Another day of epic low volume, in fact today beat last week's -40-55% below average volume that carrie through yesterday, today was the lowest non-holiday volume for S&P futures for all of 2014, 8 days of this which is ultimately unsustainable as if we didn't already realize that this bounce was unsustainable.

However for the bullish, "Buy the Dip" crowd that just mindlessly buy the dip, not even realizing why buying the dip worked and what's different now, there was a little victory lap in the NASDAQ 100 making a 14 year high and AAPL making a new all time high.

Meanwhile as that happens, the NASDAQ composite's Advance/Decline line is broken beyond repair...

NASDAQ Composite (red) vs the A/D line (green)

And while AAPL made new all time highs as $100 was a psychological magnet, I wouldn't be holding that one much longer, in fact... well we will cross that bridge when it's time to cross, but in the meantime,

If the last divergence at AAPL all time highs looked like this (apparently quite a bit on Third Point and followers, selling, I really have to wonder what might become of AAPL with this divegrence considering the last one took -45% of AAPL's value in 8 months.

While most of the averages closed around a 1/2 percentage point gain, the R2K and Transports especially lagged, +.34% and +.11% respectively and once again it seems something is scaring off buyers or encouraging selling in to the European close.

We noted this last week and I saw it today in the SPY, I wouldn't expect to see it in the IWM yet until/unless it makes some gains worth selling in to. IWM in yellow) and transports (DJ-20) in salmon as we approach the European close.

The $USDX made an 11 month high today, the biggest gain in 3 months which may explain why the 1-5 min 3C charts were showing negative divergences there today, likely profit taking, the $USD is now up +0.55% on the week.

USO continues to be slaughtered, you may recall our July 14th, USO Trade/s Set-up ,

"Initially I was looking at USO as a long/bounce trade and I still think there's a decent long bounce trade there, but the bigger trade is shorting the bounce as you get a better entry at much lower risk...Upon a closer look at the charts for Brent Crude Futures and WTI, it looks like both are set to come down, what the catalyst is, whether political as there's a strong correlation between the price of oil and economic activity or perhaps something in the works as far as a counter-insurgency in Iraq, who knows, but both Brent and USO (WTI) are showing the same trade opportunities/set ups."

The above post from July 14th was looking for a bounce and then a bigger trade in USO/Crude short, the next day USO bottomed and bounced and of course headed lower and apparently on US counter-insurgency attacks!

We've been noticing some odd behavior in VIX short term futures this week as well as spot vix today...

What happened to banging the close with VIX, above VIX is inverted to show the normal SPX correlation, it outperformed during the afternoon today.

Nine of nine S&P sectors closed green today , but the defensive "Utilities " sector led with a +1.27% gain while financials (which were showing all kinds of weakness today) came in last at +0.18% gain.

Of the 239 Morningstar Industry/Sub-Industry groups we track, the winners were down today from yesterday at 185 of 239, but still respectable, although likely closing in on an overbought condition which is odd as the market still remains in a deeply oversold mode as actual market breadth has fallen apart, in other words, it's not transient, but indicative of market health or lack of.

Percent of NYSE stocks trading 1 standard deviation above their 40-day moving average has recovered from the deeply oversold condition at 10%, but is nowhere near recovery which is what I suspected we'd see even on a strong bounce, in other words, the damage is done, much like the NASDAQ Comps' A/D line.

Percent of NYSE stocks trading 2 standard deviation above their 40-day moving average or momentum stocks are far from any recovery, even from the yellow trendline where they had already fallen apart badly.

As for Percent of NYSE stocks trading above their 40-day moving average, we went from 20% to just over 50%, still far, far from a normal area considering the relative relationship between price.

To give you an idea of how bad 20% is...

During the worst part of the 2008 decline, there were only 2 times we saw a reading lower than 20%, the first was just below 20%, the second, a capitulation event was at 10%.

Yields dropped early in trade today, but recovered through the rest of the day...

5/10 and 30 year yields... I'm not reading too much in to this.

There was no Dominant Price/Volume Relationship today, there was a co-dominance which really doesn't count, but it was between Close Up and Volume Down and Close Down and Volume Down.

Other than that, the most notable risk event may be the rising SKEW that I have recently pointed out and it's very fast ROC.

SKEW bottomed on 8/8, the same day the base finished up and just before our bounce started, I find that somewhat interesting, since though, they've been busily buying low strike puts at higher than normal premiums to protect against tail risk, otherwise known as a market crash.

As you probably know, tomorrow we get the Bank of England's minutes from their last policy meeting and at 2 p.m. the minutes from the last F_O_M_C meeting, there likely be a lot of language about accommodative policy for a "Considerable" amount of time after QE winds down in October, but the market will pay a lot of attention to anything that resembles information about the timing of the first rate hike and if more voting members are moving closer to Plosser's dissent and an earlier rate hike.

As usual, expect the typical F_E_D knee jerk reaction, but remember that more often than not the initial reaction is faded. This is the main US eco-data other than MBA purchase apps and EIA petroleum stats.

As for the bounce, the Index Futures' 5 min charts are what I usually align trades with, however this week we've already seen the 15 min chart start going negative which is unusual and now we have charts from 30 to 60 mins going negative and on a scale larger than , well on a scale that suggests this bounce was used for what we expected, net distribution, whether selling or short selling.

5 min ES already leading negative which is usually all I need to align my trades, in this case I'd be looking for short entries. however it didn't stop there...

The 15 min chart is leading negative, I don't think this would have normally shown up unless the distribution was extraordinarily large.

TF 30 min is leading negative

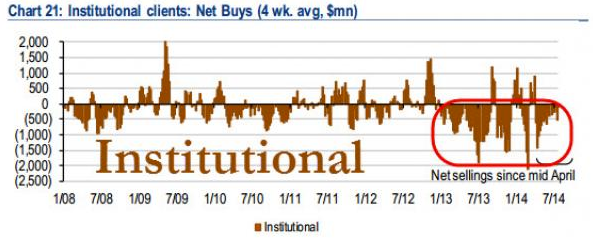

And now NQ 60 min which shows the last negative divegrence taking prices down and a smaller relative positive divergence compared to the current negative, is obviously telling us that at the end of this bounce there's significantly more shares sold or transferred from smart hands to dumb ones, just as the Institutional net sellers charts from BofA/ML have shown.

I'll likely use any upside minutes volatility to close some long positions if it makes sense and other wise be on the lookout for short position entries as I don't think we are far from the pivot, even though we'd almost always expect a reversal process, it's getting pretty insane with breadth readings and looking more and more like there's not enough support in the market to prevent a collapse if that spark should trigger.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago