After the big day down (last Thursday) the next 3 days bounce, but within the real body of Thursday's candle which is what the NDX so far has done. In fact when I posted, "What is a Mini Cycle", Nov. 8th, I described it as...

"A mini bounce or cycle is obviously subjective, but I would consider the 10/9 lows and bounce from there to be a full cycle, a mini cycle might look something like a falling 3 methods candlestick pattern, maybe even shorter. "

It seems that a lot of the signals in 3C and leading indicators actually came through today as last night I didn't feel we were completely done with the "Mini-Cycle", but winding down as indications went more negative.

I really can't say though whether the mini cycle was just for Friday's Max-Pain op-ex pin or if it was for something more, I suspected something more with the range of the last 2 weeks now becoming painfully obvious and attracting limit orders and stops, that can be tempting to hit. but on the other hand, as I said today, "There seems to be no organic demand at all"

The one thing I CAN'T get away from is a "Quiet Market", they're almost ALWAYS up to something, the problem is, most indications look bad, they don't look like that "something is the most obvious move from here, a head fake/failed breakout above the 2 week old, well defined range.

The VIX was banged at the close, but to no effect.

The SPX is inverted so you can see VXX/UVXY's underperformance. Even VIX futures didn't seem to show ANYTHING remarkable.

At first glance from last night's post and expectations, it would seem we got what we expected, with the Dominant Price/Volume relationship and all, by the way, tonight's is not consistently dominant, but mostly Close Down / Volume Down which is the theme most often seen DURING a bear market, in this case it has no immediate bias or influence on next day trading, it is the closest to unbiased of the 4 combinations. However, once again I still can't get away from that VWAP hugging, low volatility day.

"Credit Leads, Stocks Follow" and Credit markets were decidedly unimpressed with equities or the prospect of risk taking.

High Yield Corp. Credit was looking worse today than yesterday (all Leading indicators are compared to the SPX in green unless otherwise noted).

Junk Credit which is a risk asset also was way underperforming and not onboard with the equity markets at all, much like the $USD, gold and treasuries weren't Friday.

The longer term cycle off 10/9 lows shows JUNK Credit rolling over at a top after leading the SPX at the bottom and confirming the move up.

Even the long term (large trend HYG 3C chart) is leading negative, that's a lot of distribution in a very smart market.

The same is true for Junk.

When we look at the sentiment indicators, they are at extremes we haven't ever seen before and they have called many a top and bottom.

FCT leading negative on the last cycle with a clear top

FCT long term about as ugly as it gets.

While my longer term or last cycle custom TICK Indicator is clearly negative, today the TICK didn't give away anything but a very dull looking market.

I could go on and on, but the fact is, the kids playing in the room next door were too quiet. I noticed this too by the close.

As pointed out earlier, very short term (next day) sentiment in our sentiment indicator looks like something is moving to the upside out of today's range, I wouldn't trust or trade it, but that's what it looks like.

Toward the close our second sentiment indicator that was staying away joined it.

I noticed a 1 min positive in HYG, despite all the larger damage, there's a1 min intraday positive there for some reason.

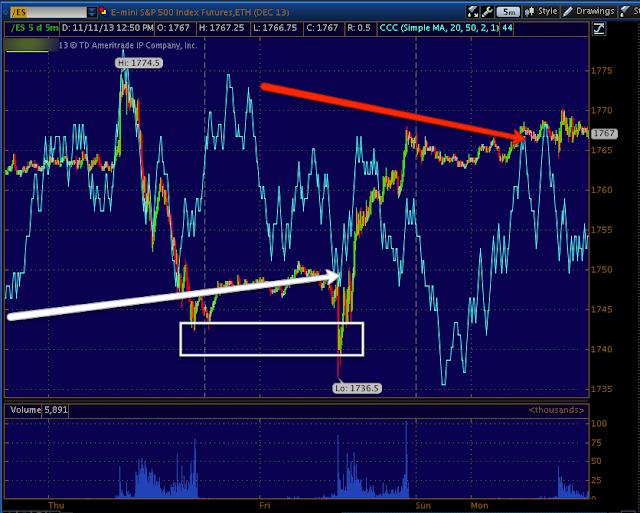

SO looking at the EUR/JPY vs ES tonight, look what I find...

The carry pair gets a boost and guess who follows?

The carry pair is candlesticks, ES is purple, so this settles who came first, the chicken or the egg, the carry pair as usual led the Index futures.

And look at the other two carry pairs...

AUD/JPPY

USD/JPY and why?

The Yen got rocked...

Remember last week we saw this happens around midnight with absolutely no news, just a crash in the Yen followed by carry trades lifting futures in the low overnight volume market? I even wrote this post...

A SAD DAY FOR THE MARKET...

" 10 point ramp in ES that sent the Nikkei up 1% almost immediately, is a disgrace and very sad to see.

The ONLY reason this happened was due to this... A ramp nearly straight up in all of the JPY carry trade crosses like EUR/JPY above.

And this was the ignition...A smak down in the Yen.

There was no reason for this, no news whatsoever.

THIS IS MIDDLE OF THE NIGHT, LOW VOLUME MARKET MANIPULATION AT ITS WORST. "

I haven't seen any news yet, this looks like the same pathetic attempt to move a market that is otherwise out of gas and looking at credit, tricks too.

SO FAR THERE'S NO NEWS I CAN FIND FOR THIS MOVE SO IT LOOKS LIKE LAST WEEK'S, FIND A LOW VOLUME ENVIRONMENT, SMASH THE YEN AND PUMP THE FUTURES, THAT MEANS THEY CAN'T EVEN RELY ON POMO ANYMORE!

The only other thing I can add is it "looked" like someone in the market knew something as the action today hugging VWAP with bonds closed and 65% of normal futures volume, JUST WASN'T NORMAL.

I wouldn't chase it, as a matter of fact I'd be very cautious, but one asset I like if this holds overnight like the last one did last week (although it started later in the night), XLF-Financials short.

XLF 15 min off the 10/9 cycle

XLF 5 min

XLF 3 min.

There should be a lot more, but first lets see if it holds over night and then we'll see what looks good.

Pretty pathetic though