We also learned Saudia Arabia has increased production of oil in February at 130,000 barrels per day to 9.85 million per day which is their highest level since Sept. of 2013. However, I'm sure you are aware of our analysis on USO / Crude as the charts improve in many ways, near term I still would expect some weakness as per today's update USO/Oil Follow Up.

Things didn't get much better for macro data from there with the gasoline discount being saved rather than spent as the cheap gas narrative has been blown out of the water by Consumer Spending this morning with the second consecutive decline for the first time since just after Lehman during January of 2009. January came in at -.2 and December -.3 and suddenly every investment bank's research department is working overtime tonight to cut their growth forecasts. This is very material as Consumer Spending accounts for about 2/3rds of US economic activity.

ISM National Factory Index also fell to 52.9 (still above contraction which is below 50), a miss of consensus with the lowest reading in 13 months and down from the previous of 53.5.

Early the market made a parabolic move, the early one we were talking about fading, I know a couple of you did. Interestingly this initial advance to NASDAQ 5000 which fell back, apparently had a lot to do with the fact that CBOE was not disseminating options information, essentially broken from about the open to 10:30 a.m., allowing the VIX to be slammed.

This is the period the Chicago Board Options Exchange was down which includes VIX . Although this was a fairly parabolic move and I said clearly I would not be surprised to see it retrace as most averages did with the Russell 2000 showing the biggest retrace, apparently it was not only parabolic activity that was responsible for the retrace (I almost never trust a parabolic move whether up or down as they tend to end in the same fashion they started just in the opposite direction), it seems some of the weakness after the initial tag of NASDAQ 500 was due to the CBOE coming back on line just after 10:30 a.m. The NASDAQ did close above $5000 which is a psychological magnet, but had some interesting charts to go along with that move.

This is the QQQ placed in to scale so you can see today's movement alone.

In Friday's "Week Ahead" we did expect some early strength based on where the 3C charts left off, if this chart picks up where it left off as is the case much more often than not, I'd say we'll be on our way to the finishing of this cycle and the weakness for the week also in the Week Ahead forecast.

SPY with Friday's late day positive divegrence leading to expectations of picking up where it left off on the start of the new week.

Intraday to the right (red on the time axis).

Only the IWM maintained an inline status from its positive divegrence close on Friday as of today's close.

IWM intraday is inline, however intraday futures for the Russell don't look so good, Futures Update.

VIX was definitely slammed and I mentioned VIX earlier in the day as well as VIX futures as well as Trade Idea: UVXY (VIX Short Term Futures) and VXX / UVXY / XIV / VIX Follow Up..

Interestingly at the end of January VIX had a RECORD NET LONG position, then came the move up in the market from the 1/29-2/2 base and this flipped the VIX net position to a net short so of everything goes as expected, traders in VIX were not only stopped out in to February, but should be stopped out again on the net short position. Why they's be net short here I don't know, if I didn't know any better I'd just stand out of the way being as VIX...

Closed at the lowest level since December 5th (yellow line) vs SPX in red. In any case, that's how te market makes the most people wrong at anyone time as it can, which is interesting with the NASDAQ 5k psychological level as one of the tenants of Technical Analysis is to buy a new high or breakout on the actual breakout (not before, but wait for price confirmation or "Chase"). In other words 5000k is not just a new high, it's a psychological level that causes movement among traders, did you see some of the volume spikes this afternoon and the QQ intraday chart above?

Our DeMark inspired custom Buy/Sell Indicator gave a sell signal back at the market's October lows (VIX October highs) and then a but in early November and now (today) a new buy signal. We don't get a lot of these, but they have proven pretty reliable especially with the VIX.

I don't see VIX Futures move too often on 3C charts, but today they were definitely moving...

The white is during the cash market. If this doesn't look like a bid toward protection, I'm not sure what would be, especially with the charts of short term VIX futures posted earlier and linked above.

While we have been expecting HYG to move lower based on recent ad trend 3C charts, for instance from Thursday, Things just got real interesting for HYG / HY Credit, you can see the long term primary trend in HYG, the Intermediate, sub-intermediate and cycle as well as VERY strong recent deterioration in the timing timeframes (1-3 mins), from the linked post from Thursday above, this is one of the charts and the commentary...

"

Need I say anything? HYG intraday, that's some serious underlying action and not bullish by any means..."

So although I was expecting HYG to start coming down, I didn't think it would take out a week's worth of gains/longs in one day or one morning as the a.m. gap was the worst of it, HY Corp. Credit (HYG).

This also broke a seious trendline that has been in effect fro all of 2015, HYG of course being one of the easiest ways to see a ramp coming or in cases like this, a negative tone to the market.

HYG's primary trend is already spelling big trouble as it is in a bear primary trend (lower lows/lower highs).

However this most recent counter trend bounce in HYG, supportive of the market) broke that trendline today easily and on volume.

This is what HYG looked like from last week (blue) vs the SPX (green) as it went flat and then dumped. This is probably one of the least understood indications and one of the most important considering where everything is right now.

Intraday at #1 is the CBOE break and #2 NASDAQ 5000 stall until CBOE came back on line with some pulling back just after. There was a minor move in HYG to try to help ramp the market in to the close, this included all 3 SPY Arbitrage assets (TLT, VXX, HYG).

Treasuries as shown earlier in the Futures Update pulled back today sending yields higher (supportive to stocks). However while I wouldn't bet too much on one day's data, the fact the short end looked worse on the Index futures charts and the fact the F_E_D's unofficial spokesman, Hilsenrath of the WSJ upped the F_E_D funds rate by more than double according to his sources at a level which would make it almost necessary to start hiking by no later than early summer, I suspect the move there was all about that article.

In the meantime, it certainly helped the market a bit as yields move opposite treasuries and they tend to pull equity prices toward them For example...

5-year Yields in red vs the SPX in green today.

Here's TLT inverted so you get an idea of what the long end of yields did in to the close as the bond market (not bond futures) closes at 3 p.m., TLT is in perfect sync (inverted) with the SPX on the closing ramp, thus long end yields were almost perfectly in sync, helping the market in to the close.

Our Leading Indicator "Pro Sentiment" had been moving down with the SPX (in green) , today it diverged by continuing to move down and this hasn't been a choppy or finicky indicator, it has been supportive of the market until last week.

Also commodities have been acting as a leading indicator recently, to the left they are leading the market up, t the right they have been leading down and today specifically they broke with the market in a move lower.

As for market breadth, it is seemingly impossible to get a Dominant Price/Volume Relationship which usually we have nearly every day, we haven't had a solid reading in a week and today is no different. Among the 4 major averages, the only one even close was the Dow with 15 stocks at Close Up/Volume Down which is the most bearish of the 4 possibilities and suggests the move is on fumes.

The other averages were pretty evenly split with nothing dominant.

Among the 9 S&P sectors, 7 of 9 closed green, this is closer to a short term or 1-day overbought condition. Ironically Consumer Discretionary led at +1.20% and Utilities lagged at -1.92%.

The Morningstar groups saw 189 of 238 close green, also much closer to a 1-day overbought event, had the Dominant P{/V been there as well, we'd have 3 of 3 and a strong next day implication, although the 3C charts picking up where they left off looks to be a fairly strong next day implication which is why I wanted to get some positions that looked interesting out there, specifically UVXY.

From a breadth perspective, the market has some very strange breadth readings that have been near motionless.

The Percentage of NYSE Stocks Trading Above Their 40-Day Moving Average (green vs the SPX in red) has NOT moved since February 5th, no higher highs, no anything.

The Percentage of NYSE Stocks Trading Above Their 200-Day Moving Average (green vs the SPX in red) Also hasn't moved, but in this case since Thanksgiving!

These are broadly divergent over a large area stretching quite a ways, but usually there's some movement on a bounce or rally , certainly you'd expect it on a new high, NADA.

And our celebrated NASDAQ 5k's Advance/Decline line leaves something to be desired...

This too has broad deterioration as it led through 2013 and then flipped and lagged worse and worse around mid-2014, but at the two relative points marked by white arrows on price (red) and the A/D line (green), note there's no higher high.

Again, near motionless as far as market breadth goes. especially when you are talking about a new high.

Tomorrow I intend to cover some of our older core positions that I've just let be because they've been doing great, but there may be some opportunities to leverage up true short positions like out HLF a;ready at a 53% gain or SCTY at a +29% gain (a market of stocks). As a true short you can pyramid up the position with the gains.

As for futures, given the parabolic stretch to make NASDAQ 5k, HYG, the 3C charts, etc., I'll be looking in on futures later tonight, as of right now, they aren't looking very good.

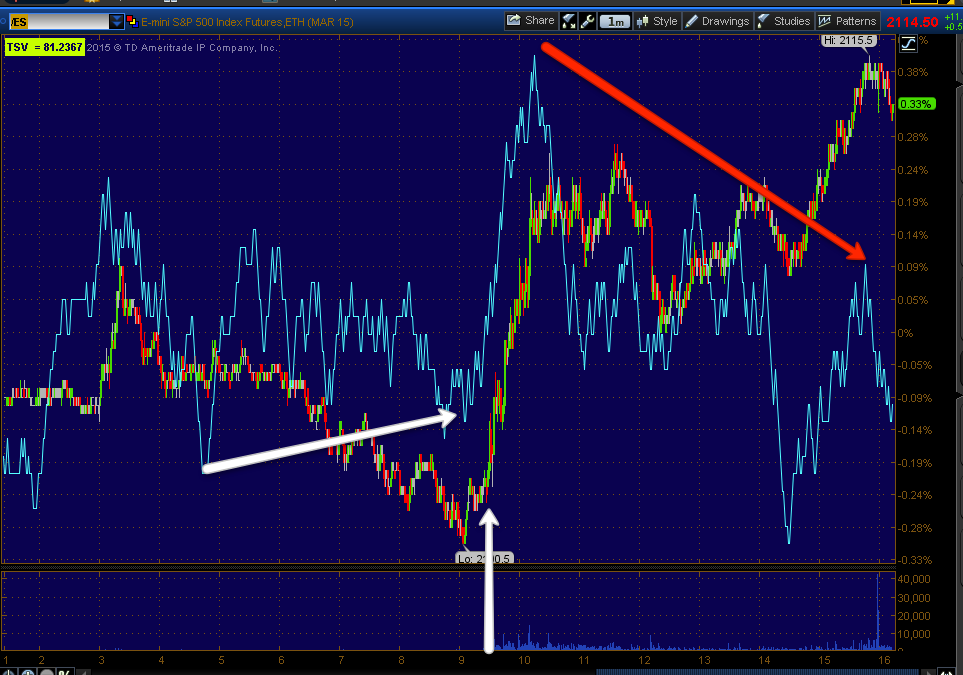

Es/SPX Futures intraday, looking a lot worse since the close, but divergent through the day.

TF/Russell 2000 futures also looking pretty extreme here.