It's really almost incredible how 2-days back to back can have such different character, yesterday was really defined by the market's weakness in not being able to stand on its own two feet without help of levers such as the SPY arbitrage, today there was no SPY arbitrage, the fact HYG is under continued distribution probably doesn't help...

HYG distribution 15 min.

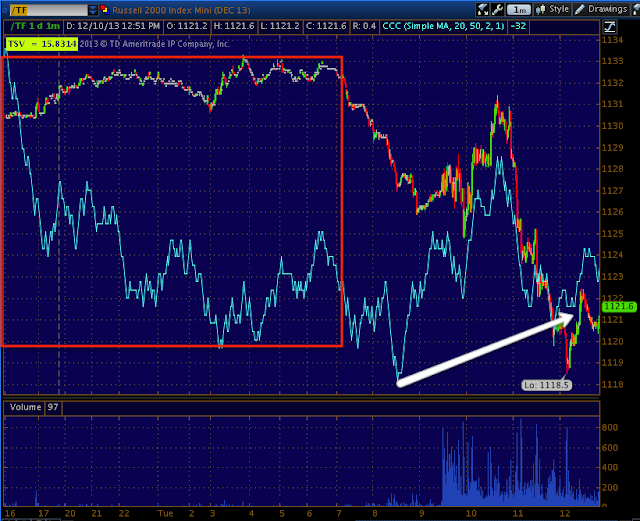

The SPX and Dow both have reversal candlestick patterns in place while the R2K is pretty severely dislocated from the pack as dispersion noticed weeks ago continues to grow.

Although there were a lot of undertones and moving very fast, almost like panic, I get the feeling the market could fiddle around in this area for a brief time, maybe let the R2K work off it's relative oversold condition and the candlestick reversals in place are not that convincing, but even so we still saw late day distribution in the Q's as you already saw, the SPY and the DIA, only the IWM stood out as being totally different.

The key at this point and has been for some time is understanding where the probabilities are. For instance, the spot VIX Bollinger Band squeeze is not forgotten, it's not done, it has just got started.

All of you know (except a couple of new members) that we called this as a highly directional upside breakout that would breakout, then hang around the area with a pullback to the 20 bar average/day and today we have a more bullish hammer-like Doji reversal candle.

We called everything that would happen here before it happened and its right on track, but we also had insight as to the probabilities as VIX futures posted and continue to post the largest leading positive divegrence I've ever seen.

4 hour VIX futures chart...

And the recent stalling of the VIX to activate the SPY arbitrage seems to be ending as you saw with HYG, but also this 15 min chart of the VIX futures also leading positive as it starts back up again.

I didn't call a long in the VXX today, maybe tomorrow, it depends on whether the market or parts of it fiddle around in the area, but above is one of the looks at probabilities. We've seen the overwhelming breadth and 3C as well a leading indicator probabilities as well.

In Index futures...

30 min Es (SPX futures) shows the last time in this area we didn't see this kind of distribution, this makes me wonder if the R2K may bounce and the other averages will go their own way.

It's for this reason I'm more interested in looking at trades, I think directionality of the market and probabilities is locked up now.

If the R2K can bounce, this 60 min chart of its futures has been right on and it's in worse shape now than ever, that just makes an IWM bounce a gift to short in to price strength.

I think the IWM probably will bounce, although it may not even last the day, as I mentioned, it may be a day trade, but I noticed my custom TICK indicator went from negative to neutral at the close.

Today we posted the second Hindenburg Omen for those who follow it, Friday was the first.

Treasuries and Gold use to act QE sensitive and even recent QE on/off events have seen that relationship maintained even though they are 180 degree opposite in their correlation now, however I think that is changing too as it seems there's a strong move toward the safety of bonds and a move toward gold on inflation expectations.

This is the 30 min 30 year Treasury futures, you know I've long been interested, but have backed off to see what happens, it may be time to pay closer attention.

And you know I love gold even though I think a pullback in to the gap is high probability, but at the end of the day today I noticed 3C improve intraday so maybe a gap higher before the pullback? Either way, long term I love it and it's not because of QE as that correlation was put to bed in 2011.

USO/Crude I still love for a move higher even though I suspect a pullback, I will add a position in oil to the trading tracking portfolio on any pullback, I've been waiting for this one for a long time.

This 4 hour chart of Brent futures looks exactly like the 60 min USO, that's a strong positive and I think we get a strong upside move that has already started.

Another of the typical levers failed today, the EUR/JPY, in fact it led Index futures lower in to the a.m. after they had been up overnight.

ES is purple and EUR/JPY in candlesticks, ES just couldn't tag the carry pair. I don't have evidence for this, but I'd say watch the pair carefully for a downturn, I suspect carry traders are going to be wrapping the carry pairs up.

I'm looking for some near term $USD strength so that may be what pulls USO back, but this is short term.

XLK/Tech tried to put in an intraday positive today, but it didn't get too far and the probabilities are firmly against it.

XLK 10 min distribution.

This is what I mean though about the separation of the market which was unheard of 6 months ago. While Tech "tried", XLF/Financials just kept deteriorating.

XLF 30 min, Financials are smokes, also note that October cycle breakout/distribution here as well.

The market is acting like a healthy bull market rotationally, but it's the furthest thing from that, this is one of the most significant changes in character as almost everything use to move together, you were either long or short, it didn't matter what and now it's all broken up with averages like the Russell 2000 smoked today while the Q's were almost flat.

Why is this important? CHANGES IN CHARACTER PRECEDE CHANGES IN TRENDS.

UNG had a nice breakout as we recently saw (another long term long favorite)...

I'm guessing the typical pullback to the yellow 10-day is going to coincide with a pullback somewhere around current / new support, we'll take a closer look at UNG then, but I suspect it will be a buyable pullback.

On the short end of the stick there are quite a few we've been paying attention to that deserve more attention, you saw BIDU today, but others include :AMZN, GS, GOOG, and of course, PCLN.

I'll be concentrating a lot more on individual trades as the market gets out of whack with this dispersion.

As far as breadth indicators, EVERYTHING went further downhill today. The NYSE A/D line looks worse and still hasn't broken above October's high, the NDX's A/D line as well as the Composite's have deteriorated recently or even more. The ABI is now heading back down toward the recent multi-year lows which is indicative of a market top, All of the % of NYSE stocks above or below their moving averages have deteriorated even more today, you may recall last night's daily wrap and the charts I posted, well they're worse.

The McCleellan Summation Index is majorly divergent and at -500 and headed down, next breadth post I'll get this up because it's screaming "Red Flag".

Also for the first time, the Russell 1k, 2k and 3k's A/D lines have all deteriorated.

Context is flat tonight so we could fool around in the area, VXX is not ready for a long so as long as it's not, there's a chance for some wobbling, I of course suspect the IWM, but whether it's intraday or not, we'll have to see what the signals say tomorrow, that's another thing, THEY ARE MOVING FASTER THAN EVER, THERE'S A LOT OF ACTIVITY IN UNDERLYING TRADE.

As of now, not much too exciting in futures, if anything changes I'll let you know.

I noticed earlier today ZH mentioned SBUX's really tight range of about a cent or so, I should have bought calls right then as I knew what it was and so do you if you remember the flat ranges and how 3C behaves (think VWAP)...

Here's the 60 minutes of ultra-tight ranging in SBUX today, I should have played a day trade with a call right then and there...

Look at the intraday leading 3C divegrence right in the same area and then... pop.

Have a great night, I'll check in if anything pops up.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago