For instance, I was looking at the IWM calls closed yesterday and thinking whether or not that was the right move. The answer depended on what time you looked at the calls bid/ask, they could have given about another 10% if nailed absolutely perfectly or they could have been at an 80% loss all in the same day. All things considered, I think yesterday's decision was the right decision. However considering all of that leverage on a move that was forecasted quite accurately with positions opened at fairly close to ideal area, why was the return so small and risk so high? I then started looking at the daily candlestick charts when I noticed something pretty amazing.

If you take the market from Thursday's close last week to today's (Thursday's) close, for all the talk of "bounce", there's only about a +0.33% difference.

If you take the averages since Friday morning to today's close here's what you get...

Other than Transports which have been beaten down badly, most of the averages are either flat or at a slight loss such as small caps/Russell 2000 (yellow).

Taking a look at the averages today, they come off a "V" shaped recovery as we predicted earlier and fill the gap for the most part exactly as predicted in the A.M. Update before the cash market even opened.

The NDX is the lone standout, everything else is either down such as Transports and the Dow, or flat such as the SPX or barely up such as the R2K.

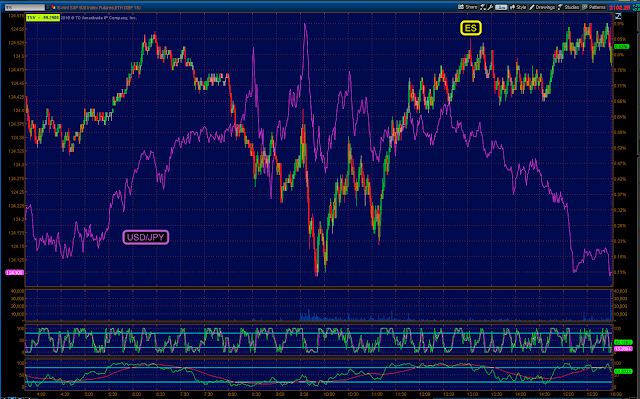

Although I recently covered it, I believe that the USD/JPY (purple) which was already showing signs of a divergence (negative) pre-market, was held in place with a $USD run higher to act as support for the market at a very "V" shaped reversal this morning to fill those gaps. As you know, I'm not terribly impressed with "V" shaped bases or recoveries, they just don't have the support for the market to build off of. Then after the gap fills are essentially completed, the divergences in the $USD and Yen make good and the USD/JPY drops in to the close as you can see to the far right (purple). I believe this is a significant event in the week's events as there was no divergence this week until it was time for the pair to start moving lower.

Yields also gave up support which started yesterday right after the F_O_M_C and carried through today.

30 year Yields (red) vs the SPX with deterioration starting yesterday after the F_O_M_C in another asset that has been leading the market as can be seen below...

This was the last bounce off the SPX's 200-day moving average around 7/10 with Yields leading the SPX to the upside and then leading to the downside right at the area we considered to be the head fake or the very top of the bounce. things were downhill from there on volume.

This would be essentially the same scenario in a smaller bounce from this week and where we are today with initial weakness yesterday after the F_O_M_C and more today. Yields as a Leading Indicator tend to act like a tractor beam and pull equity prices toward them just as they did early in the bounce as they led the SPX both times.

The only real support mechanism by the close that was still effective was the usual and the first the powers that be move to activate and that was High Yield corporate Credit.

HYG (blue) vs the SPX with today in yellow so HY Credit or more specifically the one HY Credit asset that is well known for being used to manipulate the market short term AS IT IS CURRENTLY IN A BEAR MARKET seems to have been clearly used today along with the carry cross USD/JPY and a few other assorted stocks to ramp the market to what? Unchanged, mixed at best?

I think I can be excused for wondering how much life HYG has in it as this 5 min chart leads negative, but also note when it lead positive relative to when the market started its bounce.

In fact when you get away from the very liquid HFT tracking HY Credit, even Investment Grade Credit took a hit today.

This is over the course of this week's bounce, but the deterioration recently should be obvious.

Unfortunately I don't have a Bloomberg terminal in which I can pick up any possible ticker, so below is a borrowed chart showing the tight correlation between Investment Grade Credit and the SPX, that is until today.

Investment Grade Credit (the flight to safety of Credit vs HY) even refused to follow the SPX today.

After taking a look at Leading Indicators one more time after the close, I don't see a lot of difference compared to earlier except when you look at the relative intraday performance of the SPX and these indications refusal to move higher, but rather stay in place which would create a wider divergence if it were to be plotted on something like a Histogram.

Pro sentiment 1

Pro Sentiment 2.

However what it really comes down to is the question, "Is there market support, accumulation or distribution in to the price trend?".

I usually advise people using 3C to go to longer term charts not only because they are stronger trends, but they remove a lot of noise and reveal the trend. This is the 60 min ES chart with the last bounce's cycle and distribution and this week's which is only 3 days old and already leading negative on a 60 min chart, in fact a new leading low for this mini cycle.

As for the "Gas in that Tank" charts, as I said today, there wasn't much movement simply because there has to be some true movement in the asset, smart money doesn't usually sell in to lower prices unless in a stampede panic, however that doesn't mean we didn't get anything out of today's market.

The DIA which was in line like most of the averages earlier this morning showing some clear distribution in to higher prices or as they say in the North East, the gap fill... "It was not for nothing".

The high flying (this week) transports intraday 1 min chart needs no explanation.

And the IWM intraday chart which was in line early saw quite a different 3C tone later in the day AS SOON AS THE GAP WAS FILLED.

This would be an example of one of the "gas in the tank" charts, 10 min SPY. While not screaming and I mentioned why earlier today, it wasn't confirming either.

The SPY 5 min chart is most interesting and "if" the market can put in an Igloo/Chimney top, it would fit just about perfectly with numerous set ups, Leading Indicators and the breaks starting in assets like USD/JPY, Yields, Credit, etc.

While the QQQ 10 min didn't move much today, it didn't confirm either at a relative negative divergence, but it did give away it's tone and trend.

This is the 5 min QQQ, again note just like with the IWM, once it was above yesterday's close the 5 min 3C chart goes leading negative like it fell off a cliff. If that doesn't tell us something (not that we didn't already expect this), well I'm not sure what you need to see to get the message through.

This is the 5 min QQQ, again note just like with the IWM, once it was above yesterday's close the 5 min 3C chart goes leading negative like it fell off a cliff. If that doesn't tell us something (not that we didn't already expect this), well I'm not sure what you need to see to get the message through.

As for tomorrow, I'd think it would be a traditional options expiration day in which the pin for the max-pain level is near Thursday's close and that lasts until about 2 p.m. at which point the market can do whatever it wants, maybe even an Igloo/Chimney price pattern, but it's the last 2 hours of 3C data that are the best of the week.

Looking at the chart above of the QQQ 5 minI have to remind myself this "bounce" that is literally nearly unchanged from a week ago, is only 3 days old and that's fine because it wasn't a very large base and honestly it looks fairly proportional, but the chart above seems to indicate to me some desperation to wrap things up.

I think the one thing we may not necessarily appreciate right now, is just where this market is.

May's head fake move almost disappears in this nearly 6 month range, that's a much different tone than at any other time since 2009 and we're really not that far from things getting very ugly.

The Dow is even worse which is a bit odd because usually Large Caps hold out the longest and have the best relative performance in a bear market.

The May head fake move in the Dow out of a triangle is a lot more visible. The key areas are really right where we are, the long term 2009 trend line broken, sitting right at the 200-day and having put in a set of lower highs and lower lows. The next lower low may not be that much of a move to the downside, but psychologically it makes a world of difference.

The Russell 2000 is just cradled in the 200-day...

Thus it's very likely on the next swing down, one breaks and almost all of them break. Again, a very different situation psychologically than "at long term support" and the difference is just a few percent for the most part.

While psychologically this is a game changer, from a real market perspective, the game already changed.

The green indicator is a breadth indicator using all of the NYSE stocks , specifically the Percentage of NYSE Stocks Trading ABOVE Their 200-Day Moving Average.

In a normal, healthy market this percentage runs around 80% on a bounce, we're currently at 37%, less than half the norma and only slightly more than 1/3rd of NYSE stocks sitting ABOVe their 200-day moving average so while it's a psychological nightmare for the major market averages, the actual market of stocks is already in decline. Note the very specific decline in the market's breadth since... You might have guessed it, the start of May. We're nearly at the October lows in a market that didn't go through the trauma that led to the October lows!

There isn't a single breadth indicator that hasn't declined at least by 50% since 2013 and there aren't many that haven't turned tail to the downside since early May. You don't need Hindenburg Omens or anything else to understand the moral of the story.

Going forward, I'd think as a matter of concept that we'd get a head fake move, the Chimney on top of that very clear rounding top in the averages, this is purely from a conceptual point of view as I often estimate that this occurs about 80% of the time in one form or another, but the Igloo/Chimney price pattern seems to be one of the more popular. I don't like guessing at what the market will do or when unless I have a boat load of objective evidence. We are 3-days in to this bounce that looks proportional and I'd say tomorrow will likely be a wasted day.

I'm going to be watching the charts and looking for openings and opportunities. I could take some guesses as to when I'd want to be loaded up, but I don't think guessing is worth the time it takes to read, you can get that anywhere. I want to show you the objective evidence and we have quite a bit above for a 3-day bounce (if today even counted?), but as I said late today right after I almost pulled the trigger on a few trade ideas, something tells me the best course is to just be patient and let the market tell us. That could be overnight, it could be the last two hours of tomorrow which is where I'd put probabilities or...? You pick, but that's what sports us from gamblers bettering on red or black.

As for futures tonight so far, ES is just about in line intraday 1 min, it didn't see the same gains NQ and TF did and that appears to be reflected in the charts.

NQ 1 min intraday , again clearly negative in to gains on the upside.TF/Russell 2000 futures 1 min, again, from in line to the left (overnight) to leading negative, especially since 4:30

The "Prerequisite" timeframe for trades which wasn't negative earlier in the week, has been for the second day now and the "alligator jaws" are opening wider.

And of course the bigger picture with less noise, the 60 min ES chart .

That will do it for tonight, I was forwarded some trading results from a long time member and a good friend, he hit 18 of 18 trades last month, 100% and not just little piddly gains to say he had a profitable trade. The reason I mention this is because I've watched this trader from the first day with me years ago. I can recall when things were much different. I often say there's no one right way to trade, the best way to trade is to find the style that fits you, your risk tolerance, your time available, your account size; to play to your strengths, identify your weakness and either fix it or make a rule that keeps you out of that situation. This is why I believe that trading is about as close as you come to a spiritual endeavor , more so than Yoga.

You have to be really honest with yourself, you have to be willing to look at the not so pretty parts and be willing to take action to fix them and as soon as you do, the market will uncover your next weakness of fault and you deal with that. This is a never ending process, just as spiritual growth is not an event, but a process. Too many traders bounce around from system to system looking for the "Holy Grail" of trading. I think we have some awesome tools, but I don't think anything replaces hard work, diligence and being true to your self so I just wanted to give a shout out to you know who you are! I couldn't be more happy and I wish the same for everyone because I'm yet to run in to a member that I wouldn't do anything I could (within the law) to help as I've really been blessed with some of the best people to work with on a daily basis.

In honor of my friend mentioned above and with the best intentions to see all of you succeed and find peace and happiness in your lives in trading and outside, I just wanted to repost an old article I wrote white some time ago. Mind you this was when every book on the shelf was something like "Zen and the Art of Motorcycle Repair" so it may be a bit dated, but there may be something there that you connect with. Take what you want and leave the rest.

Have a GREAT night.