I'm actually surprised how many emails there were about UNG today, it "seems" like a boring stock compared to AAPL or AMZN, but long term members who know all the reasons why we like it and now a lot of newer member who have been buying it are pretty excited about it and honestly for a asset with such a low Beta, I'm really excited about it.

For newer members, since we have been following developments in UNG since probably this time last year when not only the Rate of Change (ROC) in price gave away a change in character, but volume was a huge change and changes in character precede changes in trends, I want to share a few reasons why I'm excited about UNG.

First of all its a commodity and a clean energy source that is abundant in the US, it's really the center piece of US energy independence and doesn't have the resistance that oil, coal or nuclear have from different groups.

While we knew something was going on, the same way 3C spotted something going on in the home builders during the 2000 Tech crash (who would have thought homes that were appreciating 2-5% year on average were going to lead the next bull market after the tech revolution?), we didn't know exactly what it was. This is how the market and 3C's view of the market always aren we, if you want to wait for certainty and understanding, you'll miss the chance to make money.

Then we had the Arab Spring, without getting too much in to the geo-political landscape being redrawn in an oil rich region of the world, the fact of the matter is it' hard to put a solid new government in place that isn't a dictatorship. Why do you think Saddam and these other dictators have stayed in power so long? It's because the middle east is deeply divided, whether religion -Jewish, Sunni, Shiite, etc or Arab or Persian, those who have vs those who have not, there are a lot of things that separate these countries and a lot of it is because of the arbitrary borders drawn up in the mid 20th century that created countries like Iraq with Sunnis, Shiites and Kurds all in the same mix; only strong handed dictators can hold those countries together. With all of US/coalition military might in Afghanistan, 11 years later the government still can't project power outside the capital on their own. Basically, as far as geo-political ramifications go, we haven't seen anything yet from the Arab-Spring-just look at Egypt recently.

Putting aside the cost of gas and the potential cost f trouble erupts in one of the canals, there's obviously been a push toward energy independence and a lot of strange characters have been popping up, not because they have great ideas, but because they see the profit of an all new energy industry.

One of the things that really struck me about Natural Gas was Bernie's semi-annual Congressional testimony which is like the Superbowl for anyone in finance, they all watch it. I found it very strange that one Congressman asked Bernie about energy independence and specifically plugged Natural Gas, what does Bernie have to do with shaping Energy policy-if anything he tries to ignore it in their inflation figures. However this was that Congressman's opportunity to get a free commercial during the Superbowl and it was really a rhetorical question to push NG.

Later in 2012 the administration/EPA (I believe) passed a new emission standard for any new US power plants that eliminated clean coal and left only nuclear (URRE) and Nat. Gas (UNG). All of the sudden, Nat. Gas just saw a huge potential demand increase. So things are starting to fall in to place.

Many of you know that I had a "Person in my life" who worked for one of the big 2 ticker investment banks and he passed on to me the analysis research papers that the different trading desks used, whether FX, commodities or stocks. I thought I hit the lotto, but every idea I tried to follow failed, you now why?

Because Wall Street plans these things way in advance, they need to because of the size of their positions. If I tried the same idea 9 months after I read about it, then it worked.

So whatever happens in the market over the next few years, I think Natural Gas enters a secular bull market and we are in at the bottom, this is why when I talked about the pullback this week, I said "It really doesn't matter over a few percent, just don't miss the opportunity."

As for the charts, not a lot has changed, but here's the basics...

There are 4 stages to an asset's life cycle and they tend to repeat: Stage 1-Acumulation/Base; Stage 2- Mark-Up or the bull market trend; Stage 3-Distribution/Top and Stage 4-Decline. UNG came out of stage 4 and entered Stage 1, we are looking for stage 2 as that's where the easy money is. We have a large base with huge volume through it that should support a large move. I mentioned the last breakout we identified as a head fake or false breakout that failed and mentioned you might want to take profits (nearly 040% in many cases) and buy after a pullback. It's also my opinion that UNG needed a pullback to gather energy for a real breakout to stage 2 and that's what the yellow area is all about.

We had a good day today, I think the new format of the EIA report for Nat. Gas inventories really helped UNG. We are right at gap resistance which tends to be the strongest resistance so a pullback is still on the tableAfter that we have the Stage 2 Breakout level and then it should be a trending trade.

As for trending, my Trend Channel set to the smallest size for UNG's volatility, captured over 50% in this one move. If I widen the channel it captures over 90%.

The blue indicator at the bottom tells us where the close was within the weekly range, as you can see this is telling us something we might not have seen otherwise, the closes recently have been very bullish and growing, this tells us a lot about the character of UNG.

This is the daily MoneyStream positive divergence.

I've already made the 3C case, but...

A 4 hour chart goes from confirmation to a leading positive divergence in the base.

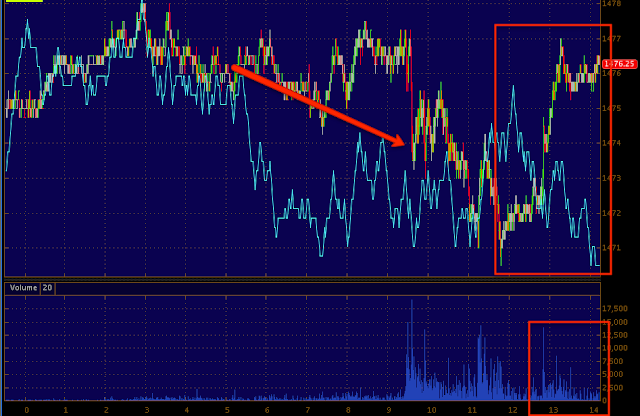

This is the last head fake breakout-not all head fakes are bas and not all declines are bad. We knew we could take profits there and enter at a better price, we could have essentially made another 20+%, but that's nothing compared to what I think UNG will do.

If you are interested in the trade and maybe need some ideas about how to play it, feel free to email me. This is a long term trade, more like an investment; you need a wide stop as we are still in a volatile base. I can help you figure out the risk and position sizing.

If we get the pullback, fantastic, if we don't, I look at it like this, "Am I going to give up on a potential 400+% trade over 4 or 5 %?"