It's beyond ironic how many times I said the Yen would be the pivotal asset for the market this week, the overnight move to the upside was Yen driven, the halt of that move was Yen driven, if I get some time I'd like to see what the new board is going to look like, it's one thing to put a BOJ head who is a currency debasement zealot up for leadership nomination, but just like our own F_O_M_C, that's one vote of a panel of 8.

Yesterday morning we knew the outcome of the BOJ policy decision, we knew that 1 member proposed "New Easing" which was rejected by the other board members, we knew and talked about Abe's new BOJ appointments having at least 1 ally in that 1 board member, but did you know what started the rout in the Yen last night and thus the futures?

Overnight the WSJ reported on what was already known...

"one board member proposed fresh easing steps—a move seen as a precursor to the aggressive easing the incoming leadership is expected to undertake to meet its target of ending deflation in two years."

This article of information already known for almost 24 hours is what kicked off the move in the Yen, now we can debate whether the article was simply cover for a move that was planned in advance, but this is what coincided with the Yen plunge and futures ramp.

You have to keep in mind that with the kind of money that is circulating around Wall Street for friends of Wall Street, a lot of what you read and hear are "plants", they are meant to facilitate a short term move, but as anyone with a shred of common sense knows, the WSJ article that started the avalanche contained NOTHING new, not even a new take on the analysis of the 1 dissenting board member!

It's not only price that is deceptive, but the entirety of Wall Street which is why its important to make fact based, logical decisions and not emotional ones, the Yen move was meant to touch an emotional nerve. Look at what happened with GLD today, it stopped out a lot of people on a very scary move and then came back to levels as if nothing ever happened; this is one of the main reasons I and most traders I know are loathe to trade the open unless we are fading some move, such as the lows in GLD this a.m., that would have made a nice chunk of change in an hour.

Here's how the FX market is shaping up and without doubt the Yen has the cleanest, clearest signals, the kind I rarely ignore while the others are not what I would call a strong edge.

Very short term the $AUD looks like it wants to move higher from these levels.

Longer term it looks like it was supported in this move and the plunge in price was a knee-jerk reaction which has no confirmation on the downside.

The Euro is positive below $1.30 to the left, right where we thought it would move higher and while it looks like there was distribution at yesterday's highs, it also moved lower on a knee jerk reaction.

The EUR/USD and the move up from below $1.30, does it do it again? I'm guessing it dos at some point.

The Yen Futures are the only ones that have a clean signal like this, in fact this positive divergence at the Yen lows at the exact same time as the NFP release this morning is probably the strongest, cleanest divergence I have seen market wide today, that doesn't bode well for the market.

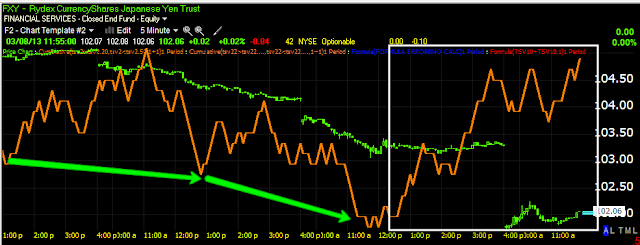

As far as the Currency ETFs, again I checked them all and only the Yen has a very clear divergence that has been proven right in the past from left to right: Negative at a gap up and deeply negative ending the Yen lower and then a positive that stopped the Yen's fall and sent it to a lateral range/consolidation, then a negative divergence sending the yen below the range, something that looks like a head fake move as the positive divergence at the lows is leading almost to a new high, remember

"Changes in character lead to changes in trend" and the lateral consolidation was the first changes in character.

Strangely the $usD was moving up pre-NFP, just before the release and then exploded higher, I see this as more of a knee jerk effect as well, but there is a change of character in the $USD as well, just not this powerful and there was no large accumulation to take advantage of the move, it's almost as if the NFP was a surprise.

Being there wasn't any significant accumulation in the $USd, I highly doubt the NFP print was expected or at least the "QE-Off" reaction wasn't expected sending the Dollar higher, it's not well supported up here, but if the Yen moves up, it's not going to matter than much in the pair (USD/JPY), it will matter to the carry, which is why I have been saying the Yen is the most important asset for the market this week, it's really the carry that is the most important, the Yen just has the power to turn the carry off.