailed 2 min chart shows a couple of intraday positive divergences in white, one causing USO to gap up on the 13th, the other lifting USO off the intraday lows of the 13th and in to the gap up of the 14th in which there was distribution right on the open and a second area of distribution at the intraday high today, although the entire area should be considered under distribution, it's just the areas mentioned are where it is sharpest and both are at the highs of their respective days. 3C continues leading negative right until 1 bar before USO breaks lower.

The 1 min chart shows a leading negative divergence off the gap up highs of the 13th and continues negative as the intraday highs today are hit and continues leading negative from there until price snaps lower. There are no significant signs of positive divergences in to the move lower on USO's chart, that could change, but if we consider the longer term charts which have always been the most meaningful, then today's price action makes sense and even though it is counter-intuitive, may just be the start; this is why I'm trying to gather data post F_O_M_C to determine whether there's a re-set since the QE3 announcement or whether this was priced in and the longer term charts, however unlikely they may seem, are still valid.

The 4 hour USO chart shows distribution during Q1, 2012 with price falling until a positive divergence of some importance around the end of June/start of July which lead price higher and now we have a similar negative divergence in place, actually sharper and more compact than the Q1 divergence which was more akin to a topping process whereas this one would be more like a reversal of a counter-trend rally.

Just food for thought and a look at how the markets are moved and manipulated, notice they waited for the Jewish Holiday when volume would be low and they could move the bid/ask spread wider (which naturally occurs as a function of lower volume) to their advantage. I'd love to see the NANEX analysis of the trading activity during those 3 minutes.