Although I said I didn't think the market looked particularly strong today and wasn't very impressed, the late day market walloping the market took didn't seem to have roots in underlying trade, it was pretty difficult to find anything responsible for it as it acted VERY much like the instant discounting of a fundamental event (an event which the market didn't see coming and has to discount, these are fairly rare, 9/11 was one of the biggest instances of fundamental discounting and of course the Syrian issue when Obama said a strike was imminent and to some degree the debacle in Washington right now).

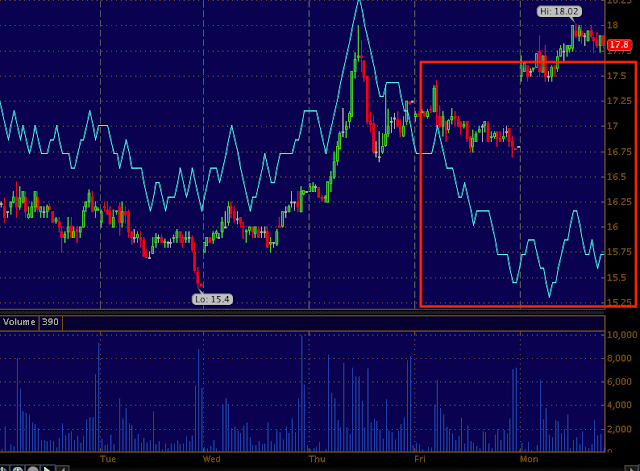

EOD trade...

The EOD trade in the SPY, very linear and on volume, has the hallmarks of a fundamental discounting event, the obvious place to look was D.C., but not much changed there. I suspected maybe some AA earnings leak, but it would have been way more evident in AA which it is not.

Still, the market is well within the reversal process range. To the left you can see an abnormal "V" reversal or an "Event", this is the F_O_M_C Knee jerk reaction I always warn of. Otherwise, the SPX is still within a reasonable range.

The daily SPY looks like this as of the close.

The Culprit to EOD trade activity appears to be Interactive Brokers releasing an increase to 100% margin maintenance schedule, that should tell you what they think about the market going forward as well as the deep liquidity problems I suspect we will experience as HFTs (liquidity providers) are shut off as the market slips.

This is the release above...

These are also some of the momo stocks that are part of the reason I put the new "Most Shorted Index" vs the R3K in among leading indicators.

On other news, when we get a move down, as you know I like to check our equity tracking portfolio for its relative performance vs. the market. I am not a believer in modern portfolio theory, in other words, I'm not a believer in having too much diversification, I want enough to actually diversify between groups that will rotate, but I don't want several stocks in the same sector for that level of diversification. However, because the Tracking portfolio is just that, stocks I have mentioned and put out as positions, I track them to see how they are doing as I don't know which members might have taken which positions.

In other words, the list is so diversified and large because of its purpose, I would not expect very good performance from it as it is WAY over-diversified.

However I'm very happy to see the results as the last several times the market has been down, the tracking portfolio is outperforming the market on a relative basis by about 700%.

The new week just started, but for the new week we are ranked 10th of 758 competing portfolios, but more importantly our relative performance vs the SPX is about 700% here. These are almost all core shorts so the SPX being down 0.75% (there's a slight delay) and our core shorts on average being up 7.25% is an excellent sign for when the market really takes a licking, it shows we are entering the right positions at the right time with the excellent risk:reward ratios.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago