As to the late day USD/JPY/Market ramp... FAIL

Now that we've moved to the right a little more you can see the positive 1 min intraday divergence, you can also see the move in the pair it created, an ant hill!

This is the pair's correlation to ES intraday, not only did ES fail even before USD/JPY at the closing ramp attempt, but it sank even lower.

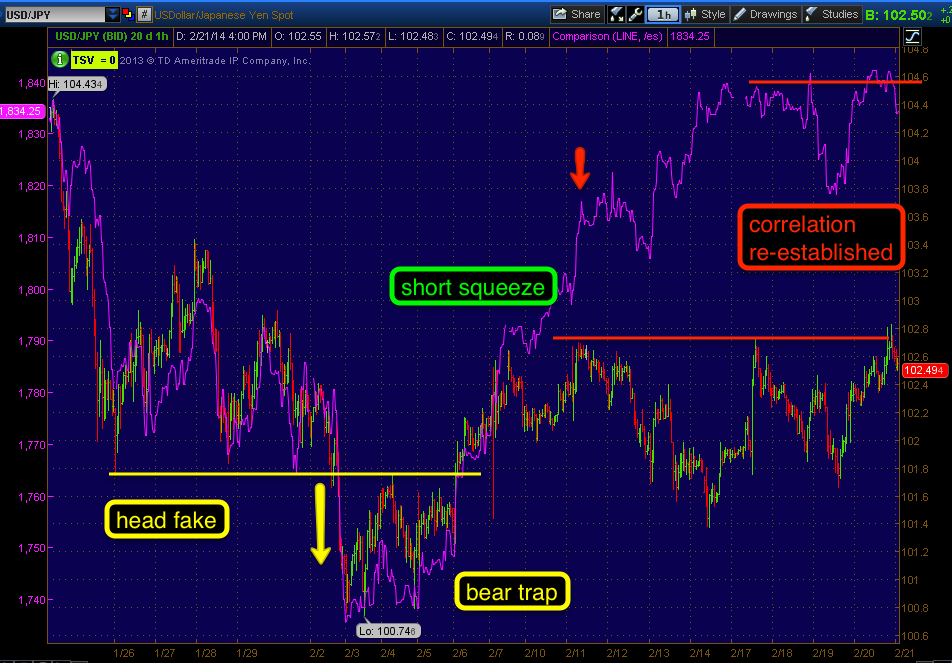

The 60 min chart shows the head fake move/bear trap, the short squeeze that came out of the head fake move and then at the 3 attempts in USD/JPY to go higher, you can see the last two, ES reconnected its correlation with the USD/JPY, as suspected, the only reason Es broke free of the correlation was because of the head fake/ short squeeze. There are nearly 70 ES points on the downside for ES to reconnect to the long standing correlation which fits with our next trend expectation and this wasn't created this week, this trend expectation has been with us since we identified the likely head fake move in early February.

As for the EOD ramp FAIL, look at it vs VWAP which has been very steady which is what we see when there's large scale distribution.

A nice steady VWAP and EOD, FAIL all the way down through the lower standard deviation.

As far as the possible bounce Monday, I'd have a REALLY hard time making the case based on objective data, for instance, take a look at the averages (I've included several timeframes).

DIA 2 min, it's nearly impossible to look at this chart and expect a bounce Monday, the best I have is the AAPL chart which saw a little deterioration, but is still positive enough to launch a short move.

DIA 5 min, so there's nothing waiting in the wings either

DIA 30 min showing the last trend failing like the other averages and Index Futures.

IWM 2 min, How could I possibly look at that and expect a bounce Monday?

5 min, again, nothing on the relative divergence side either

And the 4 hour chart is pure bear market material.

QQQ 1 min, not a hint of a positive divergence and these divergences usually pick up where they left off the next trading day (Monday).

With the 2 min hitting a new leading negative low, there's nothing there either.

The detail the 15 min chart affords us shows this move to be exactly what we called it more than a week before it started, a move to change sentiment, to get bears buying and allow smart money to sell/sell short ad there was no accumulation in the move, not even in line, just pure distribution which is what I said to expect long before the move started when I was trying to anchor expectations.

SPY 1 min is in line, but no where near a positive divergence.

The 30 min chart shows the accumulation area for the head fake move from 1/27 to 2/6, also the intensity of distribution.

The 4 hour chart is Bear material as well, you've seen the daily charts now vs some of the worst crashes over the last century, we are much more extreme and negative now than any of those including 1929.

Earlier I told you that Index futures are no better...

ES (SPX E-mini futures) 5 min leading negative

ES 15 min leading negative

And ES 30 min leading negative, this move for all intents and purposes did exactly what we expected it to, I just hope we have a little more time to enter some more core short positions because the next trend should take us below the SPX's 200-day moving average for starters.

As for some other indications, when Healthcare and Utilities are the best performing S&P Industry groups for 2014, you know there's been a huge flight to safety among the long only mutual funds and other firms. . We saw that this week with the VIX climbing and specifically today as if it were an emergency with VIX futures seeing huge accumulation on an already huge accumulated position, also Treasuries out performed their SPX correlation easily, in fact in a very scary way if I were long, but I'll rest well this weekend not having taken on longs and not having endorsed any that didn't have very good reason.

Sentiment is ready to move lower, it's not buying at this stage.

And perhaps my favorite all around Leading Indicator, Yields.

Yields called the fast collapse of prices in January, they even called the head fake "W" bottom at the lows, this current dislocation is way deeper than the last negative dislocation sending the SPX lower with a -2% and a -2.20% day, remember when the market was moving up +0.10% and everyone was so bullish and I was incredulous that anyone would even consider that a move up, I had said anything less than a half a percent isn't even worth mentioning, well here we are in the 2% moves, it won't take much for a 4 or 5% gap down to take out millions of longs and create a massive disturbance in the force filled with margin calls, talk about a snowball effect, NOW YOU KNOW WHY I'M SO DESPERATE TO GET SOME MORE CORE SHORTS IN PLACE.

Else where, the SPX , Dow-30 and Dow -20 (transports) all closed flat on the week, only the Q's and IWM were up, but I don't expect that to last, although I hope we get a little time. As mentioned, the best performing SPX groups are DEFENSIVE, dividend yielding Utilities and the one service everyone needs even in a bear market, Healthcare.

As for my custom tracking scan, Dominant Price/Volume Relationships, we had a huge one today.

The dominance looked like this for one relationship (of a possible 4), the same for all of the averages:

Dow-30 had 23 stocks in the relationship, the NASDAQ 100 had 81 stocks, the Russell 2000 had 1064 stocks and the S&P 500 had 336 stocks, a HUGELY DOMINANT THEME and it was...

Price Up/Volume Down.

Of the 4 possible combinations, not only was this Dominant in each average, but every average and it is the most BEARISH of the 4 possible relationships. Close Up/Volume Down typically is viewed as an overbought, failing trend and the next trading day almost always closes down after this relationship.

All I can say moving forward is, "I hope we have at least a day to add core shorts, PCLN and NFLX are high on my list with many others.

The release of the January F_E_D minutes was probably the most bearish thing we have seen from the F_E_D since they got involved in 2008 with extra accomodative policy, why? It's not because of the continuing QE taper which I warned a long time ago, actually the same day they announced QE 3, that they were looking for a way to start unwinding accomodative policy and normalize their balance sheet.

Remember the June QE taper Talk in which they were VERY hawkish, saying it should be wrapped up by the end of 2013 and several members wanted to start right away and then all of the sudden the F_E_D went totally silent over the issue. The reason why? It wasn't because of the loss of QE, pros knew that was coming if you listened carefully to what the F_E_D was saying, it was the interest rate hike that was initially guided as coming 6 months after QE was wrapped up. That meeting sent Bond traders in to a tizzy and they lifted the 10 year to 3%, the F_E_D was extremely alarmed and they shut up about it for the next several meeting. The other guidance was an interest rate hike would come at the 6.5% unemployment threshold, well we are at 6.6% so very close and with extended benefits a thing of the past, there are fewer and fewer people being counted as "in the labor force" which sends the unemployment rate lower even if there are more people out of work so that is a fait accompli.

The F_E_D did not give new guidance on the unemployment threshold, they only talked about how they should consider talking about new guidance.

HOWEVER, THE REAL BOMBSHELL WAS THE MINUTES PUTTING A RATE HIKE ON THE TABLE AS SOON AS MID-2014, THAT'S 3-4 MONTHS FROM NOW. FROM PREVIOUS HINTS/GUIDANCE, BERNIE MADE IT SEEM LIKE RATE HIKES WERE OFF IN 2015 AND EVEN 2016 WITHOUT SAYING SO, IT'S WHAT I CALL "PLAUSIBLE DENIABILITY" AS HE NEVER REALLY SAID IT, JUST HINTED AT IT.

This was by far the most damaging fundamental event to the market over the last 5 years, nearly EVERY F_E_D rate hike has precipitated a bear market and I don't think we need any help to get to a bear market, but the F_E_D is a for profit corporation, they have done all they can to stuff banks to the gills with cash without actually bailing them out and causing a public uproar like 2008, but the F_E_D has to make money too as they have share holders and they've reached the limit of what they'll do WHICH WAS MADE CLEAR IN THE DECEMBER MINUTES IN WHICH A SURVEY HAD BEEN PASSED AROUND TO VOTING MEMBERS AND ONE OF THEIR MAIN CONCERNS WAS THE F_E_D ITSELF TAKING LOSSES, REMEMBER THEY ARE A FOR PROFIT CORPORATION NOT SO DIFFERENT THAN BANK OF AMERICA WITH EXCLUSIVE RIGHTS TO PRINT LEGAL TENDER.

This bombshell wasn't reflected in this week's trade as people expect as the media always tells you why the market did what it did, but it will be and it won't be pretty.

Have a great weekend, if I have time between moving I'll get some individual charts up.