I'm just getting in, but I took a look at the market and the places we are involved and I have to say, I feel pretty good about our current positions both long term and short term; in fact today's QQQ and IWM calls are in the green and look set for a decent move, GLD calls are also looking good in the near future/

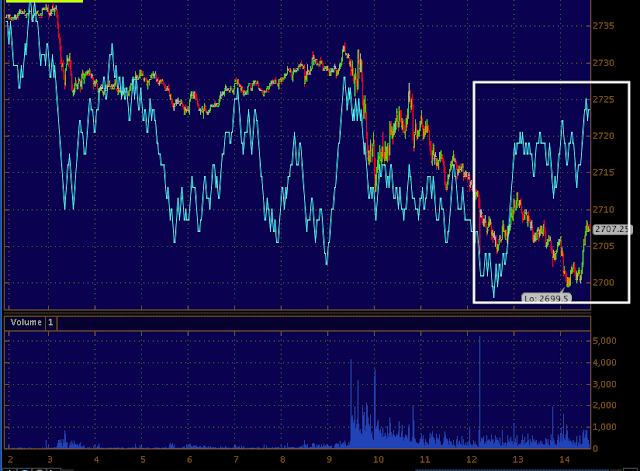

Here's a snap shot of futures now for our purposes and the closing 3C charts in the asset we are in right now. First futures...

The 5 min SPX Futures have a great leading positive divergence, this should send our weekly calls up higher in the very near term.

NASDAQ futures also have a great looking 5 min positive divergence, these have typically lasted about a day or two for some pretty decent moves in the weeklies.

The QQQ intraday chart did nothing but improve, this is still very short term, but that's all we need for the weekly calls.

Our longer term short positions we have been building should do fine as well, this long term, very important 60 min chart shows a horrendous leading negative divergence, like i said first thing today, the snake's back is broken, there may be some writhing about and we can trade that, but the back of the trend is broken, this divergence is evidence of that.

IWM intraday continued to improve as well to a fantastic leading positive divergence so we should do very well in those weekly calls entered today, I'm glad we added near the lows of the day.

Again the long term chart, 30 min IWM has a serious leading divergence and that bodes well for our longer term core short positions.

As for the GLD calls, this 5 min leading positive divergence is huge, this should be another winner.

Even the dominant price /volume relationship was perfect, Close Down/ Volume up, indicative of a short term wash out low, we should see some near term upside as the charts above show. We'll take advantage of the short term signals as long as we can, but the most important thing is to match the tool to the job, this way we can take what the market is offering rather than try to impose our expectations on the market.

So far so GREAT, I look forward to tomorrow and the weeks and months ahead, it looks like all the planning and patience is really paying off.

Talk to you very soon

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago