Today was a nice day, the December VXX $45 call position brought in +31.7% and 91.25% for a total gain of +61.25%, the best thing is that so far as I can tell, we get to do it again.

The Dow lost the $7.77 that held it above $16k yesterday with a -.58% drop or $93.12 points to leave it at 15915.65. As expected, stops were crushed on the open.

Stops triggered as the obvious level of $16k was broken on the open.

The SPX just lost its 1800 at 1795.16 or down -0.32%. The NDX Comp was able to hand on to 4k with a close -0.24% @ $4037.02.

One thing that was different about today than 4 of 5 previous days (really 4 of 4 if you take out Black Friday) was the sell-off's in to the close, we might not call today's close a spectacular rally, but it was a short term change in character.

Another change in character was volume hitting 2 week highs, in other words, the sell-off today was in to volume.

Last night I posted a chart of each of the major averages and where 3C is in the cycle, it's pretty clear and that's why I didn't need to take much action today other than to take some profits that I get to do again.

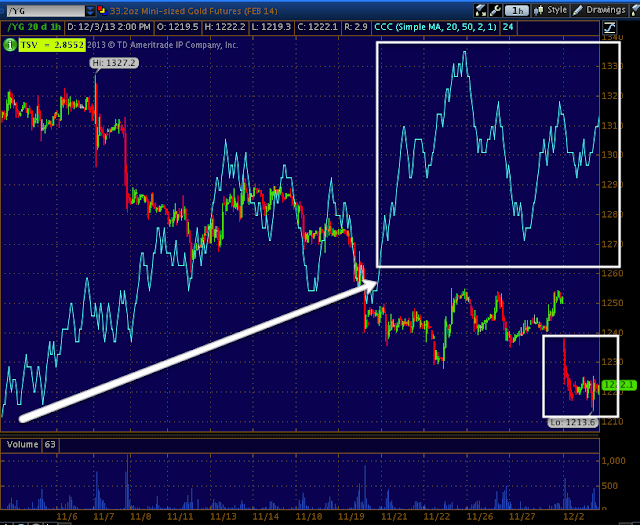

Those 4 charts could be summed up in 1 chart I think, a 60 min chart of ES or any of the Index futures.

With a divergence like that am I surprised most of last week we sold off almost every day in to the close, the VIX calls made nearly 100%, the VIX BB squeeze, the action of the last 2-days...Am I surprised? Not at all, in fact, we're just scratching the surface.

However I try to keep things realty and fact based or as objective as possible. Yesterday I mentioned the IWM trying to putt together an intraday positive near the close, I said this about the VIX Bollinger Band Squeeze that WILL produce a highly directional breakout...

"The Spot VIX officially broke out of the Bollinger Band Squeeze, although there's often loitering around the initial breakout, sometimes even a Crazy Ivan shakeout, we'll have to see if this sees the follow through tomorrow, but I have little doubt this will make a highly directional upside breakout whether tomorrow or a week from now."

Don't get me wrong at all because I haven't got to the point yet, WE HAVE HUGELY NEGATIVE SIGNALS AND CONFIRMATION, LAST NIGHT'S WRAP SHOWS A LOT OF THEM.

But like I said, "Reality based" and reality-based objective charts led me to post at 10:36 a.m. today, the following in this Market Update

"It looks like we are going to get a bounce"

This later led me to close the second half of the VXX Dec $45 Call position for nearly a 100% gain. Honestly, I probably would have set up some very short term trading positions, but I find when I put too many of these "trimming around the fat" trades out there, people get confused, so instead I just put out this post... For a Quick Trade...

Most of the positives in the averages today reached to the 3 min chart so there wasn't a huge 1-day accumulation period, in fact with the exception of the IWM which started yesterday, I can show you where most of it occurred.

That was mostly real and strong selling above VWAP this morning, but around 1:30-2:30 in the white box at the lower VWAP channel. that's where most of the accumulation intraday took place.

Even looking at my custom TICK indicator you can see it...

Note where TICK goes from negative to positive.

Now before anyone gets too confused, this is what a normal market functions like, even early in a break, that's why I took the time to show you a nasty bear trend and point out the areas that would have thrown most of us out that you don't notice when posting this MCP chart. Just click this link and roll down to the MCP chart.

As far as probabilities go, there are so many stacked against the market right here, it's difficult to even say with real confidence that the bounce set up today will make it rather than be run over like one was in AAPL. In fact, in several charts, making the case for a bounce also makes a stronger case for a continues decline, the market just doesn't move straight up or down.

I'll let last night's Daily Wrap stand for the bearish side without posting it all again.

Today we had between $3.25 and $5 billion in 2 separate POMOs, a LOT of people were convinced that the market would end green today as that money found its way in to the market. This is another change in character, as soon as a POMO was done in QE1 and 2 it ended up right in the market usually within minutes driving it higher. I'm not saying the POMO money did or did not end up in the market, but if it did, then it's another change of character as it is being used to set up brief fade trades, the same kind I would have taken by selling the VXX calls and buying IWM puts today for a 1-day trade.

If we are to believe the POMO crowd following the F_E_D's balance sheet, then today's operations (2) netted a total of $4.66 bn in asset purchases and that equates to 1.4 S&P points (3.25bn per S&P point).

I really don't want to get in to hypotheticals about where the market will bounce to, assuming it's just today's accumulation, then it's more or less nothing but noise, but I'll gladly use it to enter a new VXX Jan call position.

FIGURING OUT WHAT LEVERS HAD TO BE PULLED TO PULL THIS OFF WAS EASY...

You may recall I've been saying for 3-4 weeks now that each lever is either completely failing or losing its effectiveness? So which did they choose? It looks like all of them, which would suggest they really need quite a lot to get anything off the ground.

Of course the intraday accumulation was my first clue...(I tried to keep most of these in scale for you so you can see the size vs the previous negative, only the SPY did I slip up and zoom in too tight, but it's a good look at intraday action).

DIA 3 min

IWM 3 min, I was surprised the IWM didn't make it to 5 min, I really think there wasn't as much accumulation intraday as I might have thought.

QQQ 3 min

SPY 3 min, note the time.

In any case, there wasn't a credible 5 min divergence in any of the averages, for probabilities just go back to last night's wrap and look at the 10/15 min charts posted.

The second thing I noticed was SPY Arbitrage as well as a support mechanism, in the recent past HYG (1 of 3 SPY Arbitrage assets) has been used on its own, but there were enough negative in intraday VXX charts today for me to close the December calls, really VXX just has to stay put and HYG rise and Arbitrage supporting the market works, if VXX falls a bit it works better.

Then the weighted assets in the averages were also in use, take a look at AAPL vs the QQQ today (as AAPL is by far the most heavily weighted stock in not only the NDX, but the SPX as well) when you put them together around mid afternoon.

AAPL in white vs the QQQ in candlesticks, nearly identical until AAPL ramps up at the close dragging the NDX with it by virtue of its weight alone (which at last check was the same as 50 other NASDAQ 100 stocks combined).

Here we have the Dow-30 vs MMM which is the 5th most heavily weighted stock in the Dow and it's doing the same. A good base can be made for the #2 weighted Dow component, IBM.

So they are using the old weighted index trick as well.

Then if you don't believe me about the SPY arbitrage or at least HYG credit, take a look below...

This is SPX in green with price inverted and HYG in blue, they're a perfect match for each other today.

Even HYG alone is a lever used many weeks in a row in the last several months.

The VIX wasn't available to help as it underwent stealth accumulation and WOULD NOY make a lower low, but up here, it has some room to help, like I said yesterday, often the breakout of a VIX Bollinger Band Squeeze is not clean and price loiters a couple of days. However at the EOD you can see VXX weakness over the SPX.

So it appears the SPY arbitrage is going to be used as well.

Perhaps they need all of these because the most effective mover of the market is the EUR/JPY and they really don't know what to expect, but from what I can see, they probably do and this also makes the case for the bearish side as well.

This was actually the easiest part to figure out, but because it's not a simple indicator takes the most time.

This is the EUR/JPY in candlesticks and ES (SPX futures) in purple on a 1 min chart. This is what happened overnight as the JPY apparently saw some carry trade covering and it sent the JPY higher sending the EUR/JPY lower (as I explained last night, the first ticker in the pair is long and the second is short, they don't have to move up and down against each other, but it's a matter of relative performance).

The falling EUR/JPY drug all Index futures lower overnight as ES is nearly glued to EUR/JPY. So, this was an obvious place to look and the best way to figure it out is to look at single currency futures.

This is the EUR/JPY vs ES in to later in the a.m. and through the close, look how tightly they come together at the close.

Here I compare the Euro in candlesticks to the EUR/JPY in purple today, you can see there's strength in the Euro early morning, but it's not translating to the EUR/JPY, even at the Euro's high around noon, still the pair is seeing lower highs, that's because the Euro is only half of the carry pair.

Now look at a 1 min chart of the EUR/JPY in purple and the Yen in candlesticks also from today (remember the Yen is the short so it would have an inverse relationship with the pair).

It's clear to see Yen strength was stronger than Euro strength and the Yen's high was the EUR/JPY's low, so...

If they want to manipulate the market and have already pulled all the other levers in existence, they'd need to have some assurance that the EUR/JPY will cooperate.

So I looked at single currency futures, you know 1 min doesn't mean anything to me overnight so I went to 5 min and checked 15 where there wasn't anything.

This is the Yen on that strength seen above, but it's also seeing a 3C negative divegrence. In fact, that divergence worked and the Yen already topped for today and is headed lower... This is what the market would need, but also some Euro strength.

So here's the Euro single currency chart, you can see the distribution that led to recent weakness, it's the strongest type of 3C divergence, leading negative. The Euro also has a negative divegrence, but not as bad and it has a better accumulation zone at the upside reversal pivot.

All that really needs to happen though for the pair to rise is for the EUR to outperform the Yen, even if they both fall, as long as the Yen falls faster.

I CHECKED LONGER CHARTS TO SEE IF THIS COULD BE A LARGER MOVE THAT I CAN SEE RIGHT NOW, THERE WAS NOTHING AT 15 MIN CHARTS, BUT LOOK WHAT I FOUND AT STRONGER 30 MIN CHARTS.

That's the Yen with a HUGR leading positive divegrence, it looks like the days of the EUR/JPY ramp are just about over. This also confirms all the market signals, VIX signals, Leading indicators, etc (most of which can be found in last night's post.)

As for the EUR, on the same 30 min chart we have negative divergences, one of the smaller ones already sent the Euro lower.

This is even worse news for the EUR/JPY and thereby the market.

I don't need to post all of the charts backing up our view, you have seen it in market character, indicators, leading indicators, price action and a VERY desperate attempt to use EVERY lever at once on an intraday bounce!

This is the kind of thing that gives me the confidence to take some of the trades that are emotionally difficult to take.

I'll let you know if anything changes, but that's the way I read it now. There were no dominant Price/Volume relationships tonight.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago