Here's te breadth charts for the S&P, NASDAQ 100, DOW-30 and the Russell 2000. I usually use the NASDAQ, but I wanted to see the entire market. This is the first time I've run the Russell 2000 as it is so time and bandwidth intensive, but it's here. Each Average shows 3 different measures of breadth. Right now, they looks reminiscent of Friday's action.

Breadth is the number of stocks participating in an advance or decline, which can be very different then what price reflects in the averages due to how each average is weighted. In essence, breadth readings give you a feel for what the broad market is doing and in a healthy advance, you should see advancing breadth indicating a majority of stocks are participating. When you have a day up like today and breadth is deteriorating, it's a warning sign.

DOW -30 Breadth

% of stocks above or below their 50 bar moving average (1 min). This is a very surprising reading, to see that the % of stocks below their 50-bar m.a. is rising, and the ones above are falling.

The DOW A/D Line and Ratio, advancing issues have fallen off badly and the moving average for the A/D line has gone lateral with several crosses below.

Dow % count of new highs/new lows over a 250 bar period. The red indicator isn't surprising, there shouldn't be too many new 250 bar lows on a day up like today, but the new highs falling off is a bit surprising.

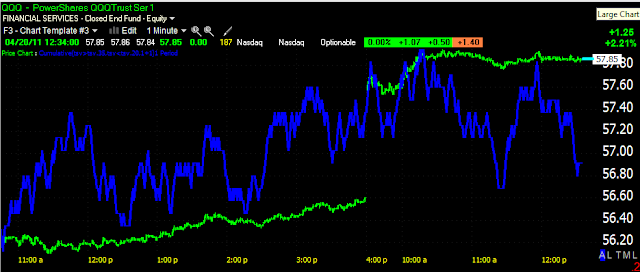

NASDAQ 100 Breadth

This is the same as the last indicator, % count new lows/highs over a 250 bar period, again new highs are falling off

Advance / Decline line and Ratio, also shows fewer advancers and the moving average of the A/D line is lateral with a cross below

% of stocks above/below their 50 bar moving average, again this is a very surprising reading, this indicator went from near 100% to 30%, and below from near zero to 70%.

S&P-500 Breadth

% count of 250 bar new highs/new lows, we see some deterioration here, but not too unexpected.

The A/D ration and line are also losing steam.

And another very surprising reading with stocks above/below their 50 bar moving average.

Russell 2000 Beadth

There's deterioration here, but not hugely surprising

The A/D ratio going negative is a bit surprising.

And again the biggest surprise in all of the averages is the % of stocks able to maintain above their 50 bar moving average, from over 90% down to 36%.