" Looking at the 3C charts in to the close in both the averages and futures, my feeling is the head fake move above $1900 which was resistance of the 3 month range and the area we expected a head fake move which in my opinion is more than large enough to do what they are intended to do, will start being resolved to the downside next week, it looks from the 3C charts going in to the close that this will likely start early next week"

Transports are down -2.8% since Friday's close and saw the worst day in 4 months today, down -1.93%

IYT/Transports which put in a Doji Star reversal on 6/9 at the top (yellow box), the same day I posted, Transports / IYT Are Looking Horrible and Transports / IYT (both on 6/9), which said,

"the daily candle for IYT is looking like a bearish Shooting Star thus far, volume is already above Friday's which is something that tends to increase the likelihood of a reversal candle being effective...I think IYT is in a very interesting spot to consider it. If you are a bit more cautious, maybe see if there's a bearish confirmation candle tomorrow, I think there's plenty of downside and this would be an excellent entry area even if you have to wait on a confirmation candle of today's possible/likely bearish reversal candle."

6/9 was the absolute top, but if you are still interested, I think we'll get a second chance after today's high volume candle.

As for the SPX, since the head fake move started, measuring from the close of Friday to the next Friday, the first week above the 3-month range and 1900 (both psychological buy levels for retail/dumb money) saw a gain of 1.21% and the next week, as mentioned regarding the increased ROC of price, was up 1,34%, so far this week we have a significant change of character and they lead to changes in trends with a loss of -.99%, we just needed the reversal process as the distribution/head fake move was there.

As for the market, the earlier bounce attempt was run over, but I think we do get one, if not early tomorrow, perhaps toward the afternoon, we'll see if it's worth trading, here are some of the closing 3C charts for the major averages.

SPY 1 min positive intraday divergence.

The 2 min is what was missing, toward the close it started going positive, I don't think this is enough for any move worth even day trading, but it may give us something to work with tomorrow.

However, while those small divergences were put together near the end of the day, look at the additional amount of distribution today, we are now leading negative at a new low, 3C is forecasting a major price decline, there are a few assets that need a few days to look like fantastic entries, I'll show you one at the bottom.

The Q's confirmed price action intraday.

The 3 min chart put in a positive the last 2 hours of the day, but still in the intraday timeframes and still needing some work, we had stronger divergences than this run over today.

The QQQ 5 min suggests a bounce which works perfectly for the trade I have in mind.

However, on an institutional timeframe of 10 mins, this is how much distribution was added today alone (from the red trendline).

And the QQQ 60 min since the February rally, this is the worst distribution we have seen and almost all of it at the head fake area.

IWM 1 min has a minor positive, but a 5 min positive was run over here today, that's indicative of panic-like selling.

IWM 2 min showed price trend/3C confirmation on the downside, so it was a solid negative day.

And the 5 min positive that was run over.

Meanwhile the long term 60 min is in leading negative position.

Another issue for a bounce tomorrow is the Dominant Price/Volume Relationship which was more than half of the component stocks of all the major averages, it was Price Down/ Volume Down, which is the dominant theme during a bear market, but has no next day short term implications, had it been Price Down/Volume Up, like Transports, the next day almost always closes higher.

Leading Indicators indicate a bounce is likely, this is probably why GLD, GDX and NUGT which tend to have inverse relationships, looked close to a pullback, although I decided to wait until tomorrow on the NUGT long before deciding, which fits with the broad market.

HYG, High Yield Corporate Credit (a market manipulation lever) is leading the SPX a bit so a bounce to that area would not be surprising over the next day or so, however...

HYG's obvious distribution isn't going to allow it to support or manipulate the market for long, you see what happened on the last leading negative divegrence to the left, we have a worse one right now,

The VIX is leading the SPX's correlation (SPX price is inverted/green so you can see the correlation), this is a trend that was clear last week with VIX futures accumulation, now all the way out to the 60 min charts.

One of our sentiment indicators is forecasting a short term bounce, the other...

is in line with price /SPX.

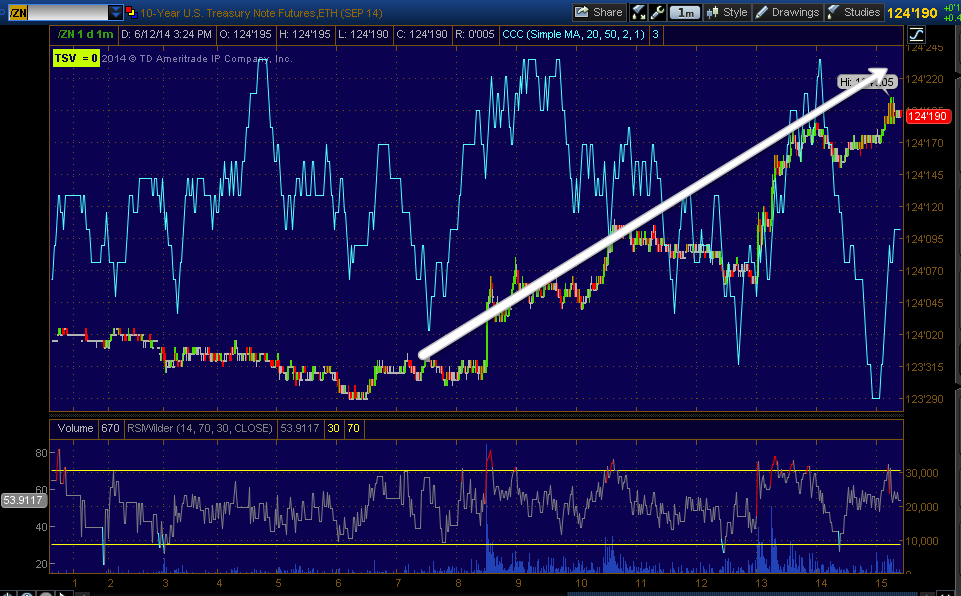

As shown in this morning's , Futures Update the probabilities on the 3C charts were for the 5, 10 and 30 year Treasury futures to rally, as you can see, the 5 year did as yields dropped and the SPX followed along as is the correlation.

Also as you saw later in the day, our TBT short (2x TLT long) trade, TLT Long / TBT Short Position Update, also rallied and the trade is in excellent position, if we get a little pullback I'll look for the entry on the intraday 3C charts.

Commods were up on Oil (Iraq), Gold and Silver, I have a feeling GLD will pull back, thus the add to on the GLD puts today, Closing 1 GLD Put, adding to another.

As far as the trade that fits with a bounce in the QQQ, AAPL is one I've been watching for a little while, it hasn't been quite ready,, but I think this is going to be our favorite kind of trade, the one that comes to us...

This is what I was waiting for, the 60 min chart to lead negative, it finally migrated out from the 15 min chart.

Here's the 30 min leading negative

And that strong 15 min chart I've been watching, while waiting to see if the distribution reached the 30/60 min levels.

Intraday the 5 min confirmed, but short term, much like the averages...

The 2 min below and 1 min above are both starting to lead for an intraday move, we just need to get the bounce and look for intraday distribution since the strategic institutional charts are already there, this should make a beautiful set up.

AAPL 2 min positive starting to form, we may even have a decent call trade.

If anything pops up overnight I'll let you know, but so far so good, we just need to keep filling out those positions as they become available, PCLN, AAPL, IYT, really I have a good 400+ on the watchlist with sell/short signals.