Hands are tied, but there was a little cheerleading and the expected dissenting vote.

As usual, the mass of media expecting a huge action, was wrong.

"Household spending increased"- counter-point, US consumer saving's rate hitting multi year lows, it won't save Q4 GDP, but makes for a cheerleading point.

"Economic growth strengthened, but recent indicators point to weakness"- counter-point- see above.

"Inflation moderated" counter-point, year over year inflation is on target for 4% which is why Bennie's hands were tied

"Expect moderate growth"-counterpoint, that's sitting on the fence as much as one can do and still have a positive sounding statement.

"Unemployment will decline gradually"-counterpoint, that's very arbitrary and subjective, are we talking about gradually over a year or over a decade or century?

"See downward risks in global financial markets"-counterpoint, is this the best these scientists of the economy can offer? Everyone knows that, even my brother who doesn't know anything about the economy or care to. However, as I stated pre-announcement, this is something they are going to want to observe to get a feel for where they will likely have to expend firepower, whether it's a BAC bailout or some kind of European aid in one of their bizarre schemes that saw European banks getting billions of dollars from the FAD in 2008/2009 to most people's surprise and dismay.

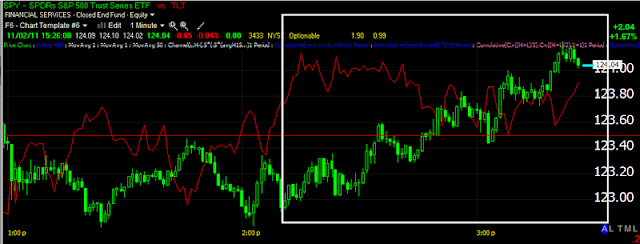

As for the knee jerk move, I don't think it has set in yet. The 10 min Bollinger Bands look like it will shortly. We have 2:15 volatility and then bak to Europe.

10 min BB's suggesting a directional move coming

Luckily I spent just about a much time on this FAD/FARCE statement as was deserved and not a minute more.