I don't know if anyone else feels it, but this market is moving fast, an effect of the volatility. I use to have time to check just about everything I wanted to, FX, Risk Assets, news, etc; now important signals can develop in a few minutes while I'm positing an update. The day goes by fast, faster than I can remember. Around 2007 and before, there use to be the summer doldrums when you could look at 100 charts and not be able to find a trade to save your life, what a difference.

The Dow and the Russell 2000 were the clear percentage winners today and it shows in the charts. Wall Street sells/short in to higher prices, the Dow and R2K gave the market that today and the market used it, you'll see in the update.

DIA 1 min with a strong leading negative divergence, if you need to, comeback and compare the SPY's 1 min chart to the DIA or IWM.

2 min DIA, another very strong negative divergence

The 5 min has a relative negative divergence which is pretty deep.

Although the 15 min chart is moving in line with price, it is at a clear relative negative divergence, usually the next step is the transition to the stronger leading negative divergence.

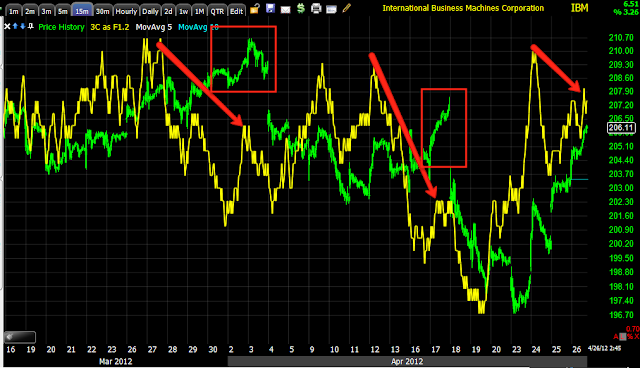

A longer term trend of the same chart shows the damage that has occurred from the 3 previous bounces, this leaves the DIA 15 min in a deep negative divergence.

The IWM was the other top percentage mover today and the 1 min leading negative divergence is sharp

That weakness has bled over to the 2 min chart which is also leading negative.

And the 5 min leading negative.

The 15 min chart is moving with the IWM and pretty close to confirmation, just slightly lower.

The QQQ 1 min is leading negative at the end of the day, but compared to the DIA/IWM, it's not as sharp.

The 5 min is still in line.

The 15 min is in a positive position, but I suppose that isn't surprising considering how long the tech sector lagged the market.

The SPY 1 min, again, compare to the DIA or IWM which performed nearly twice as well in percentage terms.

2 min SPY is leading negative, again nowhere near the DIA/IWM-you can't sell aggressively in to strength if the strength isn't there.

The SPY 2 min leading negative in to the close. I suspect this may have been some risk off profit taking ahead of the GDP tomorrow.

The 5 min is slightly leading negative.

The 15 min appears to be in line...

However when the longer trend is viewed, you can see it is not in line, it is lagging compared to the 17th, like I mentioned, the last 3 bounces did some major damage.