As promised, I'm going to keep adding to this library on 3C until it is a useful guide. You should know that this is a very hard indicator to master for a few reasons. It took me about 3 years to get the basis of what I had on my hands, it is no where near as simple as most indicators that give signals at certain levels or crossovers.

One of the most challenging difficulties in understanding 3C is understanding that it is showing you the underlying action of smart money, which often contradicts price and contradicts most of what we have been taught about the market. There are thousands of technical analysis books basically regurgitating the same thing with a new spin, but the market cannot be summed up in a book and those who truly understood it would never tell you. Why do you think it's so hard to find a book written by a Goldman Sachs trader or someone who is really in the know?

So for a few years I thought 3 was good at the daily timeframes, but was missing on the intraday, it wasn't, it was a contradiction between the reality of the market and my understanding of how the market works. I had to unlearn everything thought I knew about market function and let experience show me.

The second difficulty in understanding 3C is understanding that each timeframe represents something different, and depending where you are in a cycle, the behavior of 3C will be different.

For example, when someone asks what the market trend is, what is the proper answer to that question? This is akin to a trick question because the market can have many trends in effect all at the same time, it depends on the timeframe you are looking at and the amount of history.

Lets answer the question, "What is the market trend?"

On a monthly chart, the trend is UP

Even on a weekly chart the trend is UP

On a daily chart, the trend went from a top to a downtrend.

On an hourly chart, the trend is UP

On a 30 min chart, the trend could be up or down, depending on how much history we looked at, here the trend is down with lower highs and lower lows.

The 5 min chart shows the trend as up.

So just as the market can have multiple trends all at the same time, 3C can pick up multiple trends at the same time, that is because while Wall Street may be in a current cycle uptrend over the last week, their purpose of doing so is to get rid of more shares or to go short, so the positive divergence we see that started this uptrend, may not be the only trend 3C is showing, it could be showing Wall Street's larger motive of getting short as well. Each timeframe tells us something different.

The charts I usually deal with, multi-day, daily, hourly, 30 min., 15 min, 10 min, 5 min, 2 min, 1 min and sometimes tick by tick.

The multi day trend shows the broadest picture of the market and while our monthly chart above showed an uptrend, 3C would contradict that be showing the very negative underlying character. The daily chart can also show primary trend's underlying action. The hourly chart (don't be fooled by it's seemingly short timeframe) can show us underlying action that can influence a month long move or more. The 30 min chart is similar. It also depends on how long the divergence took to form; the longer the divergence, the longer the resulting trend that results from it generally speaking. The 15 minute chart is a good timeframe for market swings or a week to several weeks. The 10 min chart can reflect a trend of about a week. The 5 min chart reflects trends of a few days and the 1 min chart usually calls intraday moves up and down.

However, remember, I also said the function of each timeframe depends on where we are within a trend. Starting from a brand new trend, lets assume the market will soon transition from a downtrend to a new up trend. The first chart that will show a positive divergence will be the 1 min chart. When this happens, the 1 min chart may be useless in calling intraday moves as it keeps moving up in what I call a "Running Divergence". If the accumulation is strong enough, then the 5 min chart will start to show positive divergences. If accumulation continues, the 10 min chart will turn positive, at this point the 1 min chart may go back to calling intraday trends up and down as it has passe along the accumulation to longer and more important timeframestimeframes, 5, 10 and 15 minute.

Market Cycle Stage 4 "Decline"

Wall Street lets no move go to waste and the end of their successful uptrend is not the end of the game, with no more institutional support for the market, it will drop. At some point distribution is over, but the negative divergence will continue as they continue to sell, but now they are selling short. Again, one of our best timing indicators id the head fake that adds extra energy to the next trend, this time down, so they'll typically run some sort of bull trap. Another good timing signal if you are paying close attention will be multiple timeframes all showing the same signal.

One last area to over before wrap this chapter up, types of divergences.

There are two types of divergences, relative divergences and leading divergences. Leading divergences are the strongest type of divergence. I'll show you some examples.

Above is a 30 min chart of the SPY. This is a relative divergence, we are comparing 2 relative points, point A and point B. Note that price is higher at point B (you can see by the red trendline.), but even if it were the exact same level, 3C s lower at point B then point A, this is a negative relative divergence.

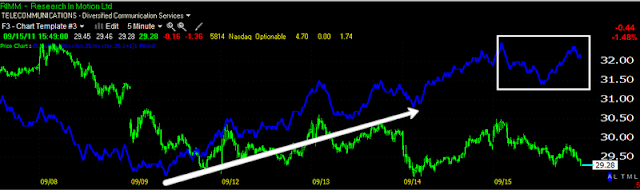

This is back in July of 2011 at the market top. The white arrow is accumulation and a relative divergence. The red arrow marks a relative divergence, but what is more important is what is in the red box, this is a negative leading divergence. Note how it is going in the complete opposite direction of price and it is making lows that when compared to 3C at similar levels in the past, price was much lower. The next chart will show you what happened after this 15 minute negative leading divergence (leading because it is leading price).

The late July/early August decline. The red box is the area we looked at in the chart above where 3C was leading negative. This shows an enormous amount of distribution which at this point, was most likely institutional short selling.

That's t for today, I will continue these posts and link them for you to go over. Email me with any questions.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago