On 6/23 I posted SCOn as a speculative long idea.

Here's SCON now...

So far it's done fairly well.

Lets look at some trade management and part of this picks up from the AAPL post last night.

Depending on your outlook and trading style, sometimes a trailing stop is best.

For a swing trade, we have an entry here when SCON has started a new uptrend, (higher highs/higher lows).

If you feel there's a decent probability of a good swing trade with at least a 10% target or potentially a trade developing in to a trending trade and you have a significant enough profit to guarantee a break even trade with this method, you might want to consider the concept above.

Our signal candle is always the last candle to make a higher high/higher low, today may qualify as it has made both, but until the close, we can't be assured it wont make a deeper low, canceling its status as the signal candle, so for now, the signal candle is 6/24. The next 4 candles could be considered a consolidation, but for purposes of this concept, the candles are unimportant and considered to be noise within the trend.

The low of our signal candle is at $2.25, none of the proceeding 4 days made a high which is lower then our signal candle's low at 2.25 (Day 1=$2.38, Day 2=$2.26 Day 3=$2.29, Day 4=2.32 and today=$2.47). Since none of the proceeding candles have made a high lower then our signal candle, the trend is still in effect.

This methodology can be used on any timeframe you choose. For longer term investors, you can use it on a multi-day chart, such as a weekly. You can use it for intraday swing trades on any timeframe, such as 15 min or 60 min.

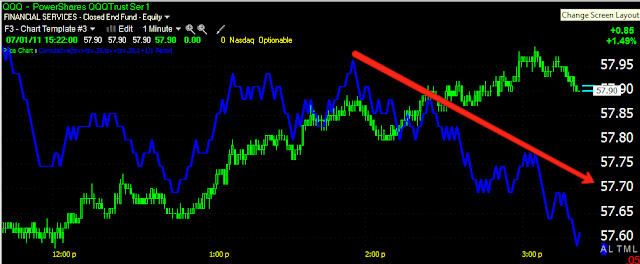

This methodology can also be helpful in analyzing the market.

Some swing traders will take total or partial profits on the first noise candle, which in this case would have given you a break even trade.

It's important to remember, a change in trend is almost always preceded by noise candles, but many times they are also just consolidations.

Here's GOOG as an example, GOOG reverses the uptrend, starts a new downtrend. The cover day posted a low which was higher then the signal candle's high, causing you to cover. In white a new swing uptrend is in effect.

This obviously works best in a trending market, it can be useful now in looking at the longer term trends on a multi-day chart and for trades intraday. These techniques do not have to be a stand alone trading system, obviously things like divergences may give you early warning to get out or enter sooner or trailing stops may play a part. However, understanding the concept is important as I believe we will be entering a market in the near future that is less choppy and a good fit for methodology like this. As always, take what you find useful and discard the rest. It may fit well with some of your current trade strategies.