Dave from Denver from his Golden Truth commentary wrote this commentary on the apparent manipulation on the part of the bankers:

MAY 2, 2011

Pure Criminality

I hope precious metals newbies have not been emotionally derailed by last night's obvious ambush of silver by the corrupt Wall Street bullion bank cartel. It's funny because just yesterday I was chatting with my significant other, who happens to be from Las Vegas, about organized crime. She mentioned that Vegas is full of organized crime gangs, not just the casino mafia. I replied that any area that generates tons of cash flow is mired with organized crime and extreme corruption: Vegas, DC and Wall Street most prominently (obviously there are others but those are the biggest). Little did I know that several hours later the action in electronic silver trading would ironically highlight my point about Wall Street!

Make no mistake about it, what occurred last night right at the open of electronic futures trading in gold and silver was nothing more than a very aggressive attempt by the big Wall Street banks who are irrationally short paper silver to shake out weak hands in order to reduce the fraudulent short positions in paper silver. Anyone who thinks last night's action - as reported in the mainstream media - was connected to a feared slowdown in China or the Bin Laden thing or the Bolivian mining news is either hopelessly naive or pathetically ignorant of the facts.

So let's look at some facts. First, no other commodities were hammered. If China slowdown fears were the culprit, shouldn't all of the base metals used in industrial production have been hit hard along with silver? Seriously. Even more telling was the fact that the dollar barely moved in either direction last night - and it's below 73 right now. The media loves to explain movements in gold/silver with inverse movements in the dollar. How come the dollar was not doing a moonshot in response to the gold/silver cliff-dive?

Second, the CME has been raising silver margins regularly now. We are not seeing this in other commodity contracts. In fact, the margin on Comex silver was raised over the weekend from a little over $12k to a little over $14k. That's over 30%. The margins on gold were not raised. The CME always seems to raise silver margins when silver is moving sharply higher and when all of the evidence points to physical silver shortages. That latter point was apparent to me when I saw the very low number of delivery notices handed out. Typically a large percentage of the open contracts are given notice and delivered within the first few days of a delivery period. Not this time. What this tells me is that banks with large counterparty delivery positions (i.e the ones with big short positions, like JPM and HSBC) are going to make an aggressive attempt to induce weaker hands to puke their positions before JPM and HSBC are actually required by contract law to make delivery. Let's see how this plays out over the next 3 weeks. Last notice day is May 27th and you can monitor delivery activity on the CME website.

Third, some big off-Comex futures brokers raised their in-house margin requirements for silver to double or more than double the required margin at the Comex. The most prominent firm, and one of the world's largest commodity brokers, is MF Global. MF Global jacked its margins on Friday to a little over $25k. MF Global happens to be run by ex-Goldman CEO Jon Corzine. Hmmm, anyone think there is any connection between Corzine and the big firms who control the Comex? How about between Corzine and the CFTC chairman who is also an ex-Goldmanite? Another very large futures broker, thinkorswim - which happens to be owned by Ameritrade - raised its margin on silver to over $30k. Anyone besides me understand that Ameritrade caters to small, individual speculators who were likely forced to sell to cover this margin hike?

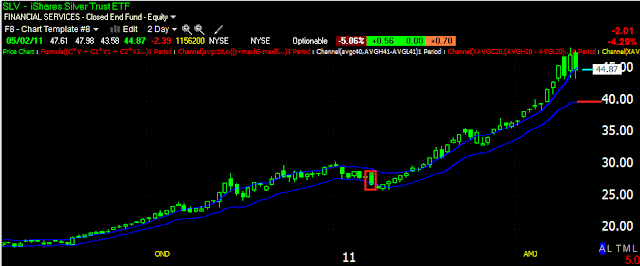

Needless to say, last night's ambush was comically initiated right at the open of electronic trading, which commences in the early evening on Sunday, when the futures markets tend to be at their least liquid. There was an absolute flood of sell orders at the open but the cliff-dive chart was accompanied by a relatively small amount of total volumn. This suggests that there were some motivated "sellers" trying to push the market lower and force selling by the MF Global or Ameritrade customers who would be unable to meet the new margin requirements. To be sure, there was also plenty of unloading by longs who were frightened by the volatility and wanted to protect any profits they might have.

Anyone who thinks this was anything but a criminal event staged by the corrupt Wall Street crime "families" needs to better educate themselves on the facts of the precious metals market. Please notice how the dollar is now plummeting, gold is now UP over $7 from Friday's close and silver is down a mere 80 cents. Kudos to all of those who understand the dynamic and held on tight to their position. It is a tried and true law of economics and markets that market interference/intervention always fails and ultimately backfires on the parties attempting to manipulate. In this case Wall Street crime families and the Fed.

Quite frankly I think it's tragic that there are well-respected analysts like Ted Butler out there spreading the gospel that the CFTC and SEC will ultimately crack down on this or that bullion ETF's like SLV and GLD are legit. In his latest newsletter he defended SLV's credibility and made the claim that SLV holds all of the bullion that it is supposed to hold. He clearly has not read the prospectus or he would understand that there are legal loopholes a mile wide in both the GLD and SLV prospectuses that make it possible for both ETF's to play the fractional/leasing games with their metal. To assume that a criminal enterprise like JPM would not take advantage of this is a tragic flaw in Butler's body of work. It is absurd to overlook the obvious connection between the JPM Comex short position and the fact that JPM is the "custodian" of the largest known stockpile of Comex-deliverable silver bars on the planet. I know based on my 25 years of experience in this industry that the people who work on Wall Street and rise to the top get there by lying, cheating and stealing to whatever extent they can. The amount of money JPM is losing on its silver short is "blood" money. Expect this aspect of the game to become even more intense. But then again Butler lost all credibility with me in this part of his otherwise brilliant Comex/COT statistical/analytic work when he repeatedly and unyieldingly defended his view that the CFTC would eventually crack down on the corruption and fraud at that Comex. I got news for you Ted: the perps would be ice-skating in hell before that ever happens...

Quick editorial update: I just learned that China and Vietnam, the largest and fifth largest gold buyers in the world were closed last night for their May Day holidays. Adds even more weight to the argument that last night was a strategic ambush.

Make no mistake about it, what occurred last night right at the open of electronic futures trading in gold and silver was nothing more than a very aggressive attempt by the big Wall Street banks who are irrationally short paper silver to shake out weak hands in order to reduce the fraudulent short positions in paper silver. Anyone who thinks last night's action - as reported in the mainstream media - was connected to a feared slowdown in China or the Bin Laden thing or the Bolivian mining news is either hopelessly naive or pathetically ignorant of the facts.

So let's look at some facts. First, no other commodities were hammered. If China slowdown fears were the culprit, shouldn't all of the base metals used in industrial production have been hit hard along with silver? Seriously. Even more telling was the fact that the dollar barely moved in either direction last night - and it's below 73 right now. The media loves to explain movements in gold/silver with inverse movements in the dollar. How come the dollar was not doing a moonshot in response to the gold/silver cliff-dive?

Second, the CME has been raising silver margins regularly now. We are not seeing this in other commodity contracts. In fact, the margin on Comex silver was raised over the weekend from a little over $12k to a little over $14k. That's over 30%. The margins on gold were not raised. The CME always seems to raise silver margins when silver is moving sharply higher and when all of the evidence points to physical silver shortages. That latter point was apparent to me when I saw the very low number of delivery notices handed out. Typically a large percentage of the open contracts are given notice and delivered within the first few days of a delivery period. Not this time. What this tells me is that banks with large counterparty delivery positions (i.e the ones with big short positions, like JPM and HSBC) are going to make an aggressive attempt to induce weaker hands to puke their positions before JPM and HSBC are actually required by contract law to make delivery. Let's see how this plays out over the next 3 weeks. Last notice day is May 27th and you can monitor delivery activity on the CME website.

Third, some big off-Comex futures brokers raised their in-house margin requirements for silver to double or more than double the required margin at the Comex. The most prominent firm, and one of the world's largest commodity brokers, is MF Global. MF Global jacked its margins on Friday to a little over $25k. MF Global happens to be run by ex-Goldman CEO Jon Corzine. Hmmm, anyone think there is any connection between Corzine and the big firms who control the Comex? How about between Corzine and the CFTC chairman who is also an ex-Goldmanite? Another very large futures broker, thinkorswim - which happens to be owned by Ameritrade - raised its margin on silver to over $30k. Anyone besides me understand that Ameritrade caters to small, individual speculators who were likely forced to sell to cover this margin hike?

Needless to say, last night's ambush was comically initiated right at the open of electronic trading, which commences in the early evening on Sunday, when the futures markets tend to be at their least liquid. There was an absolute flood of sell orders at the open but the cliff-dive chart was accompanied by a relatively small amount of total volumn. This suggests that there were some motivated "sellers" trying to push the market lower and force selling by the MF Global or Ameritrade customers who would be unable to meet the new margin requirements. To be sure, there was also plenty of unloading by longs who were frightened by the volatility and wanted to protect any profits they might have.

Anyone who thinks this was anything but a criminal event staged by the corrupt Wall Street crime "families" needs to better educate themselves on the facts of the precious metals market. Please notice how the dollar is now plummeting, gold is now UP over $7 from Friday's close and silver is down a mere 80 cents. Kudos to all of those who understand the dynamic and held on tight to their position. It is a tried and true law of economics and markets that market interference/intervention always fails and ultimately backfires on the parties attempting to manipulate. In this case Wall Street crime families and the Fed.

Quite frankly I think it's tragic that there are well-respected analysts like Ted Butler out there spreading the gospel that the CFTC and SEC will ultimately crack down on this or that bullion ETF's like SLV and GLD are legit. In his latest newsletter he defended SLV's credibility and made the claim that SLV holds all of the bullion that it is supposed to hold. He clearly has not read the prospectus or he would understand that there are legal loopholes a mile wide in both the GLD and SLV prospectuses that make it possible for both ETF's to play the fractional/leasing games with their metal. To assume that a criminal enterprise like JPM would not take advantage of this is a tragic flaw in Butler's body of work. It is absurd to overlook the obvious connection between the JPM Comex short position and the fact that JPM is the "custodian" of the largest known stockpile of Comex-deliverable silver bars on the planet. I know based on my 25 years of experience in this industry that the people who work on Wall Street and rise to the top get there by lying, cheating and stealing to whatever extent they can. The amount of money JPM is losing on its silver short is "blood" money. Expect this aspect of the game to become even more intense. But then again Butler lost all credibility with me in this part of his otherwise brilliant Comex/COT statistical/analytic work when he repeatedly and unyieldingly defended his view that the CFTC would eventually crack down on the corruption and fraud at that Comex. I got news for you Ted: the perps would be ice-skating in hell before that ever happens...

Quick editorial update: I just learned that China and Vietnam, the largest and fifth largest gold buyers in the world were closed last night for their May Day holidays. Adds even more weight to the argument that last night was a strategic ambush.

Here's the next story...