This has been a slow week, yet I've had 3 quick 1 day trades, BAC for nearly 30%, IWM earlier in the week for nearly 10% and a 5+% gain today simple using options (Puts). I always say, take what the market offers and it didn't offer much this week, but several trades set up and I took them.

I used options for the leverage, a straight short on BAC wouldn't have even been worthwhile, but with the options as leverage, it was certainly worthwhile

It looks like I left a little on the table, but I have a longer term IWM put that gained today.

A really nice close at the low of the day. I know at least two other members who took the same trade at the same time, so I'm anxious to hear how they did.

I'll have posts up over the weekend, but hopefully you'll be too busy enjoying your New Years!

Everyone be careful out there!

Friday, December 30, 2011

Just closed the IWM Trade

Well I just closed the IWM trade at a 5.38% profit for a couple of hours of work. Not too bad on such a lame day.

Other tid-bits

While I wouldn't put too much weight in to anything happening this afternoon, I did see a few small things I wanted to make note of. First as of now all the majors are in the red, Santa headed to the north pole and not Wall St. as many had anticipated solely on seasonal trends out of the current market context.

The lack of small cap leadership is one of the reasons I was bearish on a Santa Rally, but look at the intraday charts, small caps which should lead any risk on rally are definitely underperforming in the late day sell move.

While the defensive large caps are selling off too, they are making more of an effort late today, this tells me that the risk on mode is dissipating as small caps under-perform. The DIA Above.

You can see the SPY is also trying to hold whereas the IWM isn't putting in the same effort.

And the Q's as well.

Just a small observation.

IWM Put Trade From Earlier At A Profit

At first when the IWM dropped, the trade was still in the red, but I suspect the increased volatility has sent the spread wider and put the position in to a 3.5% gain on the day thus far. I'll keep it open for a bit longer and see what happens. I'v noticed the Dow/Large Caps which are more defensive and part of the reason I posted the Santa Rally video and thought we would not get one, which we haven't. The defensive nature of the market is partly what led me to that conclusion, we are seeing a sell off now in even the defensive stocks. It's hard to glean much information from such a whacky day/week, but that is what I see as of now.

Cue Sky Net, the Machines have taken over.

Right on target, 2 p.m.

Of course we don't know what the entire program is, but the start of the machines program has started with a waterfall-like sell-off.

IWM

SPY

Of course we don't know what the entire program is, but the start of the machines program has started with a waterfall-like sell-off.

IWM

SPY

It's 2 p.m., the bond market just closed....

I have been wondering all day whether a program will kick in after 2 p.m. today as the bond market is closed and volume is ultra light, it's the perfect time to run a manipulation of the market. I wouldn't read anything in to it either way if t occurs, it's blatant fertile manipulation ground, probably the most fertile 2 hours of the entire year. So as we go in to the New Year, we have 1 last 2 hour period where the computers are fully in charge. Lets see what they do.

Thursday of next week will be important

The new year flow of course will be interesting, in past years the mutual funds and hedge funds have had excess money to put to work in the market as everyone comes back from the Hamptons after a two week vacation. This year the flow is severely diminished, will they have some extra cash to invest? Doesn't seem likely. As I have pointed out, there's a difference between sidelined cash and cash that is gone for good. The nature of the mutual fund redemptions is one that suggests the cash is gone for good as redemptions have occurred in even positive market environments. The cash pulled by European banks from hedge funds is not coming back as they need to raise capital. We have seen evidence of this repatriation of capital since August when the PrimeX funds sold off for the first time below par. Some of you who have been here for 4-5 months probably remember how that effected the Euro and sent it higher with the market as algos chased what the computers thought were cheap stocks, but what was really the selling of US dollar denominated assets by EU banks and then selling the dollars, buying Euros and sending the Euro higher. It looked like a positive environment and the computers didn't know the difference, but it was due to a liquidity freeze, so once again as we often see in the market, that which looks positive is actually negative and vice-versa.

In any case I have mentioned several times that one of the best metrics of what is going on in Europe is the French bond market for OATS, the reason being is that they do not qualify for secondary market ECB intervention, which has been almost futile any way. As Italian bond yields rise, the ECB on a weekly and multi week basis goes out in to the secondary market and buys up Italian BTPs to lower the yield, like the F_E_D, they can't participate in primary auctions, but with France, they can't even get involved with buying on the secondary market so as French yields go, so to goes the EU. It's a metric that can't be manipulated, unless the ECB does exactly what it just did with the LTRO and gives the banks the money to buy the bonds for the ECB, it's a little like the F_E_D's POMO operations.

However, to date that money that could be making a 6% or so carry trade profit, has thus far ended up in the ECB's vault at a negative .75% reverse carry trade loss, we saw similar actions in the US at the last 4 week auction in which money was essentially parked at the Treasury at a 0% yield for 4 weeks rather then have it exposed anywhere in any asset, some big dollars were and seemingly still are afraid of something occurring over the next few weeks.

In any case, next Thursday the French auction off several OATS to the tune of a targeted $7-$8 billion Euros. On Thursday alone, they have Oct. 2021/Oct. 2023/ April 2035 and April 2041 Oats up for auction. Traders will be watching the yields these auctions command and any rise in yields will be a very bad sign for France. I can't imagine the auctions will be positive with all of the downgrade talk and the S&P specifically waiting for the new year to start issuing such downgrades. France losing their Aaa rating, which seems likely as a 2-notch downgrade has even been mentioned, will essentially leave the full faith and credit of the EU squarely in the very reluctant lap of Germany.

It is actually quite a busy schedule for the first 2 months of 2012 and has the potential to be a huge market moving catalyst. However our first real test will be Thursday of next week.

In any case I have mentioned several times that one of the best metrics of what is going on in Europe is the French bond market for OATS, the reason being is that they do not qualify for secondary market ECB intervention, which has been almost futile any way. As Italian bond yields rise, the ECB on a weekly and multi week basis goes out in to the secondary market and buys up Italian BTPs to lower the yield, like the F_E_D, they can't participate in primary auctions, but with France, they can't even get involved with buying on the secondary market so as French yields go, so to goes the EU. It's a metric that can't be manipulated, unless the ECB does exactly what it just did with the LTRO and gives the banks the money to buy the bonds for the ECB, it's a little like the F_E_D's POMO operations.

However, to date that money that could be making a 6% or so carry trade profit, has thus far ended up in the ECB's vault at a negative .75% reverse carry trade loss, we saw similar actions in the US at the last 4 week auction in which money was essentially parked at the Treasury at a 0% yield for 4 weeks rather then have it exposed anywhere in any asset, some big dollars were and seemingly still are afraid of something occurring over the next few weeks.

In any case, next Thursday the French auction off several OATS to the tune of a targeted $7-$8 billion Euros. On Thursday alone, they have Oct. 2021/Oct. 2023/ April 2035 and April 2041 Oats up for auction. Traders will be watching the yields these auctions command and any rise in yields will be a very bad sign for France. I can't imagine the auctions will be positive with all of the downgrade talk and the S&P specifically waiting for the new year to start issuing such downgrades. France losing their Aaa rating, which seems likely as a 2-notch downgrade has even been mentioned, will essentially leave the full faith and credit of the EU squarely in the very reluctant lap of Germany.

It is actually quite a busy schedule for the first 2 months of 2012 and has the potential to be a huge market moving catalyst. However our first real test will be Thursday of next week.

Euro/IWM Trade

So I just entered an options trade on the IWM, January 75 Puts and here's the reason why...

(remember this is a short term speculative trade)

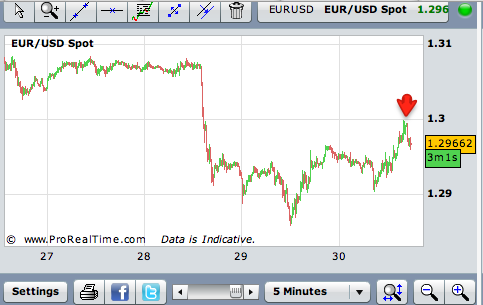

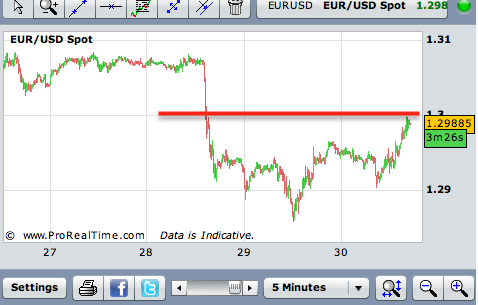

On a 5 min chart you can see the Euro testing the $1.30 area and backing off a bit.

Here's a 1 min chart with a small bullish ascending triangle that most traders would probably have expected to push the Euro through the $1.30 level, instead it failed and we have the start of an intraday downtrend. Remember that the market runs roughly in line with the Euro, especially over the last week or so, which has been all about the Euro

The FXE/Euro 1 mn 3C chart

FXE 2 mn

And FXE 5 min are all a bit negatve.

I didn't choose the SPY because it is pretty fairly correlated with the FXE/Euro.

The IWM is a bit rich to the correlation and therefore has more potential downside.

(remember this is a short term speculative trade)

On a 5 min chart you can see the Euro testing the $1.30 area and backing off a bit.

Here's a 1 min chart with a small bullish ascending triangle that most traders would probably have expected to push the Euro through the $1.30 level, instead it failed and we have the start of an intraday downtrend. Remember that the market runs roughly in line with the Euro, especially over the last week or so, which has been all about the Euro

The FXE/Euro 1 mn 3C chart

FXE 2 mn

And FXE 5 min are all a bit negatve.

I didn't choose the SPY because it is pretty fairly correlated with the FXE/Euro.

The IWM is a bit rich to the correlation and therefore has more potential downside.

IWM Trade....

I am thinking about buying some IWM puts for a quick day trade....

IWM 1 min

IWM 2 mn

IWM 15 min.

This is a speculative trade , but the Euro is backing off the $1.30 area so it may produce a little something and it's a small trade, on the other hand I will tell you that this is out of boredom and trades out of boredom are not a great reason, but other then that, it does look like it has some room to fall.

IWM 1 min

IWM 2 mn

IWM 15 min.

This is a speculative trade , but the Euro is backing off the $1.30 area so it may produce a little something and it's a small trade, on the other hand I will tell you that this is out of boredom and trades out of boredom are not a great reason, but other then that, it does look like it has some room to fall.

SPY Breaking down a little here

Here's the 50 bar 5 minute chart watched by many day traders and the SPY has seen support there all morning until the last 10 minutes or so.

SPY 1 min

SPY 2 min

SPY 5 min

These aren't the "jump off the chart" signals I'd like to see to enter a trade, but I'm not sure we can expect that today unless a major program is set to kick in at some point today.

SPY 1 min

SPY 2 min

SPY 5 min

These aren't the "jump off the chart" signals I'd like to see to enter a trade, but I'm not sure we can expect that today unless a major program is set to kick in at some point today.

As suspected and as is common, the EUR/USD is testing the $1.30 level

Why there would be a test of this important level on probably the most inactive day of the year is strange, I don't know if I should read in to it much or not, but there it is as expected.

With stocks, the head fake probability is usually very high in which the $1.30 test would appear successful at first and then fail after longs were sucked in, on a day like today, there's not many traders to suck in. The fact $1.30 has broken twice is not going to be taken well by FX traders who are trading on huge leverage and account sizes. Betting long on the Euro now s kind of like trying to catch the proverbial falling knife. LTRO is a disappointment, the banks are running scared and parking cash at a .75% loss rather then engage in a carry trade where they could actually make some money, which tells me they have little confidence in the solvency of the PIIGS. Of course and bank/investment bank's risk department as well as shareholders would probably have some probing questions for any trading desk buying 7% 10 years. Look at what happened to MF-Global.

With stocks, the head fake probability is usually very high in which the $1.30 test would appear successful at first and then fail after longs were sucked in, on a day like today, there's not many traders to suck in. The fact $1.30 has broken twice is not going to be taken well by FX traders who are trading on huge leverage and account sizes. Betting long on the Euro now s kind of like trying to catch the proverbial falling knife. LTRO is a disappointment, the banks are running scared and parking cash at a .75% loss rather then engage in a carry trade where they could actually make some money, which tells me they have little confidence in the solvency of the PIIGS. Of course and bank/investment bank's risk department as well as shareholders would probably have some probing questions for any trading desk buying 7% 10 years. Look at what happened to MF-Global.

So Much for the Christmas Rally

For over a month I've been hearing the Santa Rally this and that, some blogs have been downright nasty in their opinion of anyone who is short with statements like, "Just wait until the Santa Rally comes". Thus far for the Santa Rally Seasonal period we are down thus far. Today there are about ZERO trading desks open and the bond market close at 2 p.m., that means the machines will be running things for the last two hours of the day, I wouldn't read much in to that (machines in charge, no bond market open and extraordinarily low volume= nonsense).

The main point is that because something has a long track record of probability does not mean you should take that event out of the current context and assume it s a given. The current context is the economy the world over, (today Japan as I was starting to suspect, used $9 billion in the F_E_D's swap line showing Japanese banks are in the middle of a liquidity squeeze as well-borrowing from the swap line is akin to putting a target on your back for the short sellers, they know the bank has funding problems) is in huge trouble like never seen before.

Now the talk is of the 1st trading day of the year ramp, true we saw it at the start of this year as funds and trading desks came back online, it looked like this.

A nice ramp job... However as I have mentioned in the past, during my nearly 4 years of teaching Tehnical Analysis to beginners and intermediate students, I strived to get them to understand that charts were not most useful for resistance and support areas or indicator readings, charts were most useful as an expression of the two things that drive the market, both are human emotion and they are fear and greed. The Japanese understood this centuries ago when they created Candlestick charting to trade rice, candlestick charts are a visual representation of human emotion and even with machines in the market, they are still programmed by humans. This is why the market has so many repeating patterns over centuries of history, human emotion doesn't change. So, not to say a New Year ramp s not possible, after all a Santa Rally was possible, but a my Sunday video showed, not likely, I think it's only reasonable to put that first trading day of the New Year in to context.

This chart covers the first day of 2010, no one knew what would happen after like we do now, they knew only what had already occurred and QE 1 was still in effect. Looking at this chart, what emotions do you think carried the market? Fear? Trepidation? Confidence? Greed? I think the last two are more appropriate then the first two. The market was in a season in which many believed a new bull market had started, they had no idea that Europe was going to implode, that China was actually really going to slow down, the inflation effects of QE had not been felt, there was little reason to be skeptical of the F_E_D's intervention, we had not seen negative effects back then.

Fast forward....

What emotions do this period convey? Greed? Confidence? Trepidation? Fear? I would say Trepidation, a little fear, some denial, and probably some desperate hope.

Structurally in the market things have changed as well. Here's commentary from ZH on this week's flow of funds report:

At this point the weekly ICI fund flow update, showing the barrage of redemption requests no matter what the market does, is a moot point, but we will do it anyway: in the week ended December 21, when the market was doing its usual Santa rally antigravitational acrobatics and rising on the now denied hope that the European LTRO would be the Hail Mary pass of 2011, investors in domestic equity mutual fundspulled another $2.7 billion, leaving funds with even less dry powder, with even less ability to lever up, and with an even lower margin of error to any sharp pull backs in stocks. To date, and with just one week left in, investors have withdrawn a whopping $135 billion from equity mutual funds, which we are 100% certain is an all time record for any year in which the S&P closed even nominally positive for the year, proving that nobody believes this farce known as a market any longer. But we all know that... In further detail, investors withdrew funds for 34 of 35 consecutive weeks, have withdrawn $19 billion in the past month alone, and their flows show no indication of any sort of market correlation any longer, indicating that no matter how high the "powers that be" push stocks, retail no longer cares, and will not chase "performance" especially when said performance is 100% fraud and manipulation.

And so the Mutual funds are left with much less money as well as the hedge funds to operate. It may be time for a more defensive posture. You must understand that the weekly flow of funds is not just a number, it's showing a crashing business model and a number of funds are being forced to close shop. Layoffs are hitting Wall Street hard recently. Think about the emotions there as a desk trader, as a fund manager, these are the very emotions that move markets and now it is self preservation time. No one wants to lose that 6, 7, 8 or even 9 figure income, but this is no longer the season of funds, mutual or hedge, they went from vogue to plague and the fall from glory was fast. We can't ignore these things moving forward.

Finally look at the 2008 New Year.

Not such a great start.

Here's the period preceding it and yes, there were rallies shortly before the new year, but the overall picture conveys what emotions? I'll leave that to you.

The point is no seasonal probability can be judged in a vacuum.

The main point is that because something has a long track record of probability does not mean you should take that event out of the current context and assume it s a given. The current context is the economy the world over, (today Japan as I was starting to suspect, used $9 billion in the F_E_D's swap line showing Japanese banks are in the middle of a liquidity squeeze as well-borrowing from the swap line is akin to putting a target on your back for the short sellers, they know the bank has funding problems) is in huge trouble like never seen before.

Now the talk is of the 1st trading day of the year ramp, true we saw it at the start of this year as funds and trading desks came back online, it looked like this.

A nice ramp job... However as I have mentioned in the past, during my nearly 4 years of teaching Tehnical Analysis to beginners and intermediate students, I strived to get them to understand that charts were not most useful for resistance and support areas or indicator readings, charts were most useful as an expression of the two things that drive the market, both are human emotion and they are fear and greed. The Japanese understood this centuries ago when they created Candlestick charting to trade rice, candlestick charts are a visual representation of human emotion and even with machines in the market, they are still programmed by humans. This is why the market has so many repeating patterns over centuries of history, human emotion doesn't change. So, not to say a New Year ramp s not possible, after all a Santa Rally was possible, but a my Sunday video showed, not likely, I think it's only reasonable to put that first trading day of the New Year in to context.

This chart covers the first day of 2010, no one knew what would happen after like we do now, they knew only what had already occurred and QE 1 was still in effect. Looking at this chart, what emotions do you think carried the market? Fear? Trepidation? Confidence? Greed? I think the last two are more appropriate then the first two. The market was in a season in which many believed a new bull market had started, they had no idea that Europe was going to implode, that China was actually really going to slow down, the inflation effects of QE had not been felt, there was little reason to be skeptical of the F_E_D's intervention, we had not seen negative effects back then.

Fast forward....

What emotions do this period convey? Greed? Confidence? Trepidation? Fear? I would say Trepidation, a little fear, some denial, and probably some desperate hope.

Structurally in the market things have changed as well. Here's commentary from ZH on this week's flow of funds report:

At this point the weekly ICI fund flow update, showing the barrage of redemption requests no matter what the market does, is a moot point, but we will do it anyway: in the week ended December 21, when the market was doing its usual Santa rally antigravitational acrobatics and rising on the now denied hope that the European LTRO would be the Hail Mary pass of 2011, investors in domestic equity mutual fundspulled another $2.7 billion, leaving funds with even less dry powder, with even less ability to lever up, and with an even lower margin of error to any sharp pull backs in stocks. To date, and with just one week left in, investors have withdrawn a whopping $135 billion from equity mutual funds, which we are 100% certain is an all time record for any year in which the S&P closed even nominally positive for the year, proving that nobody believes this farce known as a market any longer. But we all know that... In further detail, investors withdrew funds for 34 of 35 consecutive weeks, have withdrawn $19 billion in the past month alone, and their flows show no indication of any sort of market correlation any longer, indicating that no matter how high the "powers that be" push stocks, retail no longer cares, and will not chase "performance" especially when said performance is 100% fraud and manipulation.

And so the Mutual funds are left with much less money as well as the hedge funds to operate. It may be time for a more defensive posture. You must understand that the weekly flow of funds is not just a number, it's showing a crashing business model and a number of funds are being forced to close shop. Layoffs are hitting Wall Street hard recently. Think about the emotions there as a desk trader, as a fund manager, these are the very emotions that move markets and now it is self preservation time. No one wants to lose that 6, 7, 8 or even 9 figure income, but this is no longer the season of funds, mutual or hedge, they went from vogue to plague and the fall from glory was fast. We can't ignore these things moving forward.

Finally look at the 2008 New Year.

Not such a great start.

Here's the period preceding it and yes, there were rallies shortly before the new year, but the overall picture conveys what emotions? I'll leave that to you.

The point is no seasonal probability can be judged in a vacuum.

Thursday, December 29, 2011

IWM Fails to impress Again

My Sunday video about the Santa Rally focussed in large part on the leadership which was in the more defensive oriented Dow when the small caps should have been leading, like the Russell 2k/IWM. This was the basis of my ideas about a Santa Rally being a dud.

Looking at the IWM's breakout at the end of day, first the IWM lagged the Russell 2k, now I understand that the managers of the ETFs can't always match performance of the underlying average point by point, but a difference of .16% ( a 15% difference in the ETF vs the underlying) is excessive. One of the reasons I like ETFs for analysis is that is where market participants express an opinion in 1 stock rather then tracking the nearly 2000 individual components and I have found from time to time that the difference between the average and the tracking ETF isn't a matter of management (well it is in a way), but it is a difference in opinion as one sees heavier selling or buying, so in some instances the ETFs performance vs the underlying (so long as it is not a small insignificant difference, a 15% tracking difference is not insignificant) can often tell you something about the mood of traders.

Furthermore the IWM barely outperformed the more defensive DIA (1.08% vs 1.07% respectively), earlier the IWM was leading by a better margin. As for the breakout itself, the IWM didn't look great.

As a matter of fact, by the lose, it failed and closed below the breakout level. Furthermore it looked like it was hitting rough resistance, but there wasn't much in the area that was strong resistance.

Small caps should have led. As I said earlier, a false breakout to the downside would probably have meant that the consolidation was going to continue its leg up, but seeing a breakout to the upside first, that' more bearish as 80% or so of these breakouts are head fakes and the price pattern of the seemingly bullish ascending wedge was there all day and was about the only thing to look at so it was obvious. So unless this was a breakout in the 20% (real breakout), I would tend to call this a more bearish move. For those who may be puzzled by what I'm saying, the heart of my comments lies within the fact that what Technical Analysis has taught you and everyone else over a century, is now being used against you as traders become predictable, it makes it easy for Wall Street to take advantage of that predictability.

The only real positive for the market I see right now is that the Euro broke out, but it's been less then an hour and it will move around a lot overnight.

Tech didn't get much of a boost and Financials didn't make any use of the move.

XLF didn't make any new highs...

and compared to XLK during the day, the move there was negligible. AAPL after the break made 3 lower highs/lower lows, it didn't take the bait and run.

Much like the end of day ramp in stocks on Friday December 23rd, which in my opinion was used to keep longs in place over a 3 day weekend when they would normally be closing positions, which led to the downside we saw yesterday, there was no positive divergence before the ramp and no confirmation in the SPY.

This is last Friday's ramp at the end of the day, note there was no positive divergence suggesting shares were being accumulated to sell in to higher prices on the open this week.

This is today, no positive divergence either, no confirmation in the 1 min or the 2 and 5 min charts below.

2 min

5 min.

So we'll see what the Euro and ES does overnight, maybe we get an opportunity early tomorrow to put on some trades. I'll be updating as I have a chance to look at the charts more closely.

Looking at the IWM's breakout at the end of day, first the IWM lagged the Russell 2k, now I understand that the managers of the ETFs can't always match performance of the underlying average point by point, but a difference of .16% ( a 15% difference in the ETF vs the underlying) is excessive. One of the reasons I like ETFs for analysis is that is where market participants express an opinion in 1 stock rather then tracking the nearly 2000 individual components and I have found from time to time that the difference between the average and the tracking ETF isn't a matter of management (well it is in a way), but it is a difference in opinion as one sees heavier selling or buying, so in some instances the ETFs performance vs the underlying (so long as it is not a small insignificant difference, a 15% tracking difference is not insignificant) can often tell you something about the mood of traders.

Furthermore the IWM barely outperformed the more defensive DIA (1.08% vs 1.07% respectively), earlier the IWM was leading by a better margin. As for the breakout itself, the IWM didn't look great.

As a matter of fact, by the lose, it failed and closed below the breakout level. Furthermore it looked like it was hitting rough resistance, but there wasn't much in the area that was strong resistance.

Small caps should have led. As I said earlier, a false breakout to the downside would probably have meant that the consolidation was going to continue its leg up, but seeing a breakout to the upside first, that' more bearish as 80% or so of these breakouts are head fakes and the price pattern of the seemingly bullish ascending wedge was there all day and was about the only thing to look at so it was obvious. So unless this was a breakout in the 20% (real breakout), I would tend to call this a more bearish move. For those who may be puzzled by what I'm saying, the heart of my comments lies within the fact that what Technical Analysis has taught you and everyone else over a century, is now being used against you as traders become predictable, it makes it easy for Wall Street to take advantage of that predictability.

The only real positive for the market I see right now is that the Euro broke out, but it's been less then an hour and it will move around a lot overnight.

Tech didn't get much of a boost and Financials didn't make any use of the move.

XLF didn't make any new highs...

and compared to XLK during the day, the move there was negligible. AAPL after the break made 3 lower highs/lower lows, it didn't take the bait and run.

Much like the end of day ramp in stocks on Friday December 23rd, which in my opinion was used to keep longs in place over a 3 day weekend when they would normally be closing positions, which led to the downside we saw yesterday, there was no positive divergence before the ramp and no confirmation in the SPY.

This is last Friday's ramp at the end of the day, note there was no positive divergence suggesting shares were being accumulated to sell in to higher prices on the open this week.

This is today, no positive divergence either, no confirmation in the 1 min or the 2 and 5 min charts below.

2 min

5 min.

So we'll see what the Euro and ES does overnight, maybe we get an opportunity early tomorrow to put on some trades. I'll be updating as I have a chance to look at the charts more closely.

Maybe, just maybe we are getting a head fake move right now...

Like I said, you have to pay extra attention on dull days...

The market is making a bit of a breakout move, yet High Yield Credit is selling off to new lows on the day.

So are Rates.

Here's the kicker, the Euro didn't start this move, so if this is an upside breakout and the Euro doesn't respond, it could very well be a head fake in which case I'll be checking BAC/XLF next.

And here's good reason, Financial momentum has fallen off.

The market is making a bit of a breakout move, yet High Yield Credit is selling off to new lows on the day.

So are Rates.

Here's the kicker, the Euro didn't start this move, so if this is an upside breakout and the Euro doesn't respond, it could very well be a head fake in which case I'll be checking BAC/XLF next.

And here's good reason, Financial momentum has fallen off.

I apologize in advance

These aren't meant to offend any one, today is just really dull and these gave me a chuckle, it was either this or pictures of what my dog has recently destroyed and I can't really top the 12" hole she chewed in my last memory foam mattress.

Turbo Tax Timmy! Does anyone really get it, how an un-convicted tax cheat becomes the head of the Treasury?

A New Species discovered!

Rumors of Kim Jong's death greatly exaggerated.

Here's to hoping! At least it would make for an interesting 4 years at the F_E_D

OK, couldn't resist after slandering my daughter, she really is loving.

Maybe a little too much.

And if I weren't so lazy in the morning, I could enjoy this everyday with a 3/4 of a mile drive from my home....

Turbo Tax Timmy! Does anyone really get it, how an un-convicted tax cheat becomes the head of the Treasury?

A New Species discovered!

Rumors of Kim Jong's death greatly exaggerated.

Here's to hoping! At least it would make for an interesting 4 years at the F_E_D

OK, couldn't resist after slandering my daughter, she really is loving.

Maybe a little too much.

And if I weren't so lazy in the morning, I could enjoy this everyday with a 3/4 of a mile drive from my home....

Market Update

For such a low volume market I'm surprised it is so listless, it's a bit annoying to watch. In any case, last update I was thinking the market may just be in a consolidation, it may be, there are a few signs that have changed a little.

DIA 1 min is mostly in line with a slight lag.

The 2 min is starting to deteriorate a bit.

As is the 5 min.

The QQQ 1 min which has been in line most of the day is starting to deteriorate.

I'm not sure what to make of this 2 min chart, but it's not particularly positive.

And the 5 min is starting to see some deterioration, this s the main difference as earlier the 5 min charts were in line.

The SPY probably looks the most reasonable as the 1 min continues its weakness

As does the 2 min like earlier, except a bit worse.

Finally the 5 min hart is starting to see some of the 1/2 min chart weakness.

However this sloppy, ascending like triangle may see a head fake in either direction at this point, if this is a consolidation then I would expect a downside head fake before a move higher (this still remains a short term correction as far as I can see as expected yesterday).

ES 1 min which carries more weight then the ETF/Stock 1 min charts is falling apart a bit here as well, this is probably the most bearish of all the charts right now.

And again we have another FX triangle, we have seen 4 of these (3 small and 1 larger) that have all had upside head fake moves that fell apart, this is probably the chart that has me thinking we are still in a consolidation, but honestly today has been very slow, which means for me, it's the time to be the most vigilant.

I still think the Euro is leading this whole move. One thing is certain, the seasonal Santa Rally has not shown its head. The most crucial time would be between this past Tuesday and the first day or two of the New Year, but as far as Santa rallies go, they are generally well in to strength by this time.

DIA 1 min is mostly in line with a slight lag.

The 2 min is starting to deteriorate a bit.

As is the 5 min.

The QQQ 1 min which has been in line most of the day is starting to deteriorate.

I'm not sure what to make of this 2 min chart, but it's not particularly positive.

And the 5 min is starting to see some deterioration, this s the main difference as earlier the 5 min charts were in line.

The SPY probably looks the most reasonable as the 1 min continues its weakness

As does the 2 min like earlier, except a bit worse.

Finally the 5 min hart is starting to see some of the 1/2 min chart weakness.

However this sloppy, ascending like triangle may see a head fake in either direction at this point, if this is a consolidation then I would expect a downside head fake before a move higher (this still remains a short term correction as far as I can see as expected yesterday).

ES 1 min which carries more weight then the ETF/Stock 1 min charts is falling apart a bit here as well, this is probably the most bearish of all the charts right now.

And again we have another FX triangle, we have seen 4 of these (3 small and 1 larger) that have all had upside head fake moves that fell apart, this is probably the chart that has me thinking we are still in a consolidation, but honestly today has been very slow, which means for me, it's the time to be the most vigilant.

I still think the Euro is leading this whole move. One thing is certain, the seasonal Santa Rally has not shown its head. The most crucial time would be between this past Tuesday and the first day or two of the New Year, but as far as Santa rallies go, they are generally well in to strength by this time.