I would be remiss not to mention the Dow finally closed over $13k

Dow closes up + .18% and above $13k

Here's the Maginot line, note volume still hasn't picked up on a break above $13k and looked like it may give it up toward the close as volume picked up considerably.

As you know we started off the day some Horrible, Bad and then Good economic news (Durable Goods, Case-Shiller and Consumer Confidence). Also the ECB's LTRO commenced today with results to be announced tomorrow so everyone knows which banks that took funds will be sold off. The LTRO also will not be accepting "selectively defaulted Greek Bonds" as announced by the ECB.

Around 10 a.m. news broke that Ireland will call for a referendum on the EU Fiscal Compact (letting the people vote-never a good idea in the EU and never one that gets too far) this sent the Euro briefly plummeting early in the session. If the referendum fails, that would make Ireland ineligible for ESM funded bailouts should they need another as Greece needed another and another and will eventually need another.

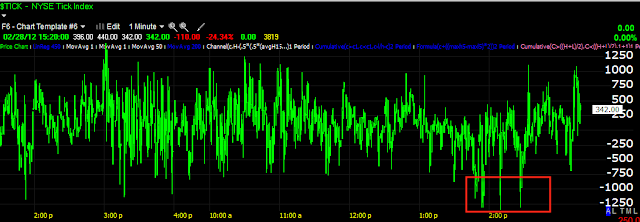

We saw a 1 minute positive divergence around 9:45 followed by strong Consumer Confidence at 10 a.m. sending the market higher (which now-a-days means .03%).

Some news about Israel and the possibility of a surprise pre-emptive attack as well as Iran announcing they'd be accepting payment for oil in gold (moving away from the $USD) had no effect on oil (unlike very recently and much like the last several months). However the talk of the use of the Strategic Petroleum Reserve may have had some effect on crude, it's hard to tell with so many months of it not reacting to geo-political news and then suddenly "seemingly" doing so. If anything, I would think talk of opening up the reserves would be taken as a hint an attack or Iran is in the works.

Lets get to the charts...

Commodities vs the SPX

Commodities were in line with the 1 p.m. market decline, the end of day push saw brief involvement and then they backed off. We'll look at this in closer detail.

High Yield Credit

High Yield Credit was leading the market early (white) and then led the selling around 1 p.m., again it led the late afternoon bounce, but failed to participate for very long.

On a longer term basis, HY Credit still hasn't made a higher high in over 3 weeks and is in fact moving the other way, down about 3% while the SPX is up about 3% for the same time frame. I post this because of Credit's leading qualities as can be seen on the intraday chart.

Yields are also a leading indicator

Yields have been on the decline as you can see, they did not confirm at all today and in fact went the other way, longer term the divergence is huge.

High Yield Corporate Credit

HYG was in sync with the market most of the day until the closing bounce, while the market's moved up HYG sold off.

As far as Sector performance, Financials started rotating out toward the end of the day, that may be part of the reason for the 1 p.m. decline. Healthcare and Staples both came in to rotation, Energy, Basic Materials and Industrials were all on the way out. Tech and Discretionary held their ground.

As you can see, the Euro/USD correlation had nothing to do with the mid-day selling.

Financials do seem to be part of the cause, you can see XLF's momentum vs the SPX was on the decline before the broad market, financials also failed to participate at the end of day bounce.

Here's XLF intraday, note the noon negative divergence, end of day there was a small divergence and then just confirmation, but overall under-performance.

Longer term, XLF seems to be seeing more downside 3C momentum.

Long term you can see confirmation in green and then a negative divergence, the white arrows show the direction of financials, the 3C divergence has definitely sent XLF lateral. It is also leading negative here.

XLE/Energy

XLE was also on the decline around noon before the broad market, energy totally failed to participate in the end of day bounce.

XLE 5 min

XLE is also showing increased negative 3C momentum, you can see this in the performance of XLE as well. Again, leading negative.

XLE 30 min. So it seems clear that Financials and Energy started falling apart late morning in to noon which weighed on the broader market.

Tech...

Tech's price performance wasn't bad and lent probably the only support to the market today, however the underlying action is falling apart, especially at the end of day which is interesting. Selling in to some strength?

The 15 min chart is deteriorating, Tech has been the last hold out , Energy and Financials look further into the mess the Tech, but Tech is heading that way.

Speaking of which, you can summarize Tech as AAPL which I mentioned today.

As I mentioned, the short term underlying action looks like AAPL is going to see downside shortly.

AAPL 5 min

AAPL, it seems to me something changed on the 15th, I would say the short term at least has had its back broken, we'll see shortly.

As for Price Volume Relationships...

The Dow's dominant P/V was the most bearish, Price Up/Volume Down. One Third of the Dow was down on the day.

The NASDAQ on the other hand had the most bullish P/V relationship, Price Up/ Volume Up

The Russell had co-domiannce, both price down, with volume up and volume down with a majority of stocks closing red.

The S&P had no dominant relationship today.

As for Treasuries...

We have a downside reversal candlestick pattern the last 2 days, a doji star followed by a bearish engulfing candle, this looks like a pullback and 3C seems to confirm it.

Here is the action of note in Treasuries, last week or thereabout, we started noticing treasuries rallying in to the close, even though they were in a short term down trend, that little change in character turned treasuries up and strangely, they defied their inverse correlation with the market as you can see the SPX in white this week.

Long term, something changed in the sentiment for treasuries, they were in a negative divergence, heading down and then all of the sudden started seeing a persistent positive divergence.

Here on the 15 min chart you can see accumulation sending TLT higher and a negative divergence that fits with the candlestick reversal above, so I'm looking for a pullback in treasuries, unless some event causes a flight to safety.

We do have the LTRO announcement tomorrow, I expect some kind of knee-jerk reaction, although I don't have a clue as to what it will be. I do have a feeling it will be short lived and it will be interesting to see if the ECB adds anything to what they have already said, part of which is that this is likely the last LTRO. I would guess that will be the major EU event tomorrow.

We have 4th qtr. GDP at 8:30 in the US, that could be a mover, also Chicago PMI at 9:45 (potential for some real volatility combined with Europe), Fisher speaks at 9:30, Bernak-a-cide at 10 a.m. and Plossser at 12. We also have the EIA Petroleum report at 10:30 (that could be interesting) and the Beige Book at 2 p.m. so tomorrow we have quite a few catalyst events so I suspect volatility. I'm especially going to be looking for our normal Wednesday USO trade, there may be enough stuff going on to get a quick trade off there. Also I'll be highlighting some more trades and looking at earnings as we didn't have a call today.