So overnight Monday/Tuesday morning there was really nothing good coming out of Europe as it opened for the week, the only thing that seemed to ramp futures was the lower cost of the $USD/JPY carry as we have been seeing this trend of the Yen gaining ground and the BOJ or PM Abe coming out and talking it back down, but that seems to be working less and less and it's becoming clear that despite Abe's picks for BOJ governors that there's still enough on the panel that are not as dovish that the BOJ may not be able to do all that Abe and new governors have been promising in recent weeks to keep the Yen low.

So as seen earlier today...

Around midnight the carry conditions became more favorable and futures moved higher overnight.

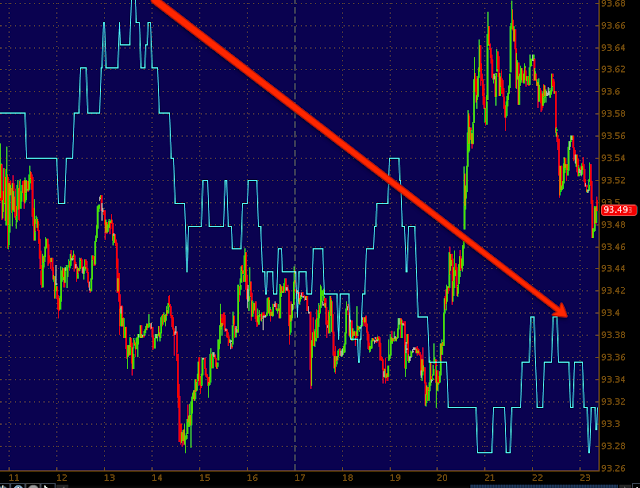

Here's a look at the Yen during market hours...

Early in the day the Yen (orange) fell which helped the SPX (green), then for a while the Yen went higher increasing the cost of carry and the market headed lower until the final hour in which the Yen started falling again and just barely ramped the SPX in to the close.

As for other currencies...

The Euro has been falling, by proxy it's not supportive (the relationship with the USD is what is truly important, but the Euro tends to move opposite the $USD).

Longer term on a 30 min chart, the rally in the SPX since November had EUR support, around February it fell out of sync and the extent to which it is out of sync now is one of many of the situations in which I have referred to as

"Rot just below the surface".

I've shown the rising $USD and it is pretty much the opposite of the falling Euro so I won't post that again, but intraday we have seen the SPX moving

with the $USD which is not the normal correlation, I think a lot of that has been manipulation of the SPX around the new high using other assets such as HYG, TLT and VXX. Today the relationship was as it should be and the increasing $USD in the afternoon pressured the market, but some of the assets used to manipulate the SPX short term were used today to dave the day and keep the downside in check.

Here's some proof of what I just said about the close, CONTEXT's SPY arbitrage model. Note how the assets used to manipulate the SPX higher came in to play around the last hour of the day as the model moved above the SPY and the Histogram went green.

Conveniently, the close was pushed right to VWAP in SPX futures!

ES (SPX futures ) lose VWAP and in that last hour we see the levers of SPY arbitrage pulled and ES ramps up to VWAP right at the close,

nearly perfectly!

Some of those assets that help move the SPX include...

HYG which was used yesterday to help the SPX higher today and as HYG fell off and turned negative the SPX saw more downside pressure, the last hour HYG popped in to the green and shortly after the SPX moved higher in to the EOD.

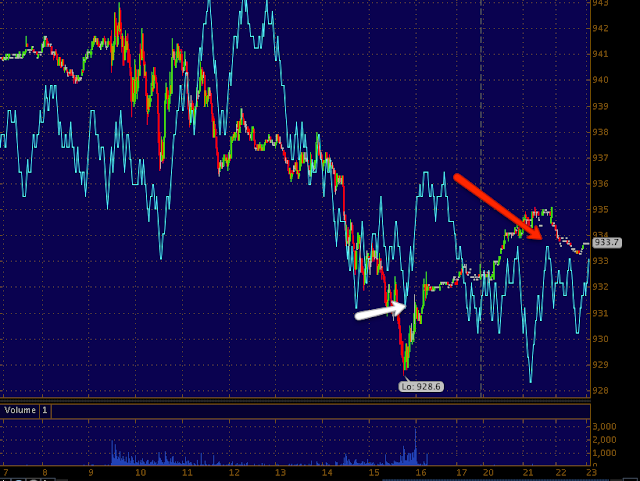

Longer term, in the category of "Rot under the surface", HYG disconnected with the SPX in January, it was pushed higher (yellow arrow), but never really got back in line. Although we see short term manipulations like yesterday, the longer term is disconnecting again as can be seen to the far right red box.

TLT (long term Treasuries) are also used to manipulate the short term SPX...

Here TLT saw some distribution on a 5 min chart, pushing it lower around the same time the SPX needed to be ready to break to new highs. However...

The short term 1 min chart where new divergences first start saw accumulation starting back up in to today's lows as the flight to safety trade was being bought again, earlier as TLT gapped up the 1 min chart had no argument with the 5 min above, now that is starting to change, this is why our positioning is short term bullish, long term bearish (the definitions of short term and long term are difficult, but PUT options for the long term bearish are April monthly expiration).

In the "Rot under the surface, TLT has seen a huge leading positive divergence in the important timeframe of 60 min that really shows the trend of the underlying flow, this shows a flight to safety.

As Treasuries are used, we should see similar action in Yields...

And as would be expected yesterday Yields were supportive of the SPX going in to today, they were supportive most of the day in fact so I'd say judging by Yields alone, we have some more short term upside.

However the longer term 60 min chart showing the rally in the SPX (green) for the entire year, it's clear where yields were supportive of the market and where they fell out of sync, it's really not much different than the 60 min positive divergence or accumulation in TLT.

Volatility is also used to move the SPX...

This is VXX in green, 3C in orange and the SPX in light blue intraday, note the VXX positive 3C divergence (white box) as it pressures the SPX, then the last hour the 2 min divergence goes negative (at the red box) and the SPX ramps in to VWAP at the close.

The longer term, more important 5 min chart shows overall accumulation of the VXX discount today as VIX futures were clearly seeing a bid.

The long term underlying trend on the 60 min chart shows a very strong flow with a leading positive 3C divergence in VXX.

Just for confirmation I checked the leveraged version of VXX (Short term VIX futures) and on the 2 min chart (intraday) we see the same EXACT thing, a positive divergence at the white box, it starts pressuring the SPX and we see a negative divergence the last hour as the SPX is ramped.

The 5 min chart looks the exact same as VXX 5 min, the discounted UVXY was accumulated where heavier institutional flows are found on the 5 min chart.

And the long term underlying trend is the same as VXX with a leading positive divergence in UVXY.

For further confirmation I checked XIV which is the exact opposite of VXX, it gives the exact opposite signals as VXX and UVXY on a 2 min chart today, distribution in to the higher prices of xIV today until the SPX in blue starts falling too far and loses VWAP, then a positive divergence, EXACTLY OPPOSITE VXX and UVXY!

The 5 min chart, confirms the 5 min VXX and UVXY with distribution of higher prices in XIV.

And the long term 60 min trend, confirms VXX and UVXY 60 min charts with the exact opposite signal, long term 60 min leading negative divergence!

The VIX (green) daily chart vs the SPX (red) shows a squeeze in volatility,

this suggests a highly directional move, if past experience is a guide, we should se a head fake move first with the VIX breaking under the triangle and the SPX making a new short term high and then a reversal sending VIX up and SPX down longer term.

With my DeMark inspired buy/sell indicator, we had a recent buy, then a Bollinger band volatility squeeze of the VIX, a head fake move to the down side and a pop higher that pulled the SPX back and also broke the Trend Channel (stopped out the trend). Now we have the same volatility squeeze building in the VIX again, this time I think we see a much bigger move,

which probably means the head fake move down in the VIX and up in the SPX is also much more convincing/stronger.

As for other assets...

Commodities vs the SPX (green) intraday where not buying the risk, they were more in line with value as determined by the $USD correlation, since stocks are risk assets too and "should" follow the $USD correlation, it would seem clear that the short term price action of the SPX is being artificially manipulated higher, but I don't think it lasts judging by all of the longer term indications.

Commodities which were needed to ramp the SPX to new all time highs were moving with the $USD last week as they too were seeing short term manipulation, however today they returned to their normal $USD correlation and traded opposite the $USD (green).

High Yield Credit, a risk asset, was clearly used yesterday to support the market as it made a stop run late in the afternoon Monday, you can see the higher high in HY credit, you can also see today's dip in HY and how the SPX lost VWAP just after, then the last hour, HY credit was also ramped and helped support the SPX and broader market.

Longer term looking at the SPX (green) rally for the year (2013) , HY credit was in line and then in 2 days it lost all of the gains for the year and went red for the year, I think that was real panic selling as 3C shows, since the moves have higher have had very little 3C support, even with those moves higher, HY credit is disconnecting again from the SPX (red box).

FCT isn't used to manipulate the market so it's a good sentiment indicator of risk, clearly it has been risk off vs the SPX (green).

The same applies to HIO, it has been risk off for almost the entire rally of 2013 which fits with many longer term 3C charts as well.

As far as sector rotation...

Short term over the last 4 days or so, there's been a clear flight to safety as Utilities, Health Care and Staples outperform while underperformance i clear in Financials, Energy, Basic Materials where a lot of momentum stocks are found (remember that when I show the breadth charts), Industrials and Tech to some degree.

For the year, again there's a clear flight to the safe haven sectors, Health care, Staples and Utilities, while risk off is seen in Energy, Basic Materials, Industrials (recently) and Tech.

As for the breadth charts just mentioned and momentum stocks... The indicator is green and the comparison, SPX is red.

The Percentage of all NYSE stocks trading 1 Standard Deviation

BELOW their 40 day moving average has seen a rise, it should be falling with a higher SPX, the 32% highs at the SPX pullback is close to being matched right now as the SPX hits new highs!

The Percentage of Stocks Trading TWO Standard Deviations Below their 200 day moving average are also rising instead of falling, from less than 2.5% to almost 3 times more as the SPX moves higher, more and more stocks are falling deeply below their 40 and 200 day moving averages,

again another example of the deeper structural ROT in the markets.

From the indications I see in short term movement and manipulation, I'd say we have some more upside short term, but I think we are very close to a major downside break, just think of the VIX volatility situation alone.

As for Dominant Price / Volume relationships today among the component stocks of the major averages, it's mixed again today, when they are all in the same direction I'd say we are close to a downside break.

The Dow has a dominant P/V relationship of Close Up/Volume Up, this is the strongest of the 4 relationships, however it often acts as a short term overbought signal. Since it's not the same for all the averages, I'd give it some leeway and not assign a directional move tomorrow, but normally if all the averages were the same, we'd expect a short term overbought situation and a close lower the next day.

The NASDAQ 100 shares the same Dominant Price/Volume relationship as the Dow. I would say it's probably a safe bet to expect a rotation to the IWM tomorrow and relative underperformance in the Dow and NDX.

The SPX also shares the same relationship, it also was a stronger relative performer, I'm guessing the IWM will see rotation tomorrow.

Note the R2K's dominant theme is Close Down/Volume down, the most benign relationship of the 4 possible, the only relationship that would be stronger for IWM rotation tomorrow would be close down/volume up.

Next up are Futures where the R2K /IWM appear to be ready to make a big move.