There are 3 general or popular carry trades (there are many others including Chinese Yuan based trades) that are all JPY based, the USD/JPY, AUD/JPY and EUR/JPY and pretty close to that order.

The continuing economic weakness, destruction of credit markets and credit creation, banks hoarding money and the absolutely dismal macro-economic data coming out of China is one of the biggest global market causes for concern,

but most traders have no idea and are literally in my view, "Whistling past the graveyard" just as they did with AAPL over $700 and Gold in 2011, despite clear signs to the contrary, we did it here in the US too, I knew there was a housing bubble in our area as early as 2003/2004.

Here's what I have, we'll look at all the pairs and their individual currency futures.

This is the AUD/JPY vs Es (SPX futures in purple) on a 1 min chart, you can see there's a tight correlation there, but not quite as tight as it should have been at the very right side of the chart when this was captured at 3:22.

This is the 5 min chart, I believe some overnight Chinese data played a role as the $AUD is VERY sensitive to China, in any case you can clearly see that ES underperformed the correlation right at the second (higher) high and things went down from there, the correlation to the left is actually better than it looks, the scaling on this platform in comparative analysis is not very good.

This on the other hand is the 1 min USD/JPY vs ES, there seems to be a much better "general" correlation in the pair including to the far right so this is probably my second choice for the Carry trade the market links to.

This 5 min chart of USD/JPY vs ES shows ES outperforming a bit, but the highs are about equal.

This is the EUR/JPY 1 min and the overall and specific market hours correlation are very good, I'd say they are the best which is a bit strange considering what Mario Draghi of the European Central Bank is up to.

On the 5 min chart there's not as good of a correlation, but we are really not so concerned with the recent past, we are concerned with what it will be moving forward so we know where to run our analysis, there's no point of looking over two currencies that have very little correlation with Index futures.

Now for the pairs themselves...

AUD/JPY 1 min 3C isn't giving us much.

USD/JPY is giving us better divergences, more importantly it's showing a positive in the area where the averages have been working on an intraday lateral base.

Interestingly the EUR/JPY is also giving us a positive divegrence in the area in which the market is working on a base.

I say interesting because CHINA has been devaluing the Yuan and specifically "Diversifying AWAY" from the $USD and they've been buying a lot of Euros, that means selling the $USD and ,buying Euros' what do you think that does to the EUR/USD pair ? Remember the first ticker is the long in the pair and the second the short, so if the Euro goes up and the $USD down, the EUR/USD goes up. With supply available of $USD's from China selling and demand high for Euros with China buying, the EUR/USD just hit a 2 year high that hasn't been seen since October of 2011, it was at $1.3966, now it is at $1.3866.

Mario Draghi, the chairman of the European Central bank obviously does not like the currency rising as it makes exports more expensive for countries to buy European goods, but he's been unwilling to debase like the US or Japan through outright monetization of debt such as QE which is the equivalent of a printing press,

however he did come out today and try to jawbone the EUR down from these highs with some statements about price stability, preparing "Non-Standard" measures to guard against deflation and that he was ready to take "FURTHER ACTION" if need be, this dropped the Euro a bit so it would not seem like the most likely candidate to be the leader of the carry trade, however currency traders have to keep in mind China is taking action, Draghi is jaw-boining and the half life of their jawboning the currency lower has had a very poor record.

Don't forget, China has essentially taken Russia's side on the Ukraine and Crimea which is coming up for the referendum vote this Sunday, they also talked about trying to create a new world reserve currency which has always been the role of the $USD, it may not be the axis of evil, but it is a powerful economic axis. I imagine traders have to take all of this in to account, FOR MY PART I HAVE AN EASIER JOB, I NEED TO DETERMINE WHAT'S ACTUALLY HAPPENING UNDER THE SURFACE OF PRICE MOVEMENTS WITH 3C.

That being said, lets look at individual currencies...

Here the 1 min Yen is seeing intraday negatives at the same time the market is trying to make positives and was/is doing so,

the importance here is no matter what pair takes over, the JPY is a part of all 3 so a negative divegrence and eventual lower prices in the Yen will be supportive of whichever carry pair is in control and it will give support to the market,. PLEASE remember though that the Yen's longer term 15, 30 and 60 min charts are very positive which means the downside market pivot is very likely and the longer term Yen charts are confirmation of exactly that.

In the meantime the 5 min Yen is also showing a negative divegrence (I started the divergence after the new contract).

The 1 min $AUD for its part has a relative and a very small leading positive divgerence in to the EOD US markets.

The 5 min chart has a relative negative divgerence and a leading negative, this isn't good for the AUD/JPY if both have negatives, the AUD needs to rise and Yen fall for the pair and Index futures to rise so this

is why I'm thinking the AUD/JPY is likely to slip out of the favor it has found this week.

The Euro on the other hand has a very nice looking 1 min leading positive divegrence and even after Draghi specifically tried to knock it down, it appears traders are just picking up at a discount.

The 5 min negative across is not surprising given the Central Bank knee jerk effect with Dragfhi out today trying to bash the Euro below or the EUR/USD below $1.39, however EOD we have in line and that's what is important is moving forward. This is a better chart than the 5 min AUD's leading negative.

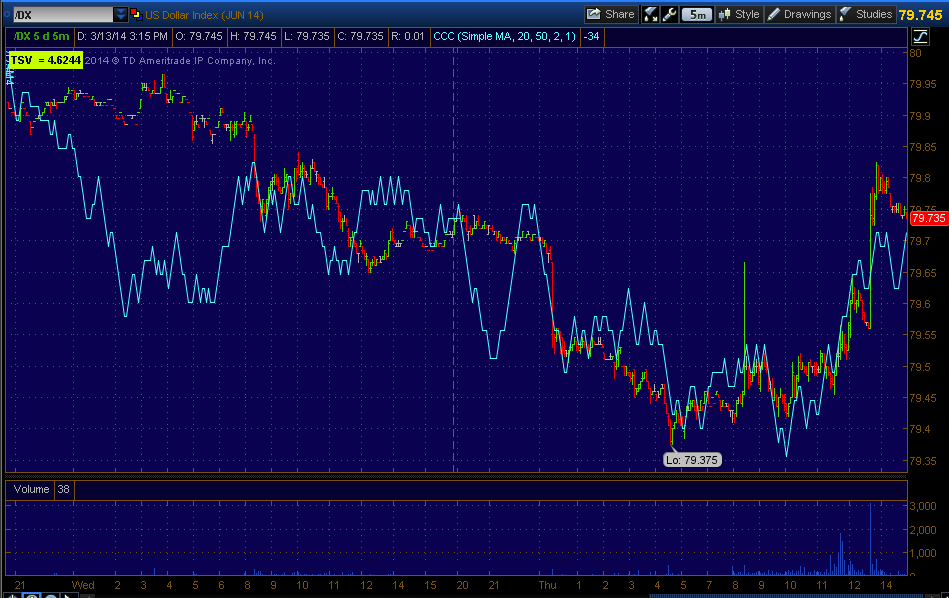

The $USD for its part is in line on the 1 min.

It's also in line on the 5 min with a small reversal process, but no divergence.

This is why I give a slight edge to EUR/JPY MOVING FORWARD, but USD/JPY may come back to lead, it just depends on how aggressive China is in selling $USD reserves. Otherwise, traders may feel China's wallet means more than Draghi's lip service and the EUR/JPY may be the Carry Trade of choice moving forward.

I'll keep an eye on this because there's a lot of leading indications at crucial points the carry trade can give us.