First a review of options expiration. Most options are bought by retail and sold by smart money, 90% of options expire worthless and smart money gets to keep the premiums. Retail looks at options in most cases like a lotto ticket, addicted to the possibility of large gains, but just like Vegas, eventually the house wins.

While I have not updated the options analysis from Wednesday, it has looked the same all week, there are a huge amount of puts outstanding and it would be in Wall Street's best interest (as the writers of the options) to pin the market at "max pain", making the most amount of contracts expire worthless. Out Wednesday SPY analysis suggested that number is in the vicinity of $140 although it could go a dollar or so either side of that as the Puts and Calls at $140 are about the same, figure in transactions costs and premiums and a close even a bit below $140 could still make the $140 options worthless. With today's break of the SPX's 50 day m.a., if I were managing the market, I would use a quick upside reversal to knock out as many positions as possible in addition to pinning the options, it just makes sense.

As I mentioned, in looking at a number of stocks tonight, even one that dropped pretty good today, there are a lot of short term positive divergences. Longer term, the ground work for negative divergences of the bounce are already in place. I personally would not like the idea of shorting Friday strength over a long weekend, but that too would work to Wall Street's advantage if they intended on shooting the market down on Monday as many would be hesitant to short a 1.5% up move in the market on a Friday, again, from a Wall Street perspective, it just makes sense.

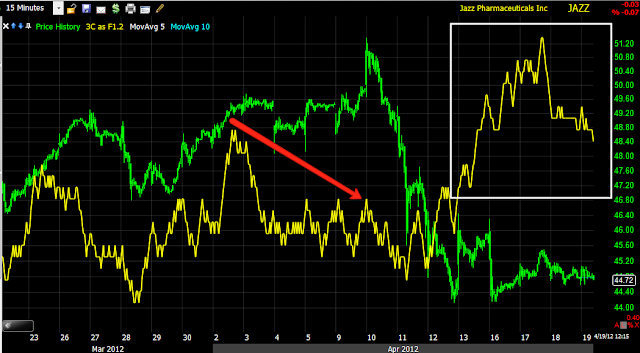

Here are a few charts that suggest there is room for such a mov; we already know that the volatility is in place for such a move so there's no stretch of the imagination there (If I included all of the charts I saw with short term 1-5 min positive divergences today, this post would have 50 charts more than it needs).

Commodities are brown, the Euro blue and the SPX green. Commodities performed a little more in line with the $EUR/USD correlation, stocks picked up on that extra breathing room in the late afternoon and the white box is where we saw the market averages put in positive divergences. It must be noted that these divergences tok place on the break of the SPX 50 day moving average, creating an abundant supply of cheap shares to pick up to support a bounce. Remember, they don't need to pick up a lot of hares to get a bounce started, they will distribute far more hares than they accumulated in to strength and all of these chart are short term only, as mentioned already, the longer term since April 10th has already laid the negative divergence ground work for the failure of the bounce.

Earlier today I showed you the point in which the CONTEXT ES model was just getting supportive of some upside, you can see since then, the support for a move higher in ES and thus the market in to tomorrow is there. This is not a huge divergence, it is just enough to crate a move up tomorrow, one I will almost certainly be looking to short in to.

ES slipped most of the day on 20% higher than average volume, however trade size was small, this is indicative of market manipulators trying to move ES higher and we have an after hours positive divergence in ES as well. Although we still have a long night and an EU open ahead of us, I must say, considering the Spanish auction results and the numerous US economic misses, the market held up reasonably well so I would think it can weather the EU open.

Yields have been looking as they should for the move lower seen here in the SPX, they also have a small positive divergence to allow some breathing room for the market. If we look at a longer period since April 10th, you would see this indicator is FAR from bullish, but once again, we are dealing with indications for tomorrow only.

As I reported today in the Risk Asset Update, the EUR/USD pair is supportive or at least is leaving open breathing room for the market in the short term, long term, not the case (meaning since April 10th).

I don't know if this will come in to play or not, but there is a bullish ascending triangle in the EUR/USD pair, it is ironically close to the apex where an upside breakout would be expected, that would also give the market more upside breathing room and set up a head fake in the Euro that could easily fail on Monday.

The $AUD as one of my favorite currency leading indicators has been leading the market lower as you can see, it has also reached short term reversion to the mean and made a higher low, this is also slightly bullish, again though, only in a very brief sense. The long term $AUD going back to mid-February or so, is very clearly bearish and explains why the market has been acting very toppy for the last month.

Credit here is not wildly bullish, but it has left some room for a potential upside move tomorrow.

Interestingly Energy has shown good relative momentum today and this could well be supportive of the market.

While financials have been out of rotation and have been dragging the market lower through the first half of today, reversion to the mean has been reached and there are higher lows, again, these are not wildly bullish, they do not change my opinion of the outcome of the bounce that has been very chaotic, but in the near term, are they supportive enough for a SPY pin at $139-$140 or so, yes.

Should we get this move up tomorrow, please understand that this would be a gift to short in to strength. I would likely try to add as much as I can in stocks that have good risk/reward potential and there are quite a few out there.

So lets see what the market does, lets be patient and if we get a gift from the market, lets consider taking that gift as we don't get many and we will be among a select few who realize what we are really looking at.

Since starting this post, the Es positive divergence has continued to build and ES is starting to respond favorably.

Good hunting to all of you!