The Vortex of Human Emotion...

What we saw on Friday, was something like we expected. As I have said recently and posted on Trade-Guild.net in “Looking Long”, DO NOT BE CONCERNED WITH DAY TO DAY VOLATILITY, WATCH FOR THE MAJOR TREND UNFOLDING AND POSITION YOURSELF WITH IT. At least that is where I see the highest probability, lowest risk opportunity right now. If you are a day trader then this doesn't help a lot, but there is some use in it. As I have described Wolf on Wall Street, like a Wolf, we are opportunistic. People all too often try to force trades and assume that the market will work with their investment strategy that may have served them well in the past-IN A DIFFERENT KIND OF MARKET!

WOWS identifies opportunities based on what the market offers. We can chase rodents, rabbits or big game and I am of the opinion that you'd like to make more money, so why chase rodents and rabbits?

Friday was described like this by about the only person I take some heed of, Don Worden,

“The Worden Report (Friday, July 16, 2010)

Urgent Dumping

It probably doesn't surprise you to learn that the Dominant PV Relationship on this day of days was PDVU. More than 2/3rds of the Russell-3000 were down on increasing volume. PDVU sometimes indicates a capitulatory shakeout, formerly usually termed a "selling climax." The market bounces to the upside (often just temporarily). But when this occurs coming off of a minor top (which this has), it indicates urgent dumping.

For the Dow, not only did volume increase, but it was the heaviest day since June 25 (one day before a five-day plunge that took out the June and February lows). Since then the market has been in a Short-Term bounce. Today that Short-Term Bounce rally was resolved negatively, as all four of the Major Averages deteriorated to Short-Term Downtrends in the data table.

Looking at it on a chart of the SP-500, I believe the probability is that this leg down will violate the July low within a few days. Many will look at the upside reversal that occurred as July began as a so-called "support level." I don't look at it that way. The market merely bounced in a logical spot to bounce within a determined down leg. And I personally expect it to cut through that level again like a butcher knife going through soft butter.

Could it bounce from that level again? Well, yes, of course the market can do anything it wants to, and sometimes it can be very surprising. But this configuration looks to me as if the elevator is heading down. If the market doesn't do what you expect it to do, the solution is always the same. Change your mind and get outta there!

Today's trading stats were atrocious. The Ten Important Averages dropped -2.99% on average. That's three percent! Wow!

The Breadth Groupings were like a teeter-tauter with a little dog on one side and a 400-pound gorilla with an elephant on each shoulder on the other side. All 31 Major Industrial Sectors were down. All thirty Dow stocks were down. Needless to say, all 16 Groupings were Super-Decisively Negative. “

I reprint this because if you are a TeleChart subscriber and read Don's nightly report, he is as “down the middle” as you get. This is one of the rare occasions I have seen him inject strong passion and extremely obvious expectations into his nightly report. I was stunned just reading it after having read his reports for nearly a decade and having met him several times.

I will be a little more restrained and go down the line of, “The market's in a horrendous position, but it can do anything it wants”, meaning I'm very confident we will move from “A” where we are, to “B”, somewhere much lower then we are currently, but I will leave some room for market surprises along the way.

What we saw on Friday was not a mesurured reaction to earnings or to Retail Sales, it was emotional. There are two forces that dominate the market and cause it to move, you may say supply and demand, but it is actually Fear and Greed. This is an extremely fearful market which gives institutional money an angle to work, if they themselves have not been badly damaged in this tsunami.

As I mentioned on Thursday and I think Wednessday too, new members should be easing into short positions unless we are breaking serious support levels which was clearly evident by price action alone on Friday, then you want to turn up the volume; so you would have wanted to accellerate your accumulation of bear positions.

Despite the spanking the market took, we are still in decent position to add to shorts and any strength should be used for that purpose. As I have said many times before, there's still a lot of downside and actually we haven't truly even really kicked this bear off. Below $104 (SPY) is where the action will really accelerate.

The first thing to look for Monday and early this week is “Follow Through”-more downside, more volume, more bad breadth. However, remember that there are typically more up days then down days in a Bear market. I saw this today by creating a quick custom indicator, there are way more days that close below the previous days median volatility or median ATR. I think there's a custom indicator somewhere in that truth-I'll be working on it.

Support levels on the SPY will include: $106.60-we're right there, a stronger level will be found at $105.90-$106.15; this is where you “may” see a short intraday bounce (50/50). There' weak suport at $105.60 and a stronger level at $105. The big test will be around $104.40 with a minor test at $104.70. The major obstacle at this point and the one that will truly RE-ESTABLISH the downtrend will be found, as Don said, at the July low, this level will tell everyone, “The Downtrend is back” and there's no arguing with it. The level is found at $101.13. The probabilities of a bounce at that level from there to $105 are better, maybe 65% chance. However if emotion rules and sentiment stays sour, then I agree with Don, “A Hot Knife through butter”.

Google (GOOG) is in big trouble and will likely lead the market lower. I think the next stop for GOOG will be $400 where it will likely bounce and may put in another leg down. Strangely, GOOG is working on a bullish price pattern called a descending wedge. In a bear market, bullish patterns are more likely to fail, but the bigger they are, the better chance they have and this is big. If it does breakout from this pattern-(let me say the false breakout last week will push this down fast) then it's upside target will be close to $600!!?? We do have to keep in perspective though that GOOG has been in a bear market a lot longer then the market itself so it may make some sense. In any case, there's short side money to be made there for now

AAPL is another horrible looking chart and market leader. This is a clear trianlge top which saw a false breakout-as I keep saying, the market doesn't work like it use to and a lot of suckers got caught in that flap; they'll be quick sellers soon. The volume is astoundingly bad as is this 4C indicator is showing pure exodus out of AAPL. On the downside, we can expect at least a move to $150, maybe even closer to $100!!

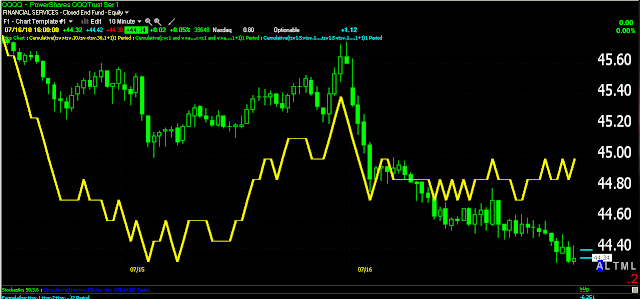

Will RIMM fare much better? At first look, this looks to be very lateral, but upon closer inspection and with 3C in yellow, we see a clear top, clear support that was broken and a classic rally to support were it failed and got dumped. The gap down in Rimm back in late June is an excellent example of stops piled up at obvious support and near a whole number ($55)-BIG MISTAKE. There's still a lot of overhead supply to feed the bear here and I see a target of $35. The stop is way to obvious at $55, I'd give it intially a little more room, but I doubt it'll be visiting that area again. This is in excellent position now for a short, just remember a wider stop and take fewer shares initially until we break July's lows.

Mondy, IBM will be a biggie releasing results, however, this is one of those stocks that is difficult to get good 3C signals because of its relative low volatility and the fact it's used as a part of basket trading to equalize ETFs-bigger stocks have this feature of being misleading so if the signal is not jumping off the chart at you, I pass them by. IBM is one I have to pass by. The only thing I see that looks strong is an early morning positive divergence, I'm not sure what time they announce.

HAS is interesting, we have a dichotomy here.

Obviousy on this 10-min chart it apears that there's been accumulation at least by market makers. I wouldn't expect to see this, I'm not comfortable with it, but I report it as I see it and we have a positive divergence on a stock that reports tomorrow a.m. The longer term blue under the chart is clealy negative so maybe we see an intial wave of buying with shorts into that at a later time, maybe a day or two? It's interesting because the accumulation was during the sell-off Friday and they know they report before the market open on Monday-lets keep an eye on this. Short term traders may like to take a crack at this one, but it should be more informative then anything especially as I'm using 3C this earnings season for a different approach.

Here's another oddity, insurance giant Brown and Brown (BRO)-I hated these guys when I was in commercial insurance, insuring the mega-condos on the beach-they had that market locked up so tight you'd have to really get lucky to steal business away from them. In any case, the 1 min 3C shows accumulation? Could tomorrow end up being an upbeat day that puts a temporary emergency brake on the market slide? Should be interesting to say the least, and if you're a day trader, this is another to keep on your radar, long term I'm not a fan of any position here.

DAL-Delta reports Monday at 10 a.m., this is a clear H&S top. At the left in the square, that is good price/volume confirmation-volume up with price and down with price, but when we get into the top formation, it does exactly the opposite, this is why people see a random price pattern and call it a H&S top when it's not-YOU MUST CONFIRM VOLUME AND IT SHOULD BEHAVE AS WE SEE HERE.

So long term , DAL is a short; when it breaks $11, you want to be pretty close to all in although you could start sliding into the position now.

As for 3C and tomorrow, I don't see much to get ecited over, it looks like it'll go down the drain real soon so that means if it pops, which I doubt, I wouldn't put too much importance on that and probably would short into any strength.

As for the market, there's no doubt that the longer, more substantial timeframes of 3C are all bearish, but there is an strange positive divergence in just about all the averges in several timeframes suggesting that this bear will try to bounce, unless there's something that's not earnings related that we don't know about that is going to hit the wires. Otherwise my guess would be maybe IBM has a decent quarter, but as I said, there's no transparancey there.

So keep Risk management in the forefront of your mind and remember a bounce will get you closer to your intended stop, which gives you less risk and the ability to take on more shares, but we love to phase into positions. The final commitment to a position should always be when it finally does what you are expecting.

So this is a guess only based on what I see, maybe some early strength maybe even a close either up or maybe a small bodied candle, maybe even an inside day. However, it shouldn't take long for this market to fulfill it's destiny. Just remember, if it's obvious, its obviously wrong.

If you need help establishing a portfolio geared for the trend or are stuck in some mucky stocks, or have any other questions, let me know and I'll try to help.

BT46n2@ gmail.com

Have a great week!