I wish I had some big puzzle to explain and all of the pieces fit neatly in to place, but the truth is, this is much more simple. If I had to I could summarize the market in a sentence, for most of you reading last week's posts, you don't even need that.

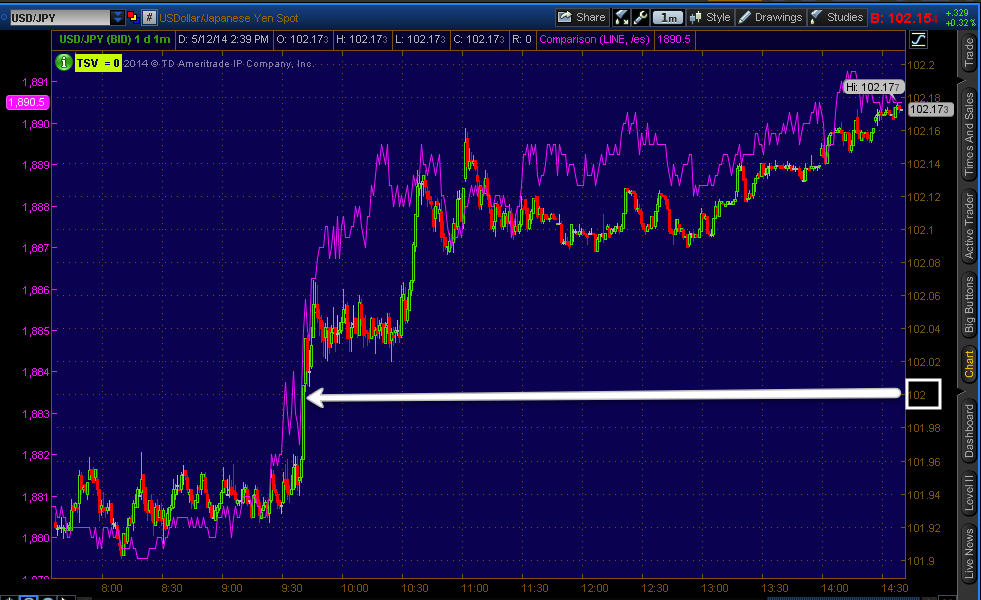

If I were to summarize the market with 1 chart, it would be this one...

As we saw all last week, USD/JPY and the VERY significant $102 level is all that has really mattered, ES/SPX futures have been following the FX Carry trade pair all last week, the only two areas where ES either underperformed the correlation or out-performed the correlation, they were both corrected in very short order to bring ES back to the correlation.

We have been expecting USD/JPY to break above $102 (remember all of the Yen negative divergences and $USD positive divergences last week?) So we knew we'd end up here, the probabilities on just about every chart say this move fails and thus it becomes very valuable to short in to price strength and 3C weakness.

Don't forget the multiple trend analysis as well as timeframe and the tone there that also says the market and the FX pair fail, again making it very useful.

The only question is "When does it fail?"...

From the intraday charts of USD/JPY, they have went from positive last week to negative this week VERY fast and not just on the usual 1 min pairs chart, but on the 5 and 15 min which is almost unheard of.

Almost all of the single currency Yen and $USD divergences that said the USD/JPY goes up last week, have reversed or are doing so already this week, very early this week.

It appears we are seeing the same on the charts of the averages as well.

Take the intraday IWM, we saw leading negative divergences migrate to longer charts all day today like this 3 min which started as a 1 min negative and this is not the only average.

So the question is, does this migration keep up and keep moving to longer charts or is it just for a specific local move? If the first is true, then this shouldn't last long and we'll have a lot of work to complete quickly, but 1-day doesn't make a trend so we will see what tomorrow brings, but that's really about the only question now, just as we knew we'd be in this place last week, we have stronger signals that say we will be below this place shortly with the market in tow.

I'll be looking at details to see if any specifics that help us answer these questions can be found, but as far as trading, the trend is clear, the "Let the trade come to us" concept is in full effect, multiple timeframe analysis is working and multiple trend analysis is at a once in a year or longer area we rarely see. The movement in both the VXX and VIX futures which have gone from 5 min positive to 1, 5, 15 and 30 min positives in about a day are pretty stunning. We couldn't ask for much more except that we have the fortitude to be patience and wait for the right moment to enter, it would be a shame to give up this set up because of greed, or fear of missing the move.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago