I'm not making a case for or against the effect of the F_E_D's POMO, certainly in the past it has been very clear with the first two operations, when POMO was in effect and when it was not, however I am making the case that you should think for yourself and while history may rhyme it rarely repeats.

One of the events that taught me this was the announcement of QE3, which everyone seemed to think would set the market on fire and whoa to anyone who was short. I wasn't fighting the F_E_D or trying to be a contrarian for contrarian's sake, we just had a strong negative signal going in to the September 13th announcement and while I openly admitted that the emotional side of me wanted to close all shorts and go full long (because of past experiences with QE), I decided not to move anything around, respect the signal that was there, respect past experience and gather more data. The more data I gathered, the more it looked like we were not just going to have a knee jerk rally on the announcement of QE3 as much as everyone seemed to think we were destined to, instead this is what happened.

From the June 4th lows to the Sept 14th highs, we saw about a +14.7% move to the upside, at the yellow arrow on Sept. 13 QE3 was announced, we rallied 1 day and after September 14th it took 4 months to see that price level again. We've moved approximately +3.5% since retaking the Sept. 14th highs until present.

After QE3 was announced the market drifted slightly lower for about a month, then we lost nearly -7.5% over the next month.

Conventional Wisdom with regard to QE3 being announced was very wrong, this is why I say respect the past, we learn from it, but don't let it determine your future, anyone who did so on September 13th of 2012 lost money because of pure laziness.

I read ZeroHedge talking about January and the P_O_M_O results for January,

"In brief: of the 15 POMO days since January 9, the market was up 13 of them, or an 87% hit rate."

Now I didn't go through every day's operations in through February because there was a P_O_M_O every day of the month except for 1, in fact the F_E_D was expected to purchase 75% of all new 30 year Treasuries offered. While I just used the schedule which you can see below...

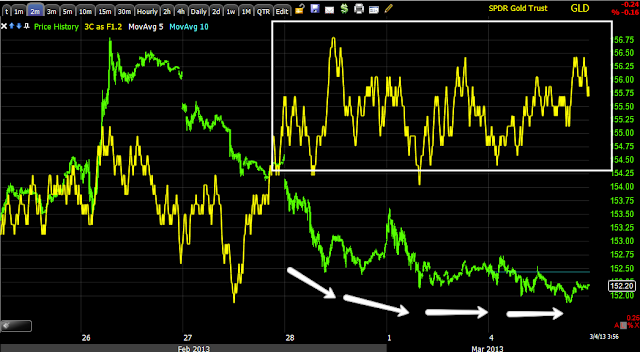

As of February 12th, the F_E_D had bought more US government debt in 2013 than the Treasury even issued so I figure the schedule is probably pretty close to the actual operations. Below you'll see the month of February (and the first 2 days of March).

Above price I listed all the days the F_E_D was scheduled to commit a P_O_M_O and a "Y" for a day that closed up and a "N" for a day that closed down. Because of a lack of space, below I put the maximum expected purchase size, this is telling because on days such as Feb 4th, we had a large POMO scheduled and a big day down, by contrast Feb 5th was a decent day up, but a scheduled max purchase half the size of the previous day. In fact many of the largest scheduled purchases saw pretty large down days.

Of the 18 scheduled purchases (only 1 day was there no scheduled purchase) 7 of those days were down giving a "Hit Rate" of 61% or just barely above 50/50, the gain for Feb. was 1.1%.

I decided just to look at some random other February years which had no P_O_M_O...

During the Bull market, the month of February 2005 saw 68.4% of the days close up and a +1.89% gain, this certainly doesn't seem to indicate that a month with a scheduled P_O_M_O EVERY SINGLE DAY save for 1, had much of an advantage over a month/year with no POMO at all.

I looked at Feb. 2007, only 47% of days closed up with a -2.17% loss on the month. I have done some research, it is not exhaustive, but it does suggest that even during a bear market we typically see about the same number of days closing up as down, it's just days like the last one of February above really make a big difference.

I went back to the early part of the bull market in February of 2004, we saw 47% of days close up with a 1.15% gain on the month.

While this is hardly a significant sample size, I think it's enough to inspire you to think for yourself and realize that while a similar program may be running, it doesn't mean the market will act the same, it may act much worse, maybe it even acts much better, but there are few things in the world as dynamic as the market with as many possible influences so while I find books like the Stock Trader's Almanac fascinating, I'd never trade by them.

Just some food for thought.

I'll have more shortly. For now, futures aren't looking very good, we of course have a long noght ahead of us, but something doesn't appear to be sitting well with futures and I expect we'll see some adverse price reactions shortly.

ES futures 1 min with a very deep leading negative divergence.

NASDAQ futures with the same.

CONTEXT for ES has deteriorated as well