This is going to be shorter than normal as it my mother's Birthday today.

Basically we have a very extreme market, we get these when there are big market events upon us most often, some times other reasons, I keep using AAPL as an example and that's probably because this market reminds me most of AAPL, the first time I had really good divergences and tried to trade around them to see the market just overrun by sellers. That's what I recognized last Thursday when I said the market didn't look right, there were positive divergences in risk assets, but something didn't look right, they took off following the divergence and shortly after were sent to lows of the day, lows of multi-days or the week, it happened again Friday and it happened last night, it's a lot like AAPL and these aren't failed divergences because the market moves to the divergence, but it just fails and never to the downside, always upside moves are sold-I said last week I have been using 3C long enough I can just feel when something isn't right, it wasn't right, but I just recently defined what those red flags were, selling of any price strength.

A few examples, note when some strength appears, not even that much, maybe just green on the day, the sellers are there-also note the difference between last week and this week when possible.

DIA-the light blue trendline is Friday's (the previous close)

IWM

QQQ

SPY

Financials

AAPL

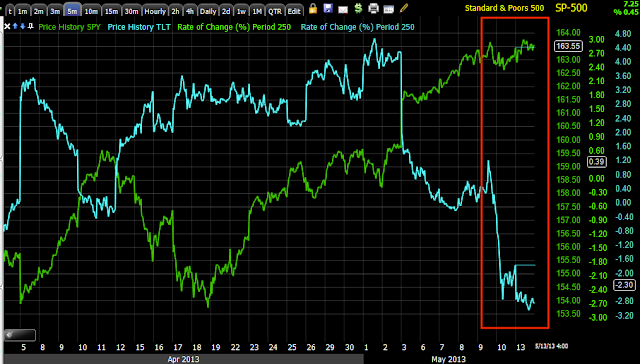

Today even lever correlations couldn't help the market.

The deep lows in TLT should (look at the correlation to the left-even though it is skewed on TLT's side) have sent the market to a vertical new high.

VXX wasn't holding the market back, in fact as VXX made a lower low in the afternoon, the SPX couldn't even make a higher high as strength was being sold.

It's hard to tell from the scale, but yields were higher, still didn't help the SPX.

HYG intraday- a possible head fake move at the EOD? We'll see...

HYG's correlation, this is what I was talking about needing to see go negative, I didn't think it woul;d be this obvious or strong.

The AUD's dislocation from the SPX...

The Euros-they are all there

HY Credit even selling off in to the close

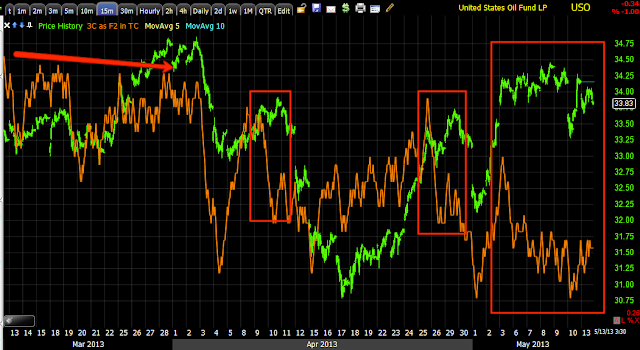

and commodities that performed much better than they should have.

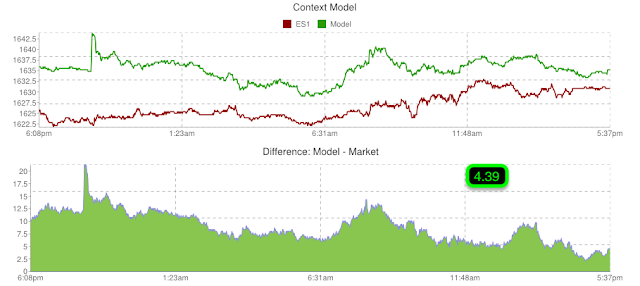

As for the 3 levers and Context...

Even with TLT and VXX down, the SPY Arb (even with HYG down from the open) just got worse all day. That's the SPY being 83 cents too rich to the model.

CONTEXT surprised a bit last night on the open at +20 ES points, now down to 4.39 points.

HYG, the EOD move may have been a head fake, I just see the EOD accumulation fell off, I wonder if it was offset by sellers.

TLT's accumulation on the other hand was solid all day, maybe that's why Yields didn't help the SPX, perhaps they knew what the tone was in treasuries-remember last night's signals for Treasuries (Futures)? Accumulation even opening down.

VXX seeing accumulation as well today.

I'm going to look at futures when I get back from dinner, but what I see above is a copy of what I saw first in

futures last Wednesday night when I said,

"

looking at the charts, something doesn't look right, it's not consistent yet through single currency futures and the pairs, but for example, the Euro which moved up, has a worsening negative 3C tone, the Dollar should look worse, but almost looks as if it's about to transition to a more positive stance. R2K Futures have a negative divergence and couldn't make a new high."

That was the first hint of what I now know was the selling of any strength, now apparent in the market once we got past op-ex Friday.

Futures to come...