For now we bounce..

Commodities are lagging intraday, mostly oil is holding them back, but I have a lot of other charts to look at.

Here again commodities have been useful as a leading indicator, thus far today they are not synced with the market, we'll see if the move in line tomorrow, it's probably early to call this a red flag.

Longer term commodity underperformance is a red flag, which makes sense with the short term 3C charts (bounce) and the longer term showing trouble in the trend.

Longer term, commodities are signaling a red flag for this trend in the SPX which I think is in the volatile proces of rolling over. This also represents problems with China's growth, Sunday night when their Flash PMI is announced, it may have very dramatic effects on the market, thus this may be why they are trying to bounce it now before the Chinese data.

This i a bit of a red flag, High Yield credit which would be an obvious choice for a risk on move has sold off all day, perhaps that is what gave the market pause seen in the short term 3C charts as a consolidation.

Longer term, a major red flag as the position in HY Credit is being unwound, note the divergence and HY Credit can not make a higher high since early February. Credit traders are a lot more in tune with the market then equity traders.

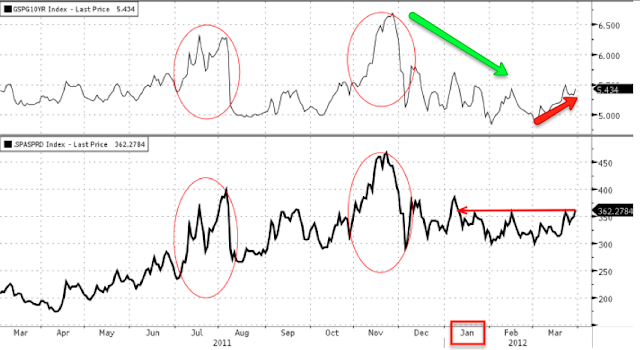

As usual, rates have been an excellent leading indicator, they signalled the decline to the left and they also went positively divergent vs the SPX.

Longer term in the trend, they are faltering. Again this makes sense with what we are seeing in 3C, short term bounce, but trouble in the uptrend.

Very long term, look at the scope of this divergence, yields easily called the 2011 top leading to a 20% sell-off, they even called the bottom before equities in October, although it may seem small and insignificant, it is nearly a month long signal. The fact they are so dislocated from the rally is a major red flag.

The $AUD does it again as a leading indicator, short term it bottoms before the SPX and is in line intraday.

Longer term the carry is being unwound and the divergence here is quite scary, this is why I would only be long for very short periods of time as when this cracks, it will be ugly.

High Yield Corp. Credit is in line with the market intraday.

Longer term it is faltering and dislocated creating a very unstable trend in the SPX.

Here's about a 3 day look at sector rotation, clearly financials leaked off badly (this is relative performance), Defensive sectors like Utilities, Healthcare and Staples came heavily in to rotation as a safe haven trade started. Energy fell off badly as did Basic Materials, Industrials to some degree and Tech is starting to roll out, most notably discretionary is falling out on this chart.

Looking at afternoon late day sector performance, the bounce is clear in intraday rotation, financials maintained, Defensive sectors fell out, Energy which is down,did show a late day surge, but still closing down. Basic Materials came back in with Industrials, Tech was a bit weaker relatively speaking and discretionary saw a slight bump.

So now I'm going to dissect the market in more detail and see where the opportnities are shaping up.