Since I've already laid out most of my thoughts on the day, there are a few more that came from some email questions and I thought I'd share some of those.

One was about the Plunge Protection Team" which is actually

the President's Working Group on Financial Markets (more at the link) which was created by Reagan in 1988 in response to the Black Monday Crash of 1987. This is a real thing, as far as their activities, as mentioned, I have witnessed them first hand as we were making a bottom in 2009, David DT and I made many observations about the PPT and got pretty good at predicting when they'd step in.

In any case, I have VERY little doubt that we saw the PPT or someone connected to them working in the markets today, it sounds tinfoil hat-ish, but read about the real group, you'll see it's not so conspiracy theory.

I think the reason we saw them today and the answer to a member's question can both be found in my email response, but first let me add an email about the PPT from another trader/member sent independently of my thoughts.

"Some time ago I read an article by a professional trader who had made a point to familiarize himself with the operations of the PPT.

Over a period of time, he had concluded that the role of the PPT was not to halt or reverse market declines.....but to step in and slow the rate of descent if a decline appeared to be on the verge of spinning out of control.

Interesting their intervention was required at this stage of the game.

Makes me suspect Wall Street has broken ranks already. Also makes me wonder if the PPT saw an air pocket below the afternoon low."

We are nearly of one mind as far as his email. From what I saw today, the divergence in TLT to counter market weakness, which continued any way despite the move to send TLT lower, was no where near the size of the large positive divergence in TLT over a period of about 4-5 months. A 5-10 minute divergence/distribution in TLT would spook traders as it would be a fairly large order and would probably be obvious that it was coming from the same place if it wasn't in one order. The point being, traders see an order that size and it sends the asset down quickly, we have talked about this numerous times in the context of how smart money has to accumulate vs the way we open a position.

The point still being, the divergence was just enough to counter something really bad from happening in the SPY.

Now my email answer to the question, "How long do you think the PPT can hold the markets up?"

My answer...

"I don't think that is or was the issue today, with the Yen so low and the SPY not being able to do anything with it, the true nature of risk was revealed, they'd rather flock to protection than take on risk with a Very cheap carry trade today. With TLT Breaking out as the SPY was topping and with few shorts in the market to provide eventual buying support, today could have been a circuit breaker downside move. Look at how much the SPY lost even with that huge and very fast move to bring TLT down. Now imagine they didn't do that and TLT gained even more upside momentum, the SPX could have been down 2-3% today with circuit breakers tripped in the a.m.

It's not so much about holding it up as it is about managing the destruction, today could have got out of control. Notice even with TLT falling, the SPY still couldn't gain any ground, it went (the SPY) from the high of the day to the low in 1 move"

Notice my answer was along the same line as the email above and the email above I received after I had sent this response. I don't think the intention was to hold the market up, there are several key ideas in my response that bear further explanation.

Yen..

As you saw, the Yen's decline below support was at the exact same time the SPY moved above resistance in to the 2 p.m. highs, the thing is, the Yen moved much, much lower making FX carry trades exceptionally attractive and cheap-that's why I said that market participants were more interested in TLT (Safety) than a very cheap and profitable (potentially) carry trade.

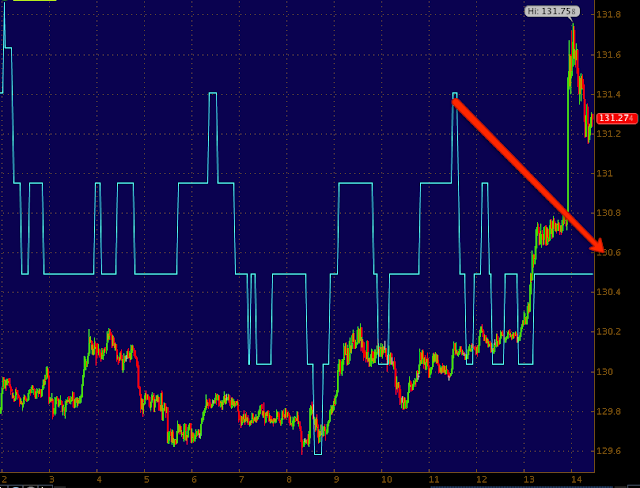

Take a look at the extent of the Yen's fall and the Carry pairs...

The Yen's decline is bullish for stocks, that's why when it broke below support, the SPY moved above resistance at the exact same time.

Note the SPY (green) breaks to the upside just as the Yen (red) breaks to the downside, this has been the correlation since November 16th, 2012 market lows through the rally since, lower yen=higher market and that's what happened intraday today.

However if you look at some recent small declines in the Yen and how the SPX has moved up on them, when you look at the size of today's Yen decline, you'd expect that the SPY would do a LOT more with it.

Remember I said the Yen was seeing accumulation late in the day, that typically wouldn't be good for the market, this is the 5 min chart of the Yen from today with a strong leading positive divergence.

Honestly it's not just the Yen alone that drives the relationship, but the actual carry trade between two FX pairs, the first long, the second short, this is how smart money leverages their AUM to buy more risk in rallies.

The Carry Pairs...

AUD/JPY during regular hours-the pair moving up is positive for the carry trade and positive for risk assets, it moved up on the strong yen decline, however it seems smart money didn't trust the carry trade and chose not to embrace risk, but safety in TLT until it was hit.

Lets remember how all of this started, last night I saw the risk positive currencies and pairs with positive divergences as well as the Market Index futures like ES, NQ and TF. Even though they responded to the positive divergence and moved higher, I said something wasn't looking right, shortly after they spent the rest of the night moving to lower lows, a significant move lower.

Then same exact thing happened during regular hours today, the positive divergences were there and they even responded and started moving higher, but again they didn't look right and I posted this and the result was this massive decline in the currencies and downside in the market indices. It's very odd, but the same thing happened twice inside 24 hours and this is not something I recall ever bringing up on this scale and being correct both times.

The fact that something is not right here is another subject altogether and I think our first email from our member about the PPT may have hit the nail on the head when he said,

"Interesting their intervention was required at this stage of the game.

Makes me suspect Wall Street has broken ranks already. Also makes me wonder if the PPT saw an air pocket below the afternoon low."

How many times recently have I used the AAPL example to explain that hedge funds herd just like retail, but when a market gets on the edge of an event like AAPL was when Dan Loeb's top 5 holdings no longer included AAPL, they do as the member wrote and break ranks, it becomes a "He who sells first, sells best" and "Every person for themselves". This is why I have said increasing volatility is not just a wider daily ATR or crazier moves up and down as we saw last week, but increasing unpredictability such as we saw last night and today. Had I gone by the signals only and not my gut feeling, our FX traders would have been in some big trouble, but after years of experience with 3C, I know when something doesn't look right, I called out both events at least an hour before and I was correct about both. This is not a failure of 3C, it represented what they started, it's just the herd didn't go along and instead chose to use the upside moves off the 3C positive divergences to sell in to and sell hard they did. *This is another reason I like to be in position by the time the market gets to this stage, I learned from trying to trade around small signals in AAPL to maximize profits, but hedge funds, "Broke ranks" and sent AAPL down 45%.

This is the EUR/JPY, another carry pair that is market positive and profitable when it rises, this is during regular hours. Its climb is now being met with a negative divergence. Many of you must remember me following the Carry Pair trends very closely every week and pointing out they were going from positive to negative, then we even saw a decline with lower highs/lower lows.

I suppose smart money didn't buy the Carry because of this reason, they'd prefer safety than taking risk right now.

This is the same pair, just since mid-April, look how big today's move was, yet the SPY could do NOTHING to capitalize off it.

I told you why last night when I showed Treasuries accumulating to head higher and head higher they did today until the SPY apparently needed protection and there was a negative 5-10 min divergence all at once in TLT to help the SPY, but my point was, TLT is the only asset I remember recently that actually saw increased volume (nearly 400% the average) on a breakout today of VERY weak resistance, yet the Dow 15k was on less volume, the SPX new high was on less volume so where do you think the demand is?

Just as a hint as of before any intervention...

TLT breakout on increased volume from very light resistance, the volume really didn't need to be that big for such light resistance, but there was demand.

Then of course the 2 p.m. intervention as I already showed, the SPY was losing traction (3C, candlestick reversals, declining TICK chart, etc).

If you look at the time stamp on the chart, the reversal from moving down (which was in large part because of TLT's gains, happened almost exactly at 2 p.m.

It just so happens that at 2 p.m we had the TLT negative divergence and why would smart money do that if they were so eagerly buying TLT days and even minutes earlier as the accumulation has shows. The only group I can think of that would have an interest is one trying to prevent a rout in the market, the PPT and they didn't use such a large divergence that anything would be changed in the underlying trend, just enough to back the pressure off the SPX which continued to fall despite the falling TLT which is what caused the SPY Arb to continue to rise.

SPY 15 min negative divergence at 2 p.m. highs

TLT 10 min relative negative divergence (the weakest kind) today at the SPY's 2 p.m. highs as it was just about to fall and fall it did despite TLT coming down.

TLT's 15 min chart with no damage at all and still in a large, powerful leading positive divergence.

If you are wondering what High Yield Corp. Credit it doing (HYG)...

HYG 2 min distribution

HYG 5 min leading negative divergence

Here's what VXX looks like

VXX 1 min leading positive

VXX 2 min positive

VXX 3 min leading positive divergence

VXX 30 min

What I get from these charts is not only is the longer term positive, but the very short term is positive and migrating as it should.

I do see some 1 min type positives in some of the averages so there may be some early attempts, we'll have to see how they play out, but with VXX so positive and HYG so negative, it seems unlikely much strength can build.

SPY 1 min intraday positive, but it also has moved off that divergence so we'll just have to wait and see, it certainly isn't anything I would have placed a long or closed a short over.

The SPY 3 min looks pretty darn far from anything resembling positive, again the VXX strength and HYG weakness suggests we have turned a page, and I think that page we may have turned is that which I have warned constantly about and that our member's email touched on, "Wall Street has broken ranks already." if so, this is truly a dangerous time for the market.

Afternoon sector performance also moved toward a defensive posture.

Financials, Industrials and Tech all rotated out in relative strength, the safe haven groups of Staples, HealthCare and Utilities rotated in.

In any case, summarizing my email response, even with TLT as a lever being pulled severely, the SPY still lost ground, had TLT kept moving higher, the SPY would have lost even more ground, the move in TLT was large for a lever pull so I shutter to think of what the SPX might have looked like with TLT higher and the average completely unable to take advantage of a severely lower Yen. I do think PPT involvement was obvious, but it doesn't seem to have been aimed at holding the market up as much as protecting against an out of control decline. Remember, shorts are not very thick and shorts represent future buying commitments, without their covering(buying) to take profits, the market would have no source of demand, so next time someone tells you how evil shorts are, remind them that shorts keep market declines reasonable and from straight 90 degree drops.

Remember we do have the typical Friday op-ex pin possible, I think whether the market moves to pin or acts significantly different will also be VERY telling. All in all, I'm very happy my positions (both Puts and shorts) are in place. This is the kind of market environment in which you can wake up to a gap down that wipes out 2-3 months of longs right on the open, we saw almost 2 months of longs cleared once this year already on significantly lower volatility.