As suspected, VXX was used earlier today.

Here are a few...

First commodities gave a clear signal earlier in the week that they went risk off, what made it stronger was the $USD was favorable for commodities gaining ground so that was a clear signal.

Today's collapse is something else.

We've been looking at High Yield Credit very closely, I figured , lets back up, note the divergence in to the 2007 top, since then HY hasn't surpassed even the area of the 2007 top, it's weaker which is to be expected when the market is built on the sand with playing cards from F_E_D candy.

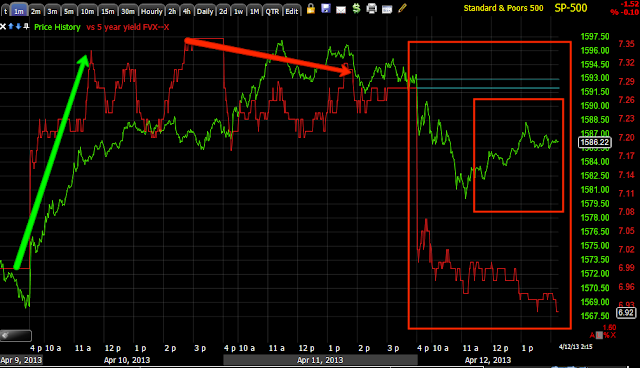

Yields (along with Treasuries -they move opposite) were favorable in green, went negative against the market in red and are leading negative as there's a strong flight to safety today.

Yields are like a magnet for stocks.

If that's so, then this spells trouble, the longer term yields which already broke to new lows for the year, the yellow area is where the market broke the trend channel and there was a significant change in character, Yields also went from not making a higher high in months to moving down.

Recently the $AUD has been tracking the market better.

Here it is today, leading the market lower.

The Euro also use to have a very high correlation with the market, it did give warning in red at the top yesterday and was supportive this morning early in white,

Here's the Euro on a longer term basis totally breaking down with the SPX, it's the same time as the Trend Channel being broken by the major averages, perhaps there's nothing wrong with the Euro as a risk indicator/leading indicator, after all I showed you last night and several times that the $USD has done the opposite of the Euro so it's not broke.

The $USD moving down is supportive of the SPX as you see, but what happened the last few days? The market should move higher based on algo arbitrage alone.

Yesterday the USD intraday was in gear with the market gains

And for the week, the USD pullback has been supportive of the market, but the last few days something hasn't been right. I will look this weekend, but I suspect currencies are about to flip, the $USD back to its uptrend, the Yen moving higher and some others that won't be good for risk assets like the SPX.

The Yen moving down is supportive of the SPX

However recently the move has lost momentum, today it's going the wrong direction. Think about the Futures long term charts posted this a.m., it seems they know something is up.

TLT today should have pulled back to the light blue arrow according to correlation, but it seems the flight to safety is that strong that it didn't.

Here's VXX with a very sharp move down in the a.m,. sharper than the market would suggest, remember this is one of the levers. Now look at this.

Around 11-11:30 the levers were being pulled, Volatility was being used to help the market of its lows as you can see in VXX as suspected.

Furthermore...

There's the short term distribution to send VXX down.

Since then it has been accumulating again as the arb is not supportive right now.

As for Sector rotation, everything that isn't a Safe Haven trade is down today except Discretionary.