Other than a little trepidation which may or may not be justified (this is a very unique circumstance in which the US "could" default and there are surely going to be insiders trading ahead of any announced deal),

today was a great day.

If you took the VXX November $15 Call trade yesterday you should have been filled around $1.09, maybe better and as of today's close, you should have nearly a +60% gain. I know a lot of traders who'd take the rest of the week off with a single trade like that and not violate risk management.

Even if you just took the UVXY long equity (ETF) position, you'd have a 1-day gain of 13%, that's not bad at all. I know it was a difficult trade to take, a lot of our trades will be because we aren't chasing price, we are watching the underlying action, what Wall Street is doing and they are doing it long before it shows up in price, but if you think about it,

you not only got in at a better price which allows you a larger position without violating your risk management, you're also a lot closer to a reasonable stop than those who chased VXX, even those who saw the price trend changing early. While it can be scary, it's almost always a better position with less risk, it's just habits and old ways of looking at the market are hard to break.

Right now, unless some really interesting trades come up, we are largely in trade management and trade set up mode, managing current positions and setting up the next round.

We are closing in on "D" day, "D" is for "Default".

I'm not getting political on anyone so plase don't take it that way, but it's a well known fact that Democrats have seen universal health care as the summit of Mount Everest, Obama wasn't the first to try. It's my opinion that this crowing achievement of his administration would be tarnished if he were to be remembered as the President who presided over the U.S. default which would come with some unimaginably nasty side-effects and unknown consequences, so I think (this is gut alone), a deal gets done.

The question is, "How much of this sis the market already bake in to price?" It would seem to me the market has largely discounted the probability a deal gets done and adjustments like today are discounting the time decay until "D" day

(with ALL RESPECT to Veterans).

I've had a lot of conversations via email with members as to what happens if a deal does get done? Is it "Sell the news" or "Relief Rally",

I can't say, I suppose it will likely be whatever Wall St. needs it to be.

One of the examples I've used in our exchanges is the announcement of QE3. If you recall on September 13th 2012 when QE3 was announced, we saw the typical F_O_M_C / F_E_D knee-jerk reaction I always warn of, it looked like this...

QE3 is announced, you may remember we had serious 3C negative s and as much as conventional wisdom and even emotions said, "Cover all shorts and go full long", I said, "We have negative s, let's just be patient" and we were right as the market lost another -8% in to the November 16th lows.

Note the F_E_D / F_O_M_C knee jerk effect, if you can find an F_O_M_C meeting that occurred and I didn't want before hand, "Beware of the F_E_D knee jerk effect", I'll give you a prize! It just happens that often, the initial reaction is usually faded or the wrong reaction.

This is the recent Sept.18th, "No Taper" with a big push to the upside, no follow through and the knee-jerk move higher was exactly that, a knee-jerk reaction that was faded.

However, back to my point...

I'm not so sure the market failed to respond to QE3 because as pundits claimed, "It was priced in". Unfortunately intraday 3C charts can't go back that far, but WE DID HAVE ACCUMULATION IN TO THE 11/16 MARKET LOW, that means whether there was no rally on QE3 because it was priced in or not, we'll never really know. It very well could have been the market needed a good, long accumulation period on the cheap which I believe they've been distributing through most of 2013, the accumulation was there on 3C charts in to the 11/16 low.

The point being, institutional money is like an oil tanker trying to make a turn whereas we are like jet-skis, things you see now they planned and put together long before, take the VXX accumulation yesterday and the run today, but I have even more intense proof, how about home builders being accumulated during the 2000 tech meltdown, when the housing boom didn't start for a couple more years, this was a 1.5 year accumulation period.

Likewise, what you see right after an event like the debt ceiling, can't be taken at face value any more than this huge multi-day 3C chart's accumulation of HOV (Homebuilder).

Not only is the base near perfect with a move below obvious support and the rounding "process" on this 3-day chart, the leading positive divegrence there is huge and right at the time when the market was getting pounded as the Tech bubble popped.

Who would have ever known that housing was going to be the next bull market after the Tech Revolution? In our case (our area), out home more than doubled in value in 2 years! Who would have known that? Someone with DEEP pockets did...

This is what the divergence would have looked like at the time...

And HOV gained 2500% from there.

Another case in point, the VXX yesterday... and just about a +60% gain today.

I think the point is made, what you see is not always what you're going to get.

So on to today...

If you don't recall, last night's Daily Wrap I posted charts of the EUR/JPY (I actually posted them earlier in the day, but I had to wait until the close to give you a better view) to show you how the carry pair was driving the market...

This is from last night's post...

To me, this is a very interesting part of our analysis because the media tells you the market did this or that because of the most obvious thing they can think of like the Congressional farce right now, but it was clearly the EUR/JPY driving and supporting the market yesterday.

I made the case and showed the charts that the Yen wasn't going to cooperate any more, today take a look at the E?UR/JPY and the market...

Yesterday ES (SPX Futures) rise with the carry pair, today the market falls with the carry pair.

Another question I was pondering was whether gold was truly acting as a "Flight to Safety" asset, today (for now at least) that question is answered...

You can see a nearly perfect inverse correlation as ES falls, Gold futures rise and vice-versa. There's even some of the same effect with silver futures, but the correlation isn't as tight.

As for the traditional flight to safety, Treasuries, does anyone recall what my price target for TLT was as it was trading up around $107-$108? It was $102 or less, we're pretty close to that level and while we don't have the signals for a position there right now, the long term signal (daily) is still solid.

The SPX/SPY had an interesting candlestick close today, you may remember last night's Dominant Price/Volume relationship, it suggested a lower (red) close today.

The upside reversal was a strong candlestick pattern of both a bullish Harami and a Hammer, today formed a Tweezer top on increasing volume.

The NDX formed a bearish Harami with a candle that would have been a bearish Shooting Star" had it gaped up, but then we wouldn't have the Harami, all in all, a bearish looking candlestick close there as well.

The Dow was VERY close to a bearish "Hanging Man " reversal candle yesterday and just a fraction off from a bearish engulfing candle today that would serve as confirmation.

I mentioned this last week when talking about price patterns and candlesticks, "Just because they aren't textbook, doesn't mean the things they represent aren't valid. For instance, the NDX yesterday was missing the gap up that would have given the closing candle the textbook designation of bearish "Shooting Star", but the long upper wick that tested higher prices and failed was still there, the small body with the close near the open was still there, the same reasons were still there. You have to be careful about looking for textbook patterns because those are 1 in 100 cherry picked for the books.

Our Leading Indicators for sentiment both closed negatively dislocated from the SPX, the rest you pretty much saw earlier today (Credit, etc..), but there's one that changed a bit...

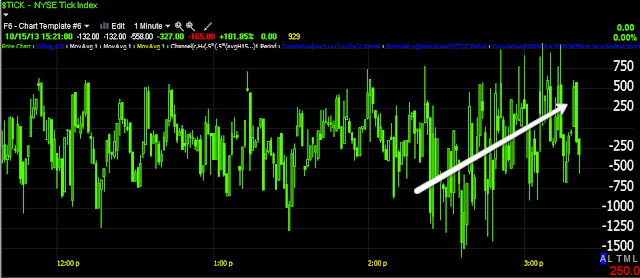

Yesterday I pointed out on the VXX vs SPX chart the strong bid in short term /VIX Futures that created more demand than supply and broke the correlation with VXX higher than it should be. Earlier today I showed you how VXX had taken off to the upside well in advance of the SPX, this inverted price chart of the SPX (green) shows the correlation and how the SPX moved down to catch up to the VIX Futures implied correlation, it didn't quite make it, but the VIX yesterday was telling us something was up and you could see that without 3C.

As far as Index futures go tonight (early on)...

Earlier it was R2K futures only that were positive (TF), late in the day, in fact at the lows of the day, ES (SPX Futures above) joined TF and as of now they are leading positive. I usually don't take 1 min charts too seriously overnight unless they are the start of a new divergence which should become clear by later tonight, otherwise I'm not too concerned.

NQ (NASDAQ 100 Futures) have stayed in line, their underlying trade has been more moderate than the others, but they did not go intraday positive, they did show some distribution at the highs for the new week as you can see above, otherwise they are unremarkable.

TF (R2K Futures) are what started this Index futures positive divegrence, as I showed later today, the IWM itself doesn't have the same signal so it's still very much up in the air.

In fact, there were only a handful of charts that had a positive intraday signal, but they were some important ones like the confirming intraday negative in VXX which caused me to take some off as the position was way too large. Again, the lows of the day saw some accumulation.

What really matters to me in overnight trade is the 5 min charts...

ES is leading negative and distribution really kicked in at the high of the week.

NQ is just barely leading negative (as I said, NQ is a bit more moderate).

TF is leading negative as well, this is the chart that kept me from moving more VXX, but these need to be checked later tonight to see if there are any changes as new divergences almost always start on the fastest timeframes first.

There's a symmetrical triangle forming in ES and NQ and an ugly version of one in TF, this would normally be taken as a bearish consolidation/continuation pattern, I'm betting though it will do as they usually do and run a head fake move to the upside, the divergences are already there for it, what happens after is where it gets interesting.

As far as Carry currencies, the $AUD could run a bit on the upside, but I don't think it's prepared to make much of a run, it just doesn't have the accumulation in place or base. I thought the same thing about the Euro earlier too after the German ZEW sent the Euro down 100 pips on the release of the survey. However I don't see this as much more than a quick dead cat bounce as well breaking up what was a bear flag. That leaves the $USD, in my opinion from the 3C charts, this is the currency that is most likely to see downside almost immediately,

typically a cheaper $USD means rising prices in stocks, precious metals and commodities, especially oil, so that may be of some help even if it's not part of the carry, SO I DON'T KNOW THAT THE YEN IS OF MUCH IMPORTANCE IN THIS SCENARIO...

In any case, I believe the Yen has some overnight weakness and should see a stronger move to the upside, it has been working on a base since yesterday, it has the 15 min3C positive, so that could be interesting with the averages running in the overnight session and the Yen strength building in right as the 1 min positives in the Index averages run out of steam.

Unlike yesterday, there's no Dominant Price/Volume relationship among the component stocks that make up the major averages. Credit isn't telling us anything new since yesterday, I'm not seeing a strong indication from gold futures, although there's a weak pullback indication which would fit an overnight Index future run.

For now, I think that's about it until we see what the futures do later tonight. I did think it was interesting that ES and the CONTEXT model met at reversion to the mean.

Hopefully you can see why I'm a little cautious on short duration positions right now.