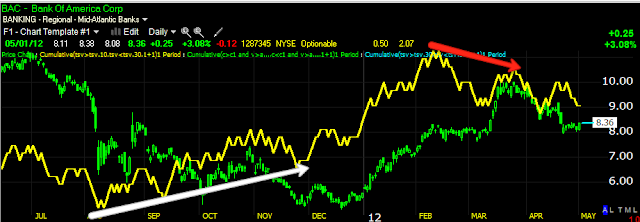

I did not enter the Financial trade in BAC as you would have heard about it before I did it. We've had plenty of really good opportunities to sell in to strength, yesterday was a tough call, but look what we got today. So hopefully you've been able to use this to your advantage.

I'll talk more about the end of this bounce after market, for now, Financials.

XLF has been sold in to strength, this should be no surprise as I have said they will sell in to any strength probably 6 times a day for the last month. There's the start of a relative positive 1 min divergence here. Remember, they need to sell in to strength, not in to declines.

The negative divergence today selling in to strength is clear, this is the same thing we have been doing, however as XLF falls back, there's the a pretty decent looking 2 min positive in place.

I'd have a hard time saying the 5 min is positive, it is just less negative than it was, you have to remember that divergences flow from the shortest time periods (like those above) to the longer time period, it's not quite there on the 5 min yet. What is VERY clear is the selling in to strength.

The danger we face as we move closer to the end of the bounce (as I have already said the last few days-"The cliff ledge is broken, Wiley Coyote just hasn't looked down yet) is that short term divergences get run over by hedge fund managers dispersing the flock to be the first to sell and keep their job, "He who sells first, sells best".

While the 15 min is CLEARLY negative here and this rounding top looks very nasty, the 15 min could be a whole lot worse. The last 3 failed bounces these pretty much were leading negative by the time the bounce failed, so there's still some promise, although as I have been trying to demonstrate with model portfolio trades, the trick is to get exposure, start building a short position in to strength and leave room for the extreme volatility.

Yesterday I said that even though the market was down and was looking ugly, there's certainly enough volatility in this market to take us above the SPX recent highs.

That's exactly what we saw today...

Yesterday's prediction for what we would see in the market looked like this...

Today's market action looked like this...

That's the argument for what volatility can do.

The close to me looks horrible and if I missed out on BAC or another financial today, guess what?

On this weekly chart, we are still significantly high, I can easily grab some FAZ, have financial coverage still at a great price and pick my longer term short on the first shakeout move. I have maintained for some time that I believe the market will take out the October lows, barring F_E_D intervention-but even if they intervene, there's a lot of money out of the market for good, there's some very good arguments being put forth-some directly from F_E_D members that another round of QE is less likely to do what the first two rounds have done.

There's something to be said for "Don't fight the F_E_D", there's also something to be said for the power of mass sentiment and the conditions in place now in Europe, China, the US, etc which form major market cycles.

And remember that the 2009-present rally was in no way organic growth, it is a house of cards built on huge excesses of liquidity so this last move up didn't have the same organic growth that the Tech revolution created to the far left, or consumer spending (even though it was mostly their now foreclosed home equity lines) from 2003-2007. Also lets not forget, the F_E_D doesn't always win...

The F_E_D didn't win this round, part of it was because what was already in motion in the market cycle, not unlike now.

Finally, at the successful intervention (and this is assuming intervention that fills the market with excess liquidity and drives already high food and gas inflation even higher) of 2009 and late 2010, we didn't have Europe collapsing like it is now, China and emerging markets were still strong, not the case now, and the F_E_D's tool box was a lot bigger and their balance sheet was a LOT smaller.

Time to go to work and see how the underlying conditions of today's trade ended.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago