One of the things I've been watching carefully is the action in the safe haven trades, TLT, a 20+ year treasury ETF has been a safe haven trade during the decline so it has been on my watch list.

What I look for is significant changes in character.

Thus far TLT's daily action, should it hold through the close sets up a Harami candlestick reversal and a nearly textbook one with higher prices being rejected on heavy, churning-like volume.

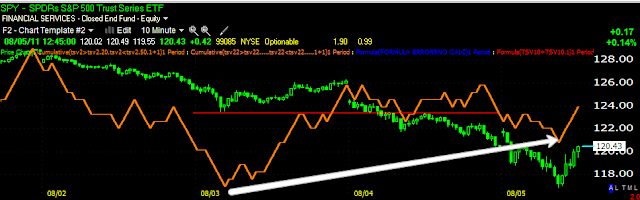

This is the first time since the move lower in the markets that TLT has crossed below it's 15 min 50 bar m.a. Also note the RSI negative divergence. I suspect there will be some volatility around the trend line, crossing above and below, but it looks like the damage is serious.

The 3C 15 min chart, the most common reversal timeframe, put in a negative divergence right as TLT was making the highs of the day, I suspect that was accompanied by churning in volume.

Here's the 1 min short term chart suggesting TLT will move toward the average, as I mentioned, there's often volatility around a break of an important price level.