I introduced this new layout several months ago, because as mentioned earlier, that which everyone knows is not worth knowing. The concept is very simple, these are all risk assets and as such, should rally in a risk on environment, when we see dislocations or divergences, especially in Credit, which is a bigger market then equities and leads equities, then we know something isn't right.

No matter how impressive a rally, there's always a reversion to the mean and usually and overshoot, but when we have multiple indications that the rally is thin and hollow and not a true smart money risk on rally, but more like a puppet show to get longs feeling emotional extremes and jumping in the market with no questions asked other then looking at a simple price chart, then the reversion to the mean is a much more dangerous event. That is the spirit in which these indicators have been introduced.

Yesterday commodities didn't participate in even the weakest risk move, that divergence led to a reversion to the mean in the short term trade, Commodities are slightly diverging again right now.

Longer term, Commodities vs the SPX in late October diverged and the market made a sharp, though brief drop. Since the late December move up Commodities have underperformed badly. This has a lot to do with China and in the coming months you will here more and more bad news out of China. I believe as far as I have seen, WOWS first pointed out the problems in commodities and speculated there were problems in China. We were proven right over the next two weeks when China's Services and Manufacturing PMI both came in at a level of contraction, that is why demand for commodities has fallen off, the Chinese manufacturing sector is falling off.

As pointed out yesterday, they extremely risk on trade of high yield credit hasn't made a higher high in 5 days, despite the SPX doing so, it appears credit has been de-leveraging as it is a much bigger market. In the short term, the SPX made a 1 day move, reverting to the Credit mean. When you see a 1 day correction like this catch up to a 5-day trend, you realize how much faster and further markets fall the they rise, which should be of concern to longs when looking at the severity of the long term dislocations in risk assets vs the SPX.

Yields have been called a "Magnet for equities", her you can see they called the 2011 top and the late July meltdown in the SPX, they are at an even deeper, longer dislocation now as I not only suspect, but am nearly 100% convinced that the strength in the market has been nothing but a sucker's rally or a bear market rally. Such a rally needs time to be convincing to lead dumb money back in to the market.

Longer term going back to the 2007 top, Yields also called that top and the first bear market rally in the decline as well as the March 2009 bottom, the late 2009 H&S after QE1 ended and have been on the decline ever since as QE2 was responsible for lifting the market, not underlying fundamentals such as improving unemployment or improving economic activity, just pure manipulation of QE2.

Even longer term, the 2000 to 2007 top is called here and the current environment is worse then ever.

In fact yields have reached an all time low not seen since the data series began in 1962.

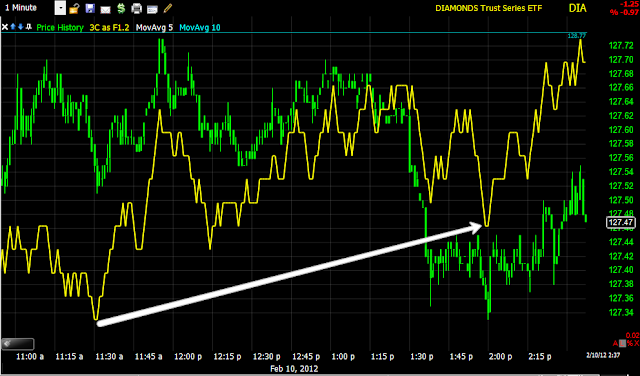

If you think the Euro/SPX correlation is dead, just look at the intraday chart of the last couple of days, the Euro called the SPX bottom, yesterday it called a top and SPX reverted to the short term mean as the Euro continues to underperform the SPX even today.

Longer term , since QE2 ended and the correlation came back, the Euro called the 2011 top as well as the late July market decline, the first October rally top that corrected and now is at a deep dislocation from the area I consider to be the bear market or sucker's rally.

the SPX has reverted to the mean short term with High Yield Corporate Credit.

Over the last several days, High Yield Corp. Credit has also refused to make a higher high with the SPX, a warning that has corrected in the short term and did so in 1 day as Credit makes a lower low.

Last night in this post, I pointed out the weakness in financials, even though they got a sweetheart deal yesterday in the Robo-signing scandal. Financial momentum fell off yesterday as I showed you and the SPX has reverted to the Financial short term mean.

In last night's post I also showed you JPM's first Engulfing bearish candle since December 6, 2010, today it is confirmed thus far with lower prices.

Sector rotation today...

Sector rotation is clearly in a risk off mood in most of the major industry groups: Financials, Energy, Industrials, Basic Materials. There's a sense of some safe haven rotation as well in improving rotation in Utilities, Healthcare and Staples. The only Industry group that is a risk on group still holding up is Tech, however this is on a relative basis vs the SPX. XLK is at a loss of -.60% right now.