There were a lot of great entries, there were some decent exits from trades yesterday that made more than 50% in 1-day and the overall tone was great. I'm going to update later because I have a few custom indicators I want to construct to give you a visual on the changing trends in volatility and a few other things.

The VIX buy signal using the DeMark inspired indicator worked well, the concepts in market behavior on the huge volatility squeeze in the VIX and predicting exactly what it would do 2 days ago was cool as well as putting or keeping us on the right track.

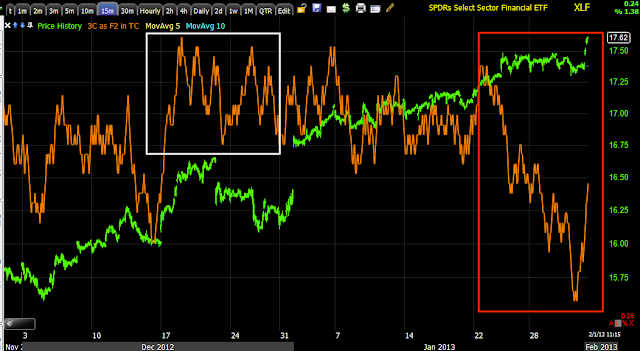

Looking at VWAP for ES and NQ, it's clear to see the selling was in to momentum moves up, there were no buying pullbacks to VWAP save for the very open, VWAP alone looked like selling all day and huge volume went through near the end of the day in ES, about 10x normal volume. The 3C signals fit perfectly with the VWAP/Volume/selling structure in ES and NQ.

Yesterday the Dominant Price/Volume relationship suggested a 1 day oversold condition and we'd see a bounce today, today's Dominant Price/volume relationship is the exact opposite, Price Up/Volume Down which is the most bearish of the 4 relationships and gives the opposite signal, down.

There were a number of low risk, yet excellent entries today. Volatility acted well, especially toward the end of the day. Credit made the situation for the market worse.

People only look at the daily gain or headlines like Dow 14,000 and don't look any further, the market is the last place in which you can expect things to be as they appear.

Today was actually a pretty stress free, easy day for me. Usually I'm looking everywhere for the hint of the clue, today they were just standing out very obvious, like yesterday and we made a nice gain out of yesterday's clues.

So all in all, I'm very happy with the day, I'll be taking a little time off to clear my head, create the custom indicators and look at everything fresh and wrap things up.

Oh and the Euro/USD, that's a move that's time looks like it has come which would be huge.

Talk to you soon.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago