Even though I showed this theme throughout numerous assets such as this post today, I'll give you a feel using the SPY, QQQ and IWM which all closed red today, even transports closed down .90% as one of the worst, however what I'm showing below may be enough for the targets of 16k, 4k and 1800 (Dow, NASDAQ Composite and the SPX closing targets yet to be reached other than intraday).

SPY 3 min positive

15 min negative

QQQ 5 min positive

QQQ 15 min leading negative

IWM 3 min leading positive

IWM 15 min negative.

The theme is the same everywhere, short term/duration accumulation for a bounce that may hit those psych targets, but lots of damage and not much can be done about it.

The key part of the week is tomorrow at 2 p.m. and it seems F_R_D members are out trying to inoculate the market from whatever is in those minutes.

So far over $5bn of POMO did nothing yesterday, today's did nothing so my question Friday of whether QE has lost its luster is legitimate, although a few days/weeks does not make a trend.

10 and 30 year treasuries sold off today in a Taper On mode and QE off, however the 5 min charts for both had positive divergences like the market, almost exactly suggesting almost exactly the same thing, a bounce tomorrow. My question is whether this is pre-minutes or post minutes, the second may suggest the minutes were leaked. As you may recall, it wouldn't be the first time as the F_E_D sent emails out to 144 of the biggest investment banks and private equity firms disclosing the information a full day before its slated release. One may be forgiven for a simple mistake of hitting the wrong button, BUT SINCE WHEN DOES THE F_E_D HAVE A MAILING LIST TO SEND THIS INFORMATION TO THEIR BANKER BUDDIES, WHY WOULD THEY NEED IT AND HOW DO I GET ON IT- THAT'S THE DAMNING PART.

VIX futures (60 min) as well as Short term VIX futures and the spot VIX Bollinger band squeeze all seem to be leaning toward the longer term negative divegrence charts and suggesting that the move started yesterday on the downside continues shortly.

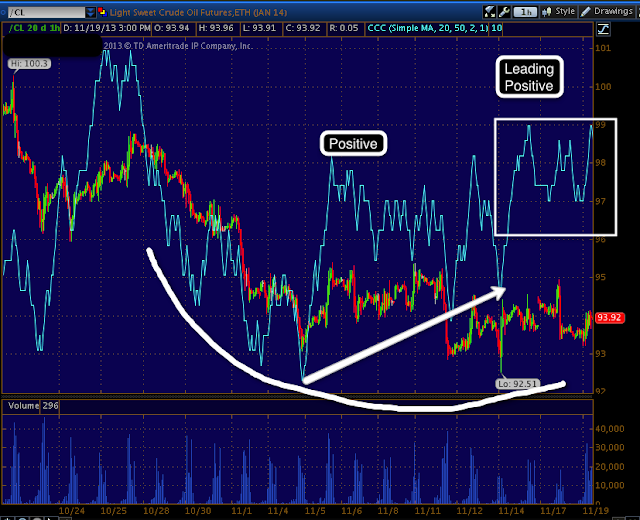

So if Treasuries are to bounce tomorrow, again this would be interesting whether it were pre or post minutes, then the question is, "What do other QE sensitive assets look like?

I have more tan enough data in gold futures to suggest a bounce which would also be QE on/Taper off just like a Treasury bounce, however we expected a pullback in Gold on Monday and a bounce from there shortly after the gap was filled (it was yesterday).

60 min gold futures look ready for upside, GLD and GDX calls are still open.

In GLD...well, pretty much the same. Even GDX (miners) look ready to bounce, but as I said before, we expected this well before the market action before the minutes so it may be unrelated and gold hasn't had the best correlation to QE since 2011 when we called a top.

As far as the $USD, down would be QE on/Taper off and I have no evidence that $USDX is ready or close to a bounce so all in all, most QE sensitive assets , including stocks, look set for at least a short duration bounce, HOWEVER THAT NEVER MEANS IT WON'T BE IMPRESSIVE; if it wasn't impressive, it would be useless and Wall St. doesn't do anything without a reason.

As for Credit, HYG has enough 3C support not to spoil the party, but it continues to move toward distribution and lower prices, I don't see HYG holding up well in the days and weeks ahead and that is important because, "Credit leads and equities follow", we have overwhelming evidence this is true, the credit markets are bigger, badder and way smarter, which is one of the red flags for the equity market.

As for FX, you can bring the Carry trade to the market, but you can't bring the carry trade to the market, at least not anymore. Increasingly as I have been noting, more and more of the tools used to ramp the market are not working as well if at all (Credit, Carry trades, even Central Bank jawboning)...

The EUR/JPY (candlesticks) vs ES (purple)... In the past it has been so easy to ramp the market overnight or even during regular hours, just drive up the EUR/JPY carry cross as you see above on this 30 min chart, but recently as I have been suggesting, things are changing...

All of the sudden ES is not ramping with the carry pairs, this is indeed a rare site that hasn't been seen in I don't know how long to this extent.

After prepared comments by Bernie were released saying:

- BERNANKE SAYS MAIN RATE MAY BE LOW WHEN JOBLESS RATE BELOW 6.5%

- BERNANKE SAYS MAIN RATE LIKELY LOW FOR LONG TIME AFTER QE TAPER

- BERNANKE SAYS ECONOMY `FAR' FROM WHERE FED WANTS IT TO BE

- BERNANKE: ‘MAY BE SOME TIME’ BEFORE POLICY AT ‘NORMAL SETTINGS’

- BERNANKE SAYS FOMC COMMITTED TO ‘HIGHLY ACCOMMODATIVE POLICIES’

- BERNANKE SAYS FOMC TO CONSIDER PROSPECT FOR LABOR MARKET GAINS

The EUR/JPY hit multi-year highs (about 4) and then this...

Bernie comments released at the white arrow and as new highs were hit, 3C went negative and the FX pair followed 3C's lead. If the markets still tracked the FX pair, I'd say this might not be a great sign early on.

ES futures initially bump[ed up on Bernie's comments, but have since moderated and gave up the small gains.

Everything I can see above from Bernie is that he's very concerned that the market is not too concerned about a tapering meaning rate increases, the problem is the last time taper talk was hot in May/June yields jumped hugely on their own, So Bernie is trying to tell the markets that the previous guidance of rate hikes 6 months after QE ends is not so much their view anymore or at least not what they want the market to believe. I mentioned this mess this morning in the a.m. observations and sure enough, Bernie is out pounding the desk

Also don't get "Accommodative policy" mixed up with QE, low rates like the nearly zero percent rates we've had since 2008 are in fact, ACCOMMODATIVE POLICY, although the market likes to read it as QE, those in the know, know what he's talking about, which just makes me wonder more, "What's in tomorrow's minutes?

Other than that, other indications...

The Dominant Price/Volume Relationship for the major averages is the same as last night, Price Down/Volume Down (this isn't for the averages themselves, but each of the compnent stocks in each average).

This reading is benign, it's the most common reading during a bear market and it does not suggest a 1-day oversold condition is in place which is part of the reason yesterday or last night I thought we would not see an upside move yet among other things, however when there's a price down/ volume up and it's dominant, then we have conditions for a 1-day oversold market. Hopwever the other indications above still stand and this doesn't outweigh them.

In my view, the CBOE's SKEW Index is still problematic and it's not just the elevated readings, it's the speed or rate of change in which they were reached.

The normal range for the SKEW is 115, as it elevates, it spells tail risk trouble. The SKEW tries to put a probability on an improbable event, some call it the "Black Swan Indicator" because high levels are indicating exactly that, an increased chance of a sudden market crash, a Black Swan.

HYG Credit and Junk credit are both in line with the SPX today, not leading either way, just in line, but that's neutral so the positives in 3C aren't or shouldn't be effected negatively by Credit, but as I said earlier, HYG's longer term charts are falling apart, it just got a very brief reprieve today that is more or less in line.

High Yield Credit is severely dislocated from the SPX longer term, but intraday it actually led the SPX a bit so that's an overall positive intraday for credit and the market tomorrow.

Sentiment (PRO) is either in line intraday with the SPX or slightly leading similar to the 3 min 3C charts for the averages so it's not surprising and doesn't change my opinion of the market near term and after.

VXX was in line more or less, there are very positive signs and that's why I went for the Call position Friday, I think they head higher, likely not early tomorrow, but overall higher, just look at the spot VIX's Bollinger Bands and the highly directional squeeze signal.

Yields as mentioned earlier in the day are leading the SPX intraday, they act like a magnet until they revert to the mean so this too is mildly supportive of a bounce (perhaps a day, maybe a half day, maybe a day and a half, as of now the divergences are small and there's not much of a foot print so I count it as noise, but it may be useful noise.

Before moving on to Japan, I just wanted to show you Financials because I made a comment about how bad they look, I just want to show you.

XLF 3 min, same thing

5 min leading negative, this is worse than just about any other average except maybe the IWM.

10 min leading negative so the intermediate and long term damage are there like the averages.

15 min leading negative at a new 3C low

The 4 hour as XLF makes the head fake move I was looking for above $21

And the daily, again with the head fake above $21, look at that daily divergence, that's a huge flow of funds.

Looking at how bad financials look, I can't help but wonder if the next crisis will once again be financial? I'm very happy to have FAZ long and XLF puts.

Tonight Japan announced the 3rd worst Trade Balance on record, exports were actually fine, it was the import surge cause by fuel as the bottom line is in a margin squeeze so like the F_E_D's earlier QE attempts, Japan's QE-Zilla has driven up inflation in all the wrong areas and the Nikkei is not sure whether to take bad news as good news or bad news as bad news, but what is clear is that Abe-enomics are looking more and more like a failure as they did when first introduced (see my articles "Currency Crisis")

Nikkei 225 futures tonight

Other than that, not much going on in futures right now, we'll see if we get the bump I have been expecting all day today, it should be useful in a lot os situations.