As the 3C ES has been a new addition, I've wanted to get some experience with the market under my belt and make sure 3C is performing as it should, the 1 min has been near flawless so I figured why not take a look at a few of the other timeframes that have been performing well.

First the SPY-I was looking for a deeper close today, but as I posted early this morning, the idea was a gap up and a close at the lows, that's what we have and if you wanted to really pinch a penny, it turns out to be a bearish engulfing candle today off yesterday's Harami reversal.

ES 15 min doing a lot of leading today as well.

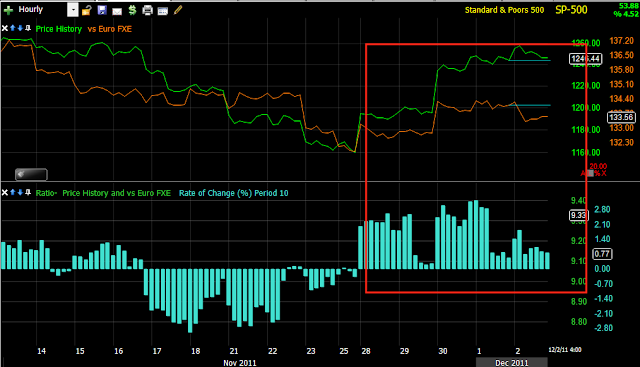

The ES Hourly

And for long term back to 2009, the weekly which would be leading to new lows below the 2009 lows, it's not that far off from 3C and Money Stream.

3C

Money Stream.

These long term charts are hard to manipulate, not even QE got past them.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago