To catch a criminal, you need to think like a criminal-same is true of Wall Street.

Here's my, "If it were me in the driver's seat on Wall" scenario...

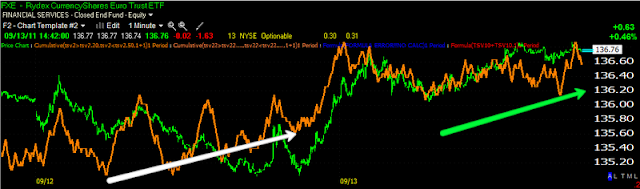

Move the market down below the bear flag... Give shorts something to sink their teeth in to.

Then, just like this dat on the 26th, at the EOD, close the market off it's highs and gap it up the next morning.

The longs are NOT important to Wall Street, it's not like, "we're all long, lets get those shorts!", it's more like "YOU ARE ALL SHEEP TO BE SENT TO THE SLAUGHTER".

So right now, what longs think about the markets has ZERO importance to Wall Street, to sell their accumulated position, they need to dazzle the shorts, get the shorts confidence in the market falling back up, draw them in and then trp them with a gap up or a big move up. Then and only then, do they have the supply of buy side they need to distribute their long holdings from yesterday/Friday.