China and Europe Dominate the sentiment driven market.

Today's jobless clams were another farce as again, last week's numbers were as usual, revised higher. There's n point in discounting current releases until a week later when they are revised, it's almost always higher. It makes one wonder at what point we'll see this in american cities?

In England protests turned violent, even turning on Prince Charles, shattering the glass of his motorcade. And this is over a hike in tuition fees for students. Here at home unemployment benefit are running out, unemployment is headed higher, home prices lower, home loans higher and inflation-real inflation (not the number we always get which is “excluding the things we use every day like gas and food”) is much higher.

The Irish bailout situation is threatening to tear the eurozone apart as key players like Germany say “Nein” to creating new facilitis to handle the bailouts that are coming. Interestingly, just about every Eropean country most likely wishes that they ddn't sign onto the Euro, although for totally different reasons.

As I mentioned last night, financials held the market in it's dead-man sone of resistance with good head start gaps being faded, the Dow toda closed down for a loss, the momentum in the NASDAQ was cut in half and the financially heavy S&P closed about the same as the XLF or financials kept it afloat. As I mentioned last night, there were plenty of financials set for follow through today and it would take a few days to unwind those positions, but he gains were smaller, the XLF is headed into a resistance zone and showing those positions being distributed.

XLF 5m

XLF 30 min

XLF Bollinger Band resistance

DIA 30 min

DIA daily

QQQQ daily

QQQQ 1 min

QQQQ 30 min

QQQQ 60 min

SPY 1 min

SPY 5 min

SPY Daily

BAC-last night I called for a stop out, today it did stop out of the trend channel

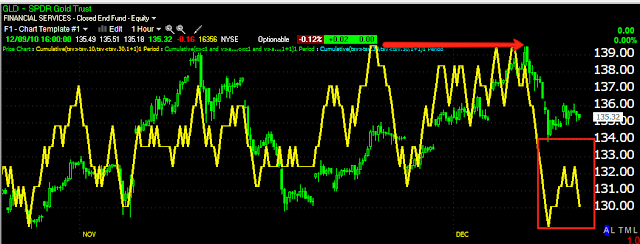

GLD 15 min reversal point

GLD hourly looking bad

JPM-as I mentioned last night, the rally in financials is being unwound or distributed-you can see that in JPM today

The Dollar looks like it's rebounding, accumulation in white-this won't be good for commodities or equities.

UUP 15 min chart in a leading divergence today

UUP hourly is turning up

The VIX hit 6+ month new lows today

Just for example, here are some of the biggest players on the major averages, as I showed last night, the Index performance is not a good representation of what is going on inside the indices themselves, this is accomplished by buying the right stocks or buying weighted stocks to give a appearance that isn't really accurate. While I don't expect you to sort through 500 charts, I thought I'd show you a representation of different industry groups and how they've acted the last several days-these aren't little stocks.

ADBE-which has been on our short list

AMZN not performing well in this market

AVB-real estate-don't forget our long position in SRS below

SRS doing very well

BA-another short idea...

BEN-financials

BXP-more real estate

DIS

JNJ

LLL

MCD... McCafe not doing so great?

MMM -another short idea recently

MON-Agricultural chemicals

NBL-energy

NEM-mining

SPG-Real Estate

VNO

WMT!

Any of the above will probably make for great short ideas. This is just a small sampling, but as I said, it reflects the market of stocks.