Again, today there's no dominant Price/Volume relationship, but another strong day in the averages.

SP&500: 348 gainers

Dow 30: 19 gainers

NASDAQ 100: 76 gainers

Russell 2k: 1519 gainers

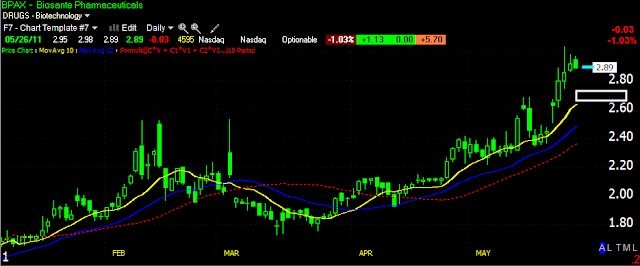

Internals weren't as interesting today as technicals. All 4 majors broke out of the trading range I identified in last night's closing post.

Interestingly today the strongest sub-industries included: Jewelry Stores, Internet Service Providers, Photographic Equipment and Supplies, Lodging, Broadcasting-TV, Sporting Good Stores, Residential Construction, Apparel Stores, Footwear, Specialty Retail, etc...

Are you seeing a pattern there? A lot of consumer discretionary, a lot of industry groups that haven't been doing well and aren't expected to do well. This actually makes sense if you look at it in light of why I've maintained my belief that we would not sink lower after Monday's plunge, but move higher and I still feel the chances are pretty good that we will see that head fake breakout. If you understand what the head fake is there for, then you'll understand why all these stocks that would seem odd balls to lead a rally, were the leaders today.

As far as silver goes, I warned several days ago that I see upside there, but be prepared for a bumpy ride. There still appears to be plenty of potential n Silver, today did do some damage though to the mid term charts.

Interesting, the CME hiked some margins and lowered others like Palladium which was on my bearish list specifically. One they hiked was the classic underperforming Natural Gas that was just featured this week as a potential bullish play coming into rotation. I found this very interesting.

I'll write a bit more when I get back, but for now, my mother has just been released from the hospital so I'm headed down to pick her up.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago