I'm going to go with the GLD July (standard) $120 Calls as I'm not crazy about the choices in leveraged gold ETS, but GLd long would be an interesting choice as well. The reason for the July expiration which I admit is pretty long is there's really not that much time until the June expiration and I prefer to have some time.

If GLD looks interesting, that means the market will also be interesting as there has been an inverse relationship between the two and GDX and NUGT are interesting as they have a near exact correlation with GLD.

For now I'm going to go with a half size position just because I'm not sure how much larger the reversal process "might" be in what looks to be a perfect head fake move and candidate for one as you'll see all these things on the charts below.

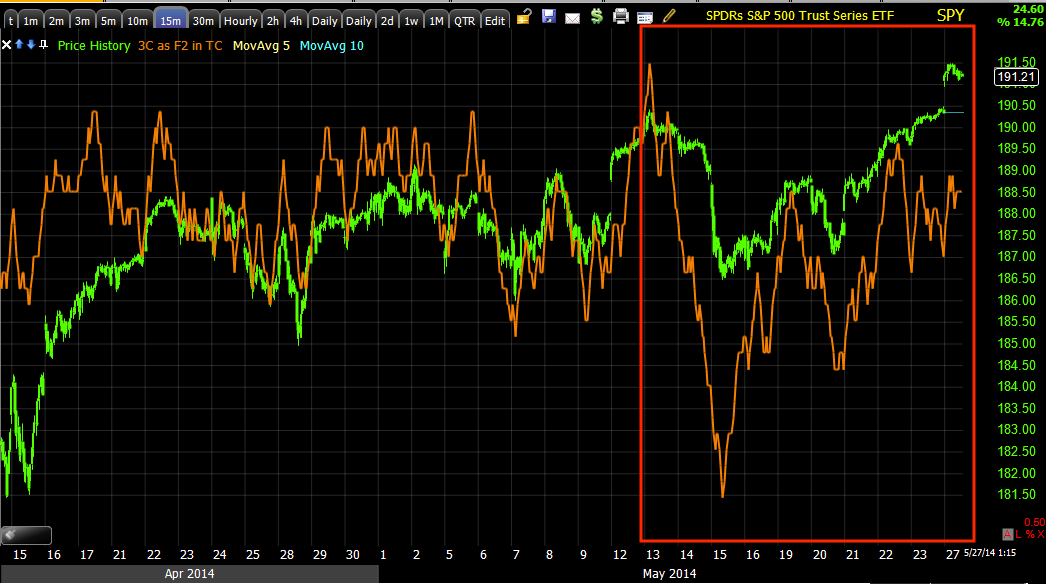

This is a daily chart of GLD (green) vs SPY (red), you can see that since March, there has been an inverse relationship between the two, this use to be there, but generally only on minor swing moves while the trend would generally move in the same direction, now the correlation is much more inverse (opposite) than it has ever been, I suspect this has something to do with the continuing taper of QE.

These are the same two assets (GLD and SPY) on a 60 min chart, also showing a VERY inverse relationship. Given what near term expectations are for the market to come down as the momentum from the bear flag / Crazy Ivan sling shot (short squeeze) wanes.

Note GLD has had a near perfect area of support that is very well defined, a break of this support or a head fake move is one of several things I've been waiting on, you'll see below why Gold/GLD hasn't been very interesting for several months as a trading vehicle.

This nearly 2 month range has been a chop-fest and really not worth the risk to try to capture a couple of points or percent at best, but with yesterday's break under the range and stops clearly hit/shorts coming in as volume surged, and with today's smaller bodied candle, GLD is looking much more interesting.

This is the intraday chart (1 min) of GLD since breaking below 2 month support and the range, there's a strong leading positive divergence, my only doubt right now is how large it might be, thus the half size position for now, plus I have to consider the tight correlation between GLD and the already half size position in place, NUGT. I'd prefer to treat both as 1 trade for risk management purposes due to the high level of correlation which you'll see below.

If you are not interested in options as GLD has a lot of leveraged ETFs, but really none with decent volume, you might consider NUGT (3x long gold miners) as an alternative play as there's excellent volume there, it's an ETF/Equity position and gives you 3x leverage.

This is the 2 min chart seeing a positive divegrence or migration of the divergence since the stops were hit and shorts entered on the volume surge yesterday. This doesn't look like the typical market maker/specialist take up that comes with market orders that can't be matched, this looks like a confirmed head fake move or one being confirmed.

We have migration from yesterday and today moving to the 5 min chart already as well.

The 15 min chart shows the negative divegrence back in March sending GLD lower and in to a range, there wasn't much going on at first and as the range developed, I wouldn't consider it a long until there was a head fake move as this range and support are VERY obvious.

However about mid-way through the range you can see a positive divegrence picking up, this is about in line with the action in Gold Miners/GDX/NUGT as they too had a range that saw a false breakout/head fake that sent price below the range where it started showing strong positive divergences.

The 15 min chart is in leading positive position already.

Even the hourly chart shows positive divergences starting at about the same area within the range.

This looks like a decent reversal process underway and with the inverse relationship with the market and all that is going on there between Treasuries, Credit and VIX, I can't imagine probabilities are very high for a large reversal process here, especially as the 15 through 60 min charts are already leading, this looks to me like a quick move to grab shares on the cheap by hitting the stops piled up under clear support.

This is the GLD (green) vs GDX (red) correlation, we saw the same kind of move in GDX which is something we talked about looking for last week and we got it the first trading day of the new week.

I'm going to go ahead and enter the 1/2 size Call position, July (standard monthly) GLD $120. As I said, because the Gold leveraged ETFs have such poor volume and because GDX/NUGT have such a tight correlation, NUGT might be a good alternative choice if you prefer some leverage, but would rather not deal with options, otherwise a straight GLD long could also be considered.