These are a number of indicators that typically lead the market that we keep an eye on, divergences between most of them and the SPX can lead to early signals or confirmation of other evidence, "3C" is short for some of the best advice I've heard from one of the most under-appreciated technician's and developer of technical indicators that I've ever seen, it stands for his advice to, "Compare, Compare, Compare".

So looking at leading indicators, there isn't anything scary on the charts that would make me fear for our trend expectations, not only early this week, but the intermediate timeframe as well.

The charts I showed you earlier (longer term 5, 10, 15 min) are still developing on the same trajectory, pointing to near term weakness in the market.

I also noticed a nearly parabolic intraday move in the IWM, those always grab my attention as they typically fail. I also noticed AAPL's intraday charts are starting to give way as they hadn't before.

As for leading indicators, the signals here are very much along the lines of a market pullback as we expected, nothing really too surprising, but good confirmation.

The EUR/USD pair has been consolidating in what most technical traders would consider a bullish consolidation/continuation triangle, that makes it a perfect price pattern to manipulate and send the FX pair lower (which also would put pressure on stocks and there are plenty of excuses in the EU to do it). The Psychologically important $1.30 level isn't too far off, I'm surprised we didn't see a false breakout above that level and then a move lower, but in any case there's a 3C negative divergence in the EUR/USD as seen above.

FCT just happens to be a good leading indicator, don't ask me why. Look at the reltive price levels of both FCT in lavender and the SPX in green between the two relative points, FCT is in a negative divergence here.

On an intraday timeframe FCT pretty much followed the SPX, but recently it made a new low on the day as the SPX was near the top of its range highs intraday.

Yields show a couple of positive divergences sending them higher, they act like a magnet for equities. Today's intraday price action has seen yields diverge to the downside significantly, this is still a short term signal, but one worth noting.

"Credit leads, stocks follow" as they say. High Yield credit (in this case Corporate) is used to express a bullish view on the market, Investment grade is a flight to safety. Here HY corp. Credit sees a negative divergence at the highs Friday which also look like a head fake move and it is underperforming the SPX on a relative basis.

High Yield Junk Credit is seeing similar action starting with a negative divergence at Friday's closing highs.

Straight High Yield Credit is also showing a divergence at the same place Friday as well as a recent turn to the negative as the SPX was near the top of the intraday range, that was a very specific cue.

As you can see above, Treasuries trade opposite the market (SPX green/TLT red), so...

It's interesting today that there's a gap up in a flight to safety trade like this when the market has not yet broken down to the same extent, beyond that there's a 15 min positive divergence which we had seen (in other timeframes) last week as part of our analysis for this week, this points to a pullback as well.

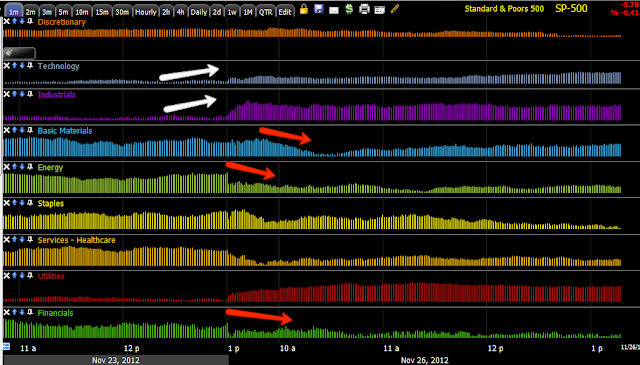

Sector Rotation on a relative basis since Friday vs the SPX has seen Financials rotate out along with Energy (2 of the 3 most important groups) and the high Beta Basic Materials Group. Utilities (another flight to safety trade) are rotating in, Industrials and Tech also look good at least up to this point.