It would be really cool to tell you something really exciting about the market today, but the market was just slightly less dull today than yesterday thanks to the market being so dull that it created a huge Bollinger Band volatility squeeze, the biggest of the year and still the best we got was the SPX +0.17%, the NDX100 -0.43%, the Dow at +0.34% and the R2K as the big boy at 0.45%.

The dominant Price/Volume relationship for all 4 major averages was the bullish Price Up/volume Up, which often creates a 1-day oversold condition, but how in the world the dominant relationship has "Volume up" in this low volume environment almost beats me, it's compared to yesterday when the Far East was shut down, so anything would have produced more volume today and still be pathetically low.

The range was extremely low, the volatility and average trade size were all low. How volatility or ATR could actually be lower than the first month of the year is beyond me, especially after it started really climbing, but it did, which is why so many traders are using the word, "Bored", I prefer "Dangerous".

SP-500 through the VERY low ATR/Volatility of the first month of the year without a single real pullback, followed by a high volatility/high ATR, choppy market than went no where, but rather churned and followed by the lowest volatility/ATR of the year over the last 2 days.

The NASDAQ 100 saw the lowest volume of the year, in fact it was only a few percent away from the low volume of Dec. 31st, New Year's Eve. when most every human trader on Wall Street is still in the Hamptons.

The Dow-30 was even lower than December 31st and the only day that had lower volume this year so far was, you guessed it, yesterday with the Chinese Lunar New Year and Japan closed yesterday.

Perhaps even worse as the SPY with volume just a hair above the December 24th half day!

SPY with the lowest volume of the year, just a hair above a half day on December 24th-Christmas Eve.

Usually these low volume markets are easy to ramp, however we saw some big name stocks take it on the chin today, among them: FB -3.15%; AAPL -2.51%; QCOM -1.92% KO seeing a big gap down and nasty day at -2.72%, CSCO -1.41%; AIG -2.08%; BBY -1.78%.

As I have been warning about, High Yield corp. Credit which has been severely dislocated from the risk appetite in the major averages has seen a positive divergence for at least a couple of weeks on a 15 min chart, unless there's some sort of pairs trade going which I kind of doubt with Junk credit acting the same, it looks a lot to me like a short squeeze, but as noted earlier, HYG was up right off the open with no market correlation and saw distribution right on the open, again leaning my opinion toward a short squeeze.

This is a 2 min chart of HYG Credit in green, the SP-500 in red and 3C on HYG in orange. The point being the SPX is higher generally because HYG is so dislocated from the normal risk 1.0 correlation the two assets have during a healthy rally as you have seen in any of the

Leading Indicator updates such as today's. The white arrows show that HYG rallied right off the open, while the SPX didn't make any real move until about 12:30 while the 3C indicator shows HYG seeing distribution right off the open. HYG still has a decent amount accumulated on the 15 min chart so I expect it will run higher and will need to run higher to run out any shorts, but it doesn't seem to have any positive correlation with the market.

At the same time, the less volatile (recently) High Yield Credit has no correlation with the market today as it dropped vs. the SPX.

The difference between High Yield corporate and High Yield doesn't bother me as HY Corp. is far, far more dislocated with the SPX and in short squeeze area as everything we have seen so far today has suggested and as expected before the move even started.

Commodities behaved very strangely today...

Commodities (brown) where the mirror opposite of the SPX, this is not the normal risk on correlation that would see the two move together, instead stocks followed the legacy arbitrage correlation with the $USD while commodities moved 100% against it, almost as if they were afraid of inflation from the currency destruction wars being played out across the globe, a situation that the educated G7 apparently doesn't have a realistic enough grasp to release an intelligent, understandable press statement without moving the entire FX market against what they intended this morning.

Commodities in brown usually move 180 degrees opposite the $USD, today they moved exactly with it while the SPX moved as it should have.

Still, as I started the "Week Ahead" post with on Sunday night, Currencies, as expected, are the pivot for equities, perhaps the G7 confusion is why we saw such timid stock performance and low volume today as no one understood what to expect from the G7 as their initial statement pre-market this morning sent FX pairs rocketing up, like the EUR/USD up 100 pips after the statement that sounded as if there was no currency war, while two members, Japan and the U.S. openly declared Japan was waging such a war with the US Secretary of the Treasury fully supporting it this morning. So the G7 revised their statement and said that the market "Misunderstood what they said", it was simple, plain language, the entire FX market misunderstood? The revised statement took a tougher stance specifically against Japan, so did the G5 craft that statement as Japan is unapologetic and the US as recently as this morning supported Japan's currency devaluation measures?

This may sound boring, it may seem irrelevant to the market, it is not.

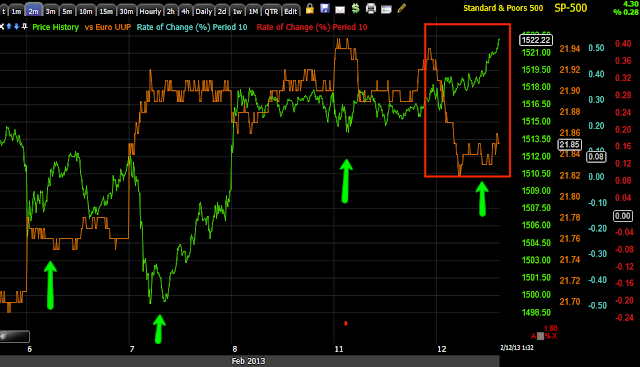

As the Euro climbed earlier today the market followed it, in the afternoon as the Euro maxed out and headed lower the market followed it, although a few hours behind-there's more than 1 currency the market is keyed in on.

As the orange $USD headed lower in a minor pullback, it gave the market some breathing room, but as it became clear the $USD was moving higher in the afternoon, the market which has one of the strongest FX correlations with the $USD, started heading down.

What I found interesting was the $USD recently put in a 5-day gain that's the largest in something like 7 months, during this time the market went in to a high volatility, lateral trading range, as the $USD pulled back just a little today, the market moved up just a little.

Before the close, I had been watching the QQQ and the NASDAQ futures, I put out a QQQ call trade idea in the weekly options, a long NASDAQ trade I expect to be closed tomorrow, which says something about the market as well.

Here's what I saw...

In yesterday's

Market Wrap I even said that I thought I might have missed the Put trade in the NASDAQ which was down -.43% today, which would have been a decent weekly options put trade with these words...

"

The 5 min negative divergences in the Futures today have been the recent signal to buy puts for tomorrow"

I was exactly right, had I bought the weekly options put on the NASDAQ 100/QQQ, I'd likely have a double digit gain today. Seeing the positive divergence today in the 5 min NASDAQ futures, I decided to go for the weekly options QQQ call, another reason and the reason I expect to close them early is the QQQ daily chart itself.

The 3-day pattern in the QQQ closing daily candles shows resistance on day1, a loss of momentum at yesterday's reversal Doji star and downside confirmation with resistance today, although not very strong. My hope and expectation is a gap up in the QQQ like what I drew in under the red arrow, in which the calls would be sold, with a close lower confirming the 3-day reversal pattern in the Q's right above resistance- it's a pretty bold call based on market behavior, but one I think is at least worth a shot here.

Since the SPX/ES gained today and the 5 min chart had a negative divergence, I didn't see the same opportunity as probable in the SPX, however with the negative 5 min divergence, if the QQQ plays like I expect and the SPX is weak on the close as the 5 min negative shows today, we'll have an interesting day tomorrow.

5 min ES/S&P futures with a negative divergence vs the positive in the NASDAQ futures (keeping in mind the SPX closed up a bit today and the Q's were the biggest loser today, closing down), this is similar to the rotation seen during the volatility stage of the previous week.

Right now, CONTEXT is negative vs the SPX, I want to see what it looks like during the State of the Union Address tonight at 9.

Finally I will remind you of what is happening in the big market momentum stocks, posted earlier today under "

Market Breadth".

In green, Stocks trading 2 standard deviations above their 40-day price moving average, these are the NFLX's, the PCLN's the former AAPL type stocks, momentum stocks and since the 4th of January when over 44% of all stocks were trading 2 SD's above their 40-day price moving average, the SPX (red) has climbed almost 4% while the number of these momentum stocks performing well has fallen by 70% to a mere 12.89%,

that's a massive breadth problem.

I'm going to catch the State of the Union Address by Obama and see how currencies and the futures react, anyone remember the day Clinton would give a press conference and the market would rally 200+ points? What happened? I thought Obama was the great orator of our time?

If there's anything interesting, I'll follow up... The question I think most analysts of the market are asking is why is the market so dull when it's so easy to ramp right now? I can't help but think the chart above partially holds the key to the answer.